Bitcoin (BTC) price consolidated between $16,400 and $16,780 over the course of the week. Prolonged sideways movements trigger risk-off sensitivity and drive investors to despair. Crypto analysts are undecided in which direction the new levels will take in this environment.

How strong is Bitcoin to hit $20,000 next week?

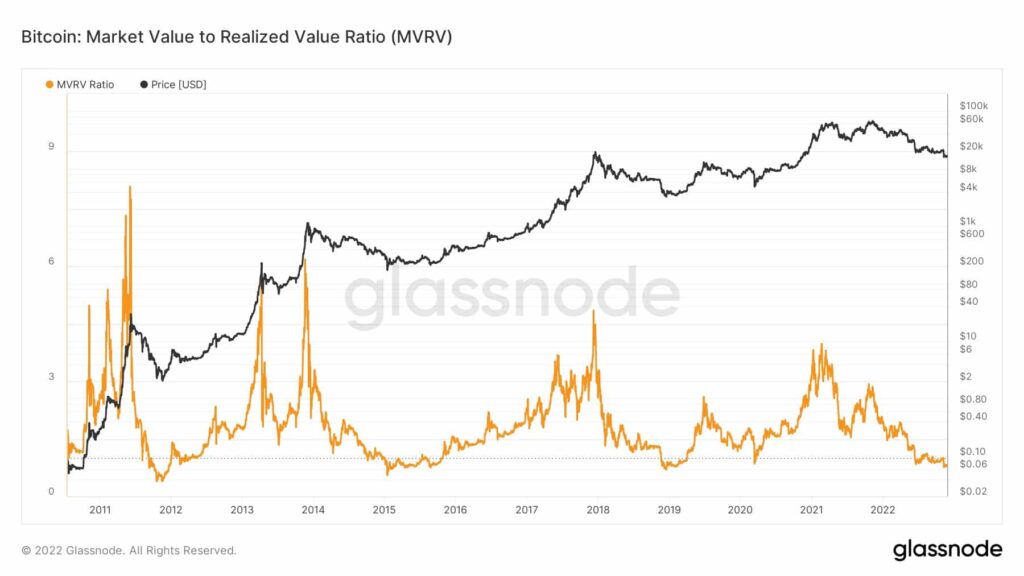

Recognized crypto analyst Michael van de Poppe shared Bitcoin’s MVRV Ratio data on this in a tweet on Nov. According to MVRV data, Bitcoin has reached the same level as previous bear markets.

Historically, the BTC price had risen from these levels in November 2018, January 2015, and November 2011. While Bitcoin mostly follows historical chart patterns, many say it will be different now. People are waiting for Bitcoin to drop further as the crypto market is still under pressure.

However, Poppe says that Bitcoin should hold current levels for short and long term periods. According to the analyst, if Bitcoin price rises above the $16,800-17,000 range, it will head towards $18,400. Whales are already starting to buy the dip as Bitcoin and Ethereum drop below support levels.

Glassnode reports stock market exits peak

According to Glassnode data, the amount of BTC coming out of the exchanges has reached the ATH level. Meanwhile, a total of 179,250 Bitcoins have emerged net from crypto exchanges in the past 30 days. This indicates that the market is currently approaching the bottom. The data shows that Bitcoin’s number of foreign currency deposits has reached a 2-year low of 1,735.12.

According to reports, BTC is exiting exchanges at a rate of over 172,000 per month. Thus, it surpassed the previous high set after June 2022 sales. However, the total confirmed transactions have also seen an uptrend over the past two weeks. Glassnode reported that accounts holding more than 1 Bitcoin reached 951,823 ATH.

179,250 #bitcoin have been withdrawn from exchanges on a net basis over the the last 30-days, another new all time high. $BTC pic.twitter.com/Xc3Slwd0ln

— Dylan LeClair 🟠 (@DylanLeClair_) November 26, 2022

Reached ATH on confirmed transactions

Total confirmed transactions surpassed a multi-month high of 246,000 transactions per day. It was noteworthy that 29.2% of total transactions (77.1 thousand withdrawals) were related to foreign currency withdrawal transfers. 18.2% (48.1 thousand deposits) is recorded in foreign currency deposit transfers.

The boom in exchange-related activities brought the dominance of foreign currency deposits or withdrawals to 47.4% of the total. This was the highest level for the year. Higher stock market dominance is often linked to a bull market and high volatility event selling.

Analysis shows these levels will be critical

Bitcoin price is currently trading above $16,600. A downside break of the 23.6% Fib level could see the 38.2% Fib level at $16.275 and the 61.8% Fib level at $15,900.

The fact that important technical indicators such as RSI and MACD oscillate between buy and sell zones shows investors indecision. However, the 50-day moving average continues to support BTC around $16,450, indicating that the uptrend is likely to continue. If there is buying pressure in the market, an upside break of the $16,785 level will allow BTC to hit $17,000 in a few days.

Bitcoin basic news feed

In significant news, Singapore’s central bank, the Monetary Authority of Singapore (MAS), issued a press release this week to clarify the various misunderstandings and issues that have arisen in the wake of the FTX crisis. MAS explained why it preferred Binance over FTX.

Singapore's Central Bank Warns that Not All Crypto Activities Are Regulated

👉 https://t.co/dVlHdYd2yV#Solana #bitcoin #ETH #USDINR #Cryptocurency #Crypto #news #nftart #NFT #BTCUSDT #BTCs #SHIB #DOGE #NFTs #ElonMusk #SGXNIFTY #StockMarket #Cryptos pic.twitter.com/fUCmnzyKJW

— Cryptopoint (@pixiuAI) October 6, 2022

According to MAS, neither Binance nor FTX are licensed in Singapore. FTX hasn’t attracted many users in Singapore, but Binance manages to do so. In late September this year, MAS ordered Binance to stop providing payment services to Singaporeans. A few months later, the cryptocurrency exchange ceased operations in Singapore.

The regulator stated that there is no evidence that FTX is directly targeting Singaporean customers. Also, Singapore dollars could not be used to transact in FTX. On the other hand, Singaporeans can use FTX services online. According to MAS, the most important lesson to be learned from the collapse of FTX is that trading cryptocurrencies on any platform is risky and investors can lose all their money.

Singapore's central bank warns against crypto, says retail investors risk 'significant losses' https://t.co/igZoYBgE0l

— CNBC (@CNBC) November 9, 2021

According to MAS, many cryptocurrencies have lost value and are extremely volatile right now. Moreover, MAS says that the current turbulent period in the crypto industry shows that crypto trading is dangerous. Singapore’s central bank’s warning that even legitimate crypto exchanges could crash had a negative impact on the BTC price.

$1.5 billion worth of Bitcoin exited from Coinbase

On November 24, 50,000 BTC was withdrawn from Coinbase, and the value of the withdrawn Bitcoin was over $800 million at the time, making it the second largest amount of BTC withdrawn from Coinbase in 2022.

Another 50,000 BTC withdrawal, worth approximately $825 million, took place on November 25. Institutions are taking advantage of low prices and accumulating BTC as on-chain data shows market bottom is near.

JUST IN 🔥

A total of 100,000 #Bitcoin were withdrawn from #Coinbase in the past two days – the third-largest BTC withdrawal in @coinbase history.

— Satoshi Club (@esatoshiclub) November 25, 2022

The second 50,000 BTC withdrawal was the third largest BTC withdrawal in Coinbase history, reducing Coinbase reserves by more than $1.5 billion in just two days. Statistics show that Coinbase is not the only exchange that has received significant BTC withdrawals.

Bitcoin worth $1.5B withdrawn from Coinbase in 48 hours

On Nov.24, 50,000 BTC were withdrawn from Coinbase. The amount equated to over $800 million at the time, which marked the second-largest BTC withdrawal from Coinbase in 2022. The next day, on Nov. pic.twitter.com/DOlRtaJKDE

— HappyRabbit (@HappyRabbit996) November 26, 2022

Since January 2022, the BTC balance on all exchanges has fallen steadily. Bitcoin balance on decentralized exchanges fell below 12% for the first time since January 2018, according to the data.

Binance adds another $1 billion to its bailout fund

cryptocoin.com As you follow, Binance announced that it has launched a new recovery fund on November 24. The initiative aims to help the crypto industry, which is going through tough times after the FTX collapse. According to the exchange’s blog post, Binance has allocated $1 billion to this fund and this amount can be increased to $2 billion if necessary.