The gold price rose as a softer dollar reignited bullion’s appeal to offshore buyers. However, expectations that the US Federal Reserve and other major central banks will raise hard interest rates limited further gains. Analysts interpret the market and share their forecasts.

“The recovery in gold is like a short-term moderation”

Spot gold was trading at $1,667.89, up 0.5% at the time of writing. U.S. gold futures rose 0.2% to $1,675.30. Meanwhile, the dollar index (DXY) fell 0.4%. This made dollar-priced bullion cheaper for offshore buyers. Benchmark US 10-year Treasury rates also fell after rising for two days. Yeap Jun Rong, IG market strategist, comments:

No slack in the Fed’s tightening policies suggests any rally is potentially sellable. So, the rebound in gold looks like a short-term moderation from oversold technical conditions.

“Probably, the overall bearish trend for the gold price will remain intact”

cryptocoin.com As you follow, Federal Reserve’s No. 2 official announced on Friday that he fully supports the Fed’s game plan to keep interest rates higher for an extended period to curb inflation. Gold saw its sixth consecutive monthly decline in September. Thus, it recorded the longest streak of monthly losses in four years. U.S. nonfarm payroll data will be on investors’ radar, due Friday. There’s also a range of manufacturing PMI data for insight into the health of the global economy. Yeap Jun Rong makes the following statement:

For a relief rally, golden bulls prefer warmer (payroll) data. However, the lack of any pause in the Fed’s policies likely indicates that the overall bearish trend will remain intact.

“Gold price reversed intraday rise”

Market analyst Haresh Menghani makes the following assessments on the developments in the market. Gold gained positive momentum on the first day of the new week. It reached a new daily top around the $1,670 region in the early European session. However, the increase meets fresh supply at higher levels as spot prices tumbled below $1,665 in the last hour.

The combination of factors is putting downward pressure on the US dollar. This provides some support to gold in dollar terms. News that the UK government is expected to withdraw the higher proposed income tax rate provides a good boost for the British pound. This continues to weaken the dollar, with further declines in US Treasury bond yields.

In fact, the benchmark 10-year U.S. Treasury bond is pulling away from the 12-year high it touched last Wednesday. Apart from that, concerns about a deeper global economic downturn and geopolitical risks are providing a modest rise for safe-haven gold. However, expectations of a more aggressive policy tightening from major central banks, including the Fed, are likely to restrain the non-yielding yellow metal.

Investors will follow this data

Investors seem convinced the Fed will continue to raise interest rates faster to curb inflation. They’re also pricing in another super-large 75 basis point increase in November. The bets were reaffirmed with the latest hawkish statements from several FOMC officials and the release of US Personal Consumption Spending (PCE) data on Friday. This warrants some caution for the bulls.

It is also possible for investors to avoid making new directional bets. They may prefer to stay on the sidelines ahead of the important US macro data scheduled for the beginning of the new month. A very busy week begins with the release of the US ISM Manufacturing PMI on Monday. This, along with speeches from FOMC members and US bond yields, will increase demand for USD. It will also add some momentum to the gold.

But the focus remains on the closely watched US monthly jobs report on Friday. The NFP report will play an important role in influencing the Fed’s rate hike expectations and USD price dynamics. This, in turn, will help traders identify the next leg of a directional move for gold.

“More consolidation likely”

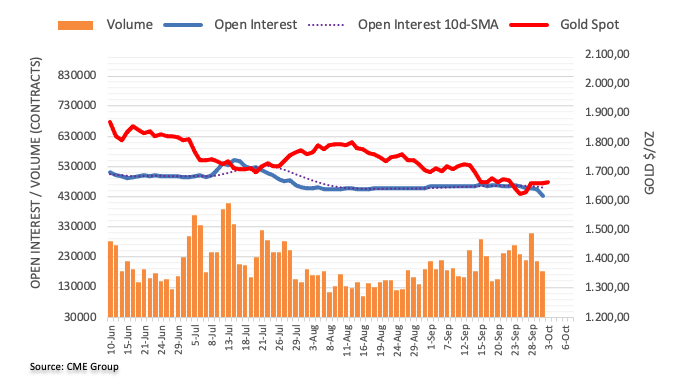

Open interest on gold futures markets fell for the second straight session on Friday. This time it saw the biggest single-day drop since March 10, with around 21.3k contracts. Volume followed suit. Nearly 32.8k contracts shrank in addition to the previous daily drop.

Market analyst Pablo Piovano notes that the inconclusive price action of gold on Friday was behind the narrowing open interest and volume. According to the analyst, this has also revealed more sideline trades in the very near term. Meanwhile, the analyst says the extra gains will likely target the initial weekly high of $1,688 (September 21).