Markets saw the Federal Reserve minutes as a bit of a hawk. As interest rates rose, the US dollar strengthened. Therefore, the gold price has bounced back from its short-term rally. Now the markets will try to catch clues from the words of Fed Chairman Jerome Powell at the Jackson Hole symposium.

ANZ: Gold price to find solid support at $1,700

Rising US Treasury yields weighed on investor appetite. The US dollar gained some strength. Due to the negative impact of this environment on investor demand, the gold price declined. ANZ Bank economists expect the yellow metal to find a bottom at $1,700. In this context, analysts make the following assessment:

Aggressive Fed rate hikes and a stronger dollar are pushing the gold price down. However, it is possible that rising recession fears due to rising interest rates against sticky inflation are giving way to some safe flows.

TDS: Jackson Hole will whet the appetite for gold

cryptocoin.com As you can follow, there was a hawkish tone in the FOMC minutes released on Wednesday. Therefore, gold price closed in negative territory for the third day in a row. Fed Chairman Jerome Powell will speak at the Jackson Hole symposium next week. TD Securities strategists note that Powell may withdraw market expectations for rate cuts. Therefore, strategists assess that the demand for the yellow metal will decrease. Strategists make the following statement on the subject:

Markets are pricing in a 75 basis point increase in September at a terminal interest rate of 47% and a terminal interest rate of 3.67%, which is only marginally lower than previous minutes. That’s because the dated minutes provided little additional information for markets to digest. It’s possible that Jackson Hole provides a platform for the Fed to push back market prices on rate cuts. This is likely to reduce investment appetite for gold.

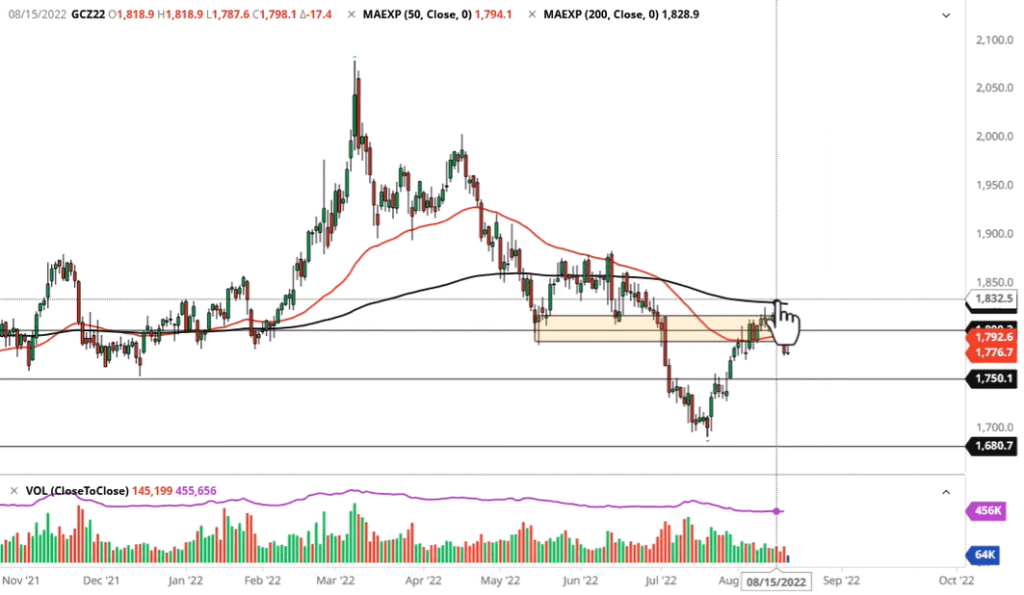

Gold price technical analysis: Gold gives up on early gain

Market analyst Christopher Lewis analyzes the technical outlook for gold as follows. Gold markets initially tried to recover during Thursday’s trading session. But it gave back its gains pretty quickly. Therefore, it indicates that gold perhaps does not have enough momentum to continue the uptrend. It’s also a sign that we’re getting ready to break a bit.

If this were to be the case, we can predict that interest rates in the US could start to rise. But at this point, there’s still speculation about any potential moves. As a result, gold is a very volatile instrument and is heavily influenced by interest rates. It is therefore at the mercy of the bond market. At this point, I think you have to be very cautious. But I support the downside, at least in the short term.

Below, the $1,750 level is more likely than not offering significant support. Therefore, it is necessary to be aware of the potential importance of this area. I think we’ll probably see more noise than anything else. But that’s no surprise given how noisy the markets are in general. The above 200-Day EMA has shown resistance recently. I think this should continue to be your main measure of whether we are in an uptrend or a downtrend.

Currently, I don’t see a meltdown as “imminent”. That said, I think it’s more likely that we won’t keep falling. In this context, gold will breathe in short-term rallies until it clears the 200-Day EMA. Short-term charts probably remain the best way forward in this market.

Pablo Piovano: There is room for more fall

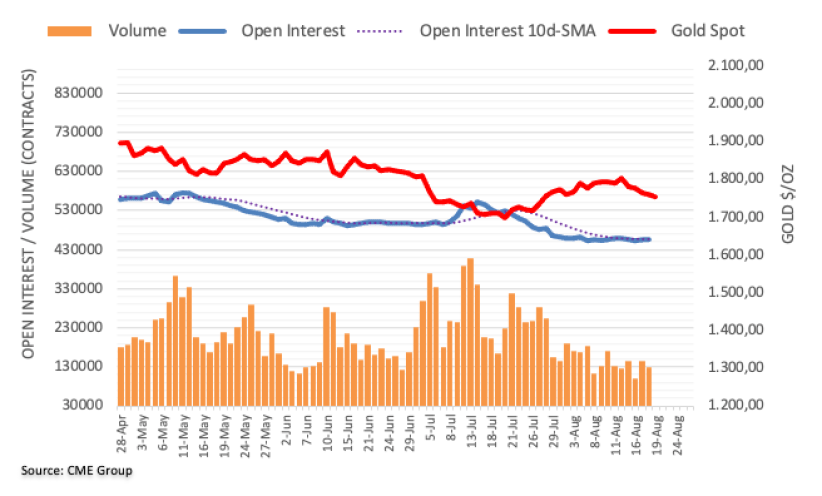

Open interest on gold futures markets rose just 481 contracts this time on Thursday, according to the latest data from CME Group. This shows the rise in the second consecutive session. Instead, the volume remained volatile. It narrowed by around 14.1K contracts, partially reversing the previous daily pattern.

Gold price continued its downward move on Thursday amid a minor rise in open interest. However, according to market analyst Pablo Piovano, the next target emerged at the weekly low of $1,711 (July 27). That’s why the analyst says there is still room for more drop in the cards.