Bitcoin is currently trading at its August lows. After several weeks of sustained bullishness, the leading cryptocurrency has faced wild rejection along with the rest of the markets. As BTC drops further, analysts in the space are sharing their views on the direction of the market.

“Bitcoin may drop to these levels in the coming weeks”

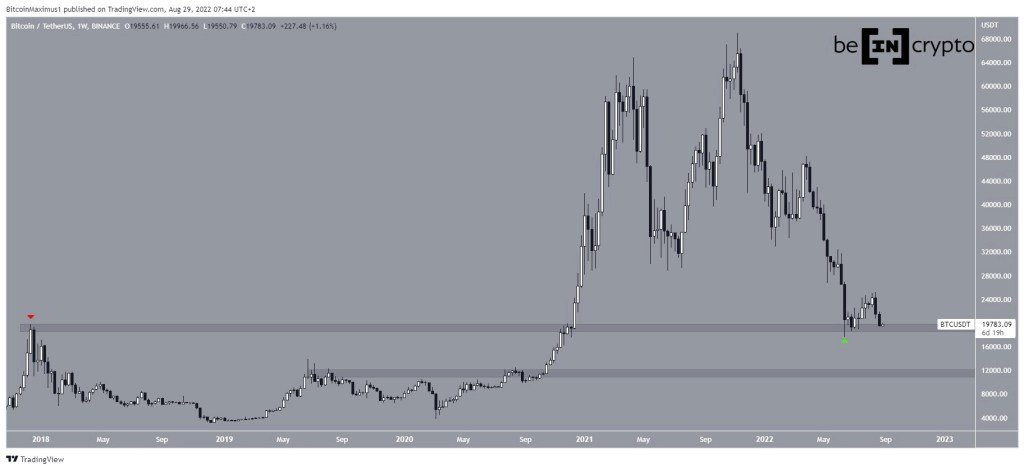

Famous crypto analyst Capo has once again changed his mind for BTC. After the sudden collapse of the $22.5k support on Friday, the analyst predicts further declines. According to the analyst, the main target for BTC is currently $16,000. In the meantime, let’s mention that Bitcoin last saw $16,000 in December 2020. Since the collapses brought about by the pandemic, the entity has not visited the region again. BTC was close to this level in the crash in June. The leading cryptocurrency fell to $ 17,708 on June 18 for the first time in 2 years.

The current bear market has already brought its lowest level in 2 years. At a time when analysts believe the bottom is already in, Capo says more dips could come. He mentions that a price of $16,000 is “very likely for the coming weeks.” This brings further uncertainty to the space at a time when the Funding Rate is already seeing dominant short sentiments. According to the analyst, key resistance levels of 22,500 and 23,000 and a drop to the $19,000 support will confirm $16,000.

“Time to buy for BTC”

On the other hand, analyst Michaël van de Poppe advises investors to buy BTC now. The CEO of Eight Global stated in a recent tweet that the Hash Ribbon indicator gives a buy signal. Now it’s “time to start building your investments,” says Poppe. Bitcoin is currently worth $20,043 and has lost 7% of its value last week. BTC has already reached the level below $20,000 today. Although it is experiencing a rapid recovery, it is possible for the asset to return there.

“Bitcoin will not make ATH until 2024”

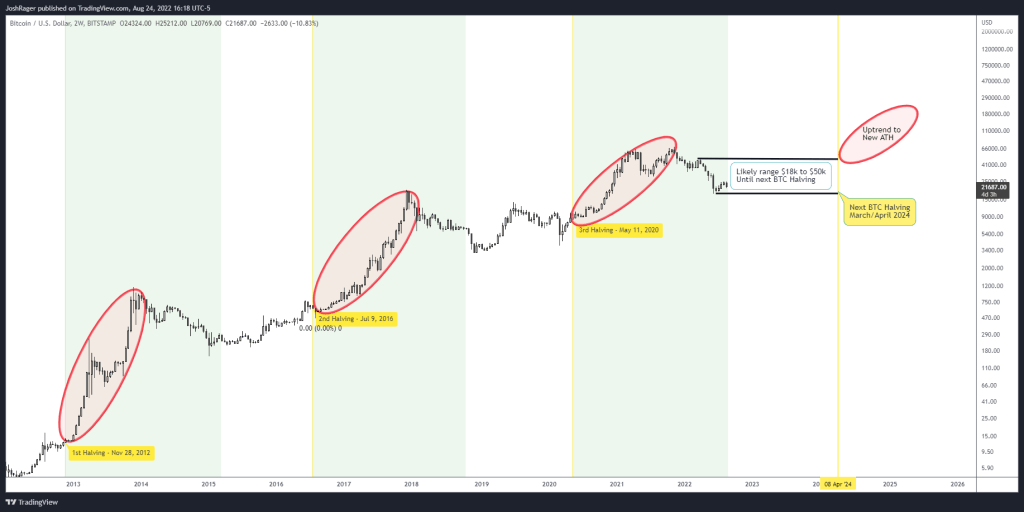

The pseudonymous analyst, known in the industry as Rager, spoke to his 206,100 Twitter followers. Accordingly, Rager says that September is generally not a good month for BTC. Looking at the chart that Rager published, Bitcoin shows an average decrease of close to 6% in September. The crypto analyst is betting that while Bitcoin may be bearish in the near term, BTC is poised to trade in a wide range between $18,000 and $48,000 next year. Therefore, he states that he will buy long-term spot under $20,000.

In his prediction for Bitcoin for the next year, Rager talks about halving. cryptocoin.com As we reported, 835 days have passed since the last halving of BTC. The analyst says that the halving happens when near the bottom of the cycle. “So far, there is a situation where the Bitcoin bottom is in unless the stock market continues to break down,” he says. He then states that he expects a one-year interval. According to the analyst’s chart, BTC could trade sideways until April 2024 before starting a new uptrend towards its all-time high.

“BTC could make a breakout to $11,000”

Bitcoin has formed two different bearish candles on its weekly chart. If there is a break below $19,300 in the leading cryptocurrency, the price has the potential to drop as low as $11,000. However, the chart also reveals that BTC has broken the ascending channel pattern. Breakouts in such channels are a harbinger of price corrections. As a matter of fact, BTC is currently experiencing a correction and it is possible to make a new bottom.

“I expect a 50 percent drop in Bitcoin”

Market analyst Todd Horwitz, who is very popular in the field, also talked about BTC. The analyst stated that he expects a 50% to 60% collapse for Bitcoin. He predicted that this would emerge as a result of global developments. Horwitz, who bet that the Fed will increase by 100 basis points in September, says this move will be disastrous for cryptocurrencies. According to him, the collapse he predicted in BTC will come after this move of the FED. Horwitz expects a price of $12,000 to $13,000 in the leading cryptocurrency.