Bitcoin fails to catch a break after ‘hot’ PCE numbers penalize US stocks and return DXY from the brink of collapse. Analysts predict the next stops of the leading crypto.

Headwinds for Bitcoin post PCE?

Bitcoin tried to reclaim $24,500 the previous day but ultimately failed as resistance kept gains in check. With this, cryptocoin.comAs you follow, Bitcoin reacted with a decline to the latest US Personal Consumption Expenditure Index (PCE) data, which was 4.7% instead of the 4.3% forecast.

This will cause Federal Reseve to consider a larger rate hike at its March meeting, according to popular analyst Tedtalksmacro. This is a potential headwind for risky assets, including crypto. “Here comes the 50bps speculation in March,” the analyst commented in an episode of a Twitter thread.

“As long as BTC stays above this level, it’s fine!”

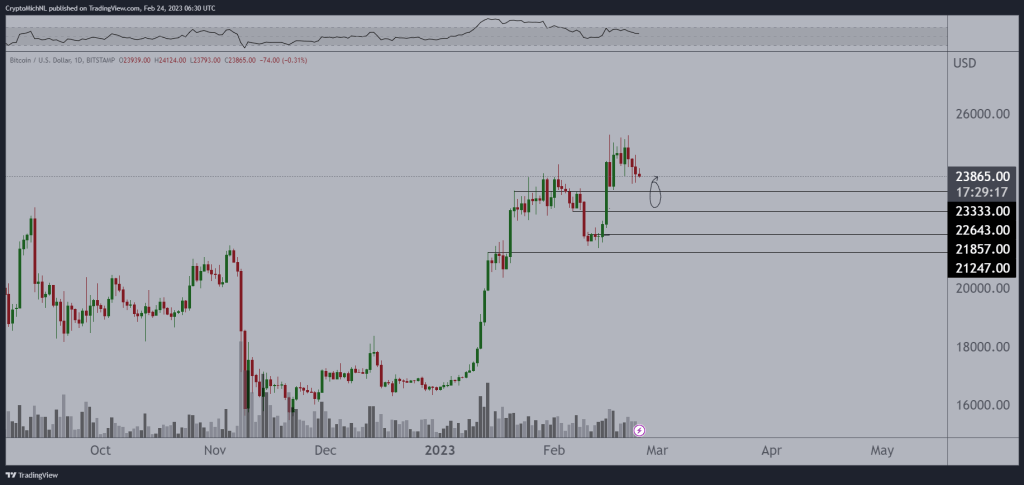

Meanwhile, another veteran analyst, Michaël van de Poppe, remains optimistic about short-term prospects, focusing on BTC itself. Next to a chart highlighting key levels, he places the following assessment:

Markets are still in a regular correction within an uptrend. As long as Bitcoin stays above $22,000, this will be enough to expect a continuation towards $25,000.

BTC explanatory chart / Source: Michaël van de Poppe/Twitter

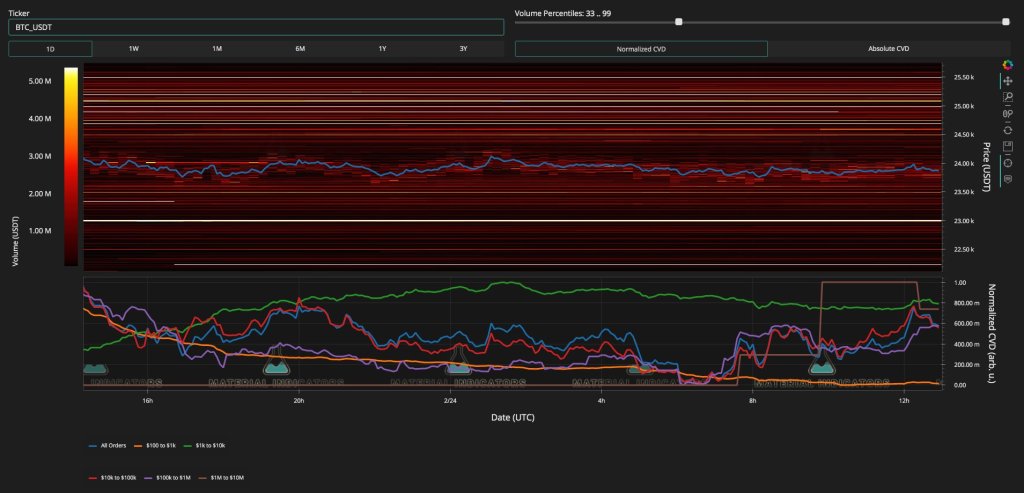

BTC explanatory chart / Source: Michaël van de Poppe/TwitterMonitoring resource Material Indicators highlights that resistance on the Binance order book has risen above the spot price, with the most support at $23,000.

BTC order book data (Binance) / Source: Material Indicators /Twitter

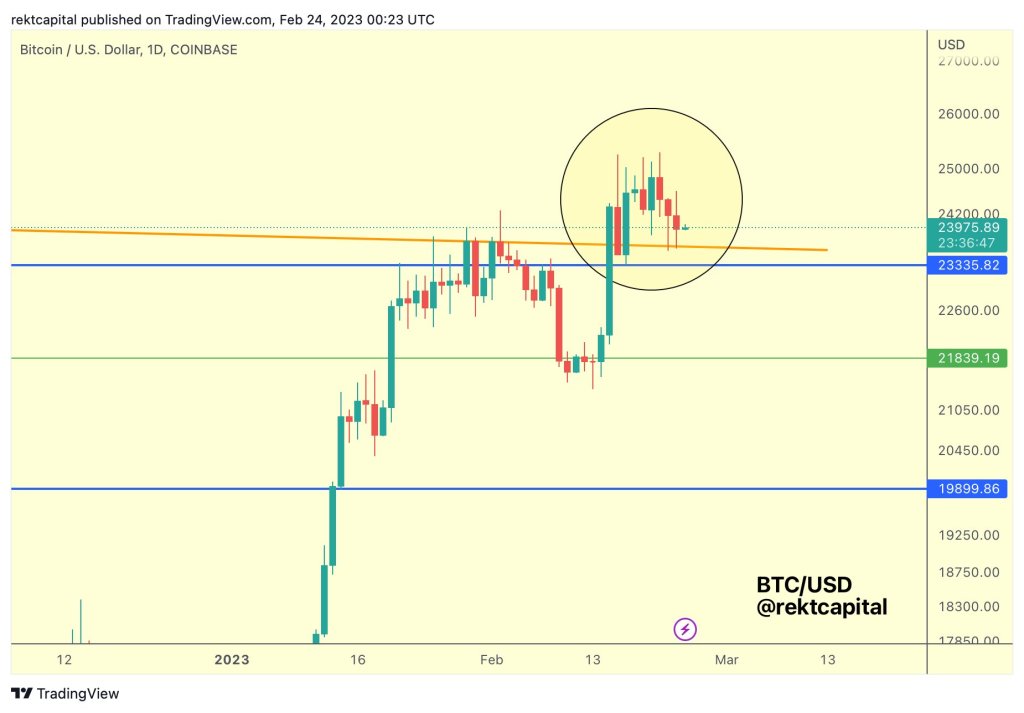

BTC order book data (Binance) / Source: Material Indicators /TwitterPopular trader and analyst Rekt Capital, on the other hand, shows that BTC has recently been trying to hold an inverted trendline to support intraday timeframes. In this context, the analyst makes the following comment:

No 3rd consecutive retests yet, but BTC is still hovering above the Lower High resistance. If this price stability continues here, it can be argued that the price is slowing down on the sell-side momentum against this new Lower High support.

BTC explanatory chart / Source: Rekt Capital/Twitter

BTC explanatory chart / Source: Rekt Capital/Twitter“If Bitcoin breaks this level, the door of 21 thousand dollars opens”

The widely followed analyst alias Pentoshi reveals that the market is no longer as bullish as it was a week ago. The analyst says his confidence has waned from last week due to weakening momentum. In this context, Pentoshi makes the following assessment:

Do I trust the market as much as a week ago? No. Most, if not all, altcoins look tired. There are definitely momentum concerns. So I will click less than before and be less aggressive in the market compared to last week.

Focusing on Bitcoin, Pentoshi says that if the leading crypto breaks below the support level of around $23,300, it will likely drop to the $21,000 price level. According to Pentoshi, the bullish thesis for Bitcoin will be invalidated if BTC breaks below the $23,300 support level. In line with this, the analyst says, “I’ve said it before, but until ‘lose this line’ disappears, you should have a bullish bias.”

Source: Pentoshi/Twitter

Source: Pentoshi/TwitterUS dollar pushes 2023 high

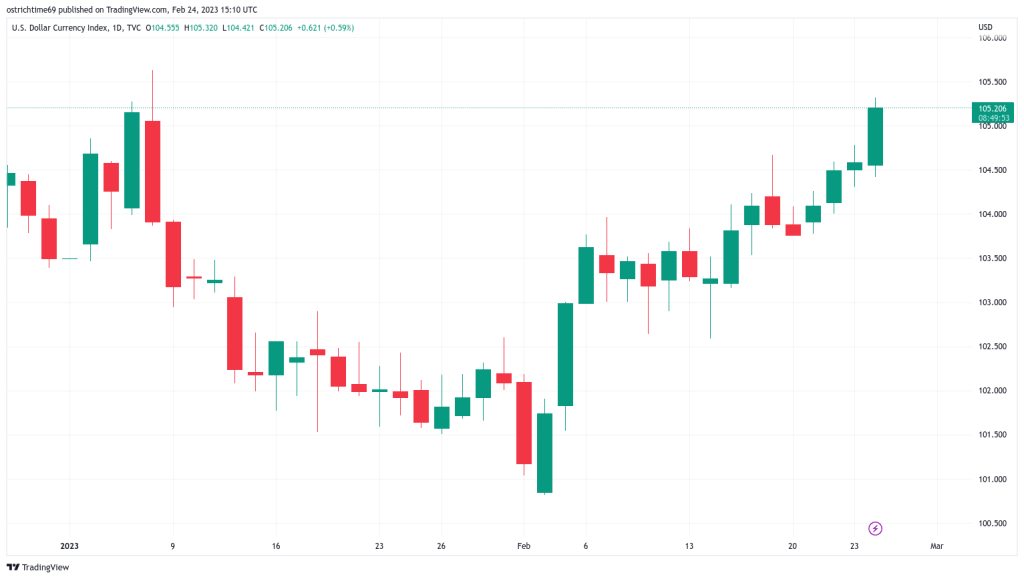

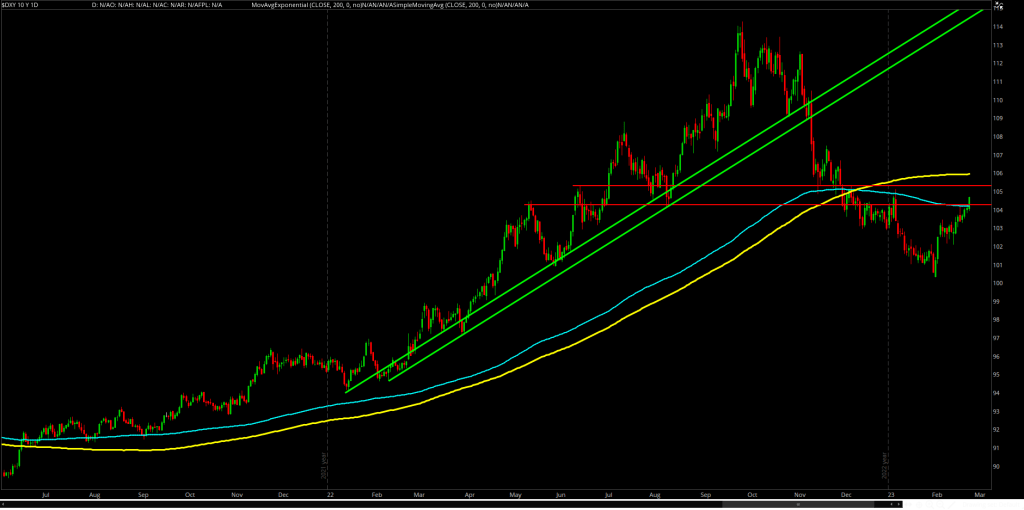

The US stock fell more markedly on PCE data, and the S&P 500 and Nasdaq Composite Index fell 1.4% and 1.7%, respectively, at the time of writing. The US Dollar Index (DXY), which climbed to 105.3, its highest level since Jan. 6, provided welcome support.

US Dollar Index (DXY) 1-day candlestick chart / Source: TradingView

US Dollar Index (DXY) 1-day candlestick chart / Source: TradingViewDXY weakness characterized much of the crypto rebound in January and reversed in February in line with the increasing difficulty of Bitcoin bulls willingness to make more than 50% gains. “The US Dollar Index is heading towards the 200-day moving average cloud,” Caleb Franzen, senior market analyst at Cubic Analytics, said in part of a Twitter comment. Franzen added that DXY ‘could see more bullishness in this range, but the entire range is potential resistance’.

US Dollar Index (DXY) explanatory chart / Source: Caleb Franzen/Twitter

US Dollar Index (DXY) explanatory chart / Source: Caleb Franzen/Twitter