Gold price lost altitude on Monday as a stronger US dollar weighed on the yellow metal. However, negative sentiment and catalysts from China have been supporting the dollar in recent days. The market is taking a cautious stance ahead of this week’s FOMC meeting minutes. Analysts interpret the market and share their forecasts.

“Gold price is consolidating here”

cryptocoin.com As you can follow, gold has risen by about 1.6% last week. However, the week started with a decline. At the time of writing, spot gold was down 1.04% to $1,783.38. U.S. gold futures were last traded at $1,797, down 0.98%. The dollar strengthened against its rivals, wiping out previous losses. This made gold more expensive for buyers of other currencies. Clifford Bennett, chief economist at ACY Securities, comments:

Gold seems to be consolidating here for a week or two before continuing its upward march towards $2,000 again. There may even be some who will feel the need to take profits to offset the weakness of their wealth portfolio. Gold will likely be supported around $1,785. A slide to $1,760 cannot be ignored. However, this represents a great long-term buying opportunity.

“The same problems still apply for gold”

Meanwhile, Richmond Fed Chairman Thomas Barkin said on Friday he wants to raise interest rates further to contain inflation. Investors will watch the FOMC meeting minutes on Wednesday for more clues to future rate hikes.

Traders are pricing the probability of the Fed’s 75 basis point hike in September at 44.5% and a 50 basis point increase at 57.5%. While gold is seen as a hedge against inflation, rising US interest rates are reducing the appeal of non-yielding bullion. In a note, ANZ analysts underline:

Gold posted its fourth consecutive weekly gain as inflationary pressures eased. However, the same issues are likely to be negative ultimately.

Reuters technical analyst Wang Tao looks at the technical front of gold. Spot gold tends to retest the $1,784 support.

Gold price technical analysis

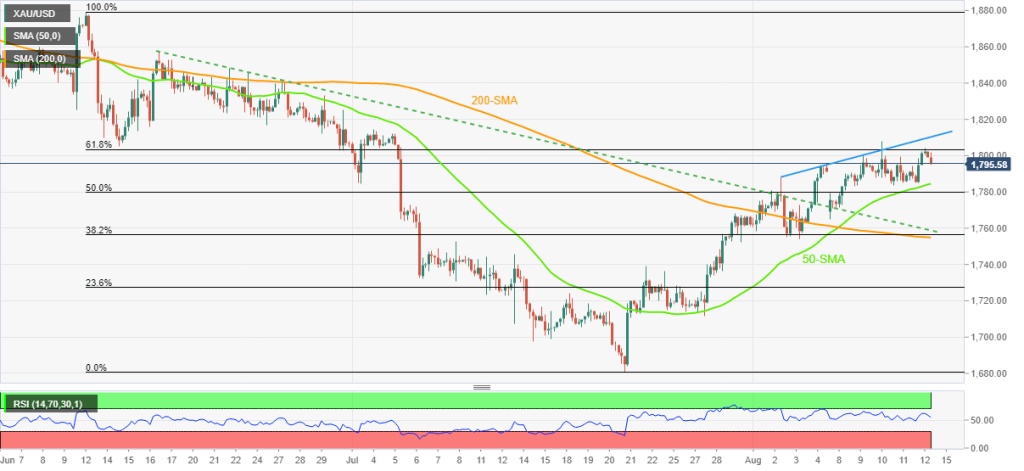

Market analyst Anil Panchal analyzes the technical outlook for gold as follows. Gold price bounced back from the 61.8% Fibonacci retracement of the June-July retracement. So it’s printing its biggest daily loss in over a week. However, the RSI (14) pullback also supports gold’s recent weakness.

On the other hand, pullback moves need to be confirmed at the 50-SMA near $1,784 before leading gold sellers to the previous resistance line on June 16. However, it should be noted that a convergence of the 200-SMA and the 38.2% Fibonacci retracement level around $1,754 looks like a tough nut to crack for metal sellers later.

Alternatively, the upside openness of the 61.8% gold rate near $1,805 may not be there to push gold higher. Because a two-week resistance line near $1,811 is acting as an extra filter to the north.

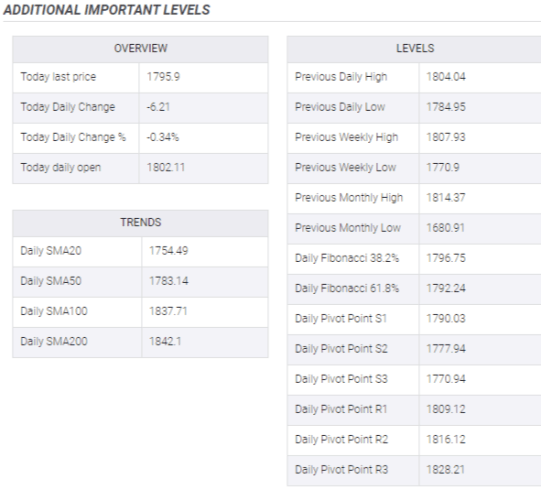

Additional important levels for gold price

Additional important levels for gold price