Gold prices bounced slightly on Monday. However, the market remains cautious. Investors’ focus is on US inflation data. The data is crucial as it could affect the size of the Fed’s next rate hike. Analysts interpret the market and evaluate technical levels.

“There are some leverages that reduce the downward pressure on gold”

Spot gold was trading at $1,726.8, gaining 0.64% as of writing. U.S. gold futures rose 0.59% to $1,738.8. Clifford Bennett, chief economist at ACY Securities, comments:

There are some persistent general leverages that reduce the downward pressure on gold. However, this week’s inflation figure may provide some relief. Another indication that inflation may have peaked could be encouraging for the gold market. The Fed will continue to increase no matter what. However, an end in sight is possible to push gold back up after recent sharp declines.

“Spot gold tends to rise to $1,729”

cryptocoin.com As you follow, the US Consumer Price Index (CPI) increased by 8.5% in July. August CPI, which will be announced on Tuesday, is expected to increase by 8.1% compared to this.

Fed officials on Friday ended the public disclosure period ahead of the central bank’s September 20-21 policy meeting. Authorities have made strong calls for another extreme rate hike to combat high inflation.

Markets largely expect the Fed to raise interest rates by 75 basis points this month. Meanwhile, European Central Bank policymakers raised key interest rates to 2%. Spot gold is tending to break the resistance at $1,720, according to Reuters technical analyst Wang Tao. After that, it will attempt to rise to $1,729.

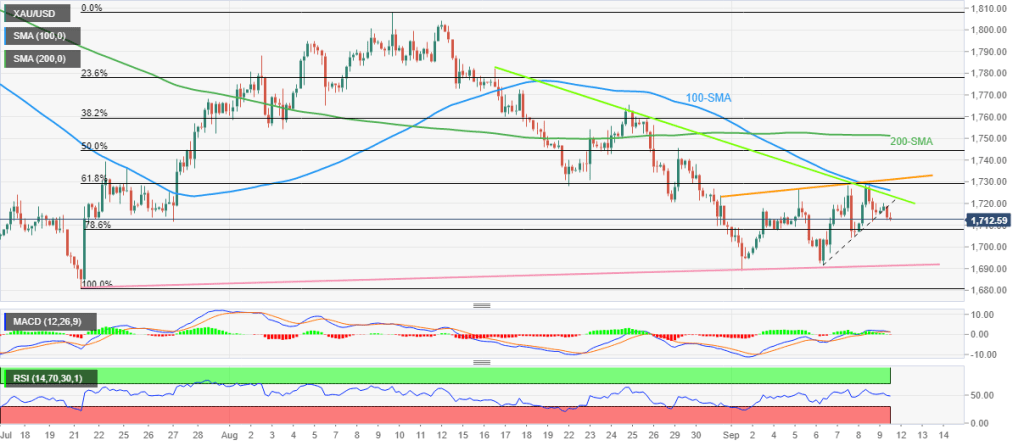

Technical Analysis: Gold sellers target $1,690

Market analyst Anil Panchal analyzes the technical outlook for gold as follows. A clear break of an upward sloping support trendline from last Wednesday, resistance currently around $1,720 is pushing gold price towards the $1,700 threshold.

However, an upward sloping support line near $1,690 from July 21 will likely challenge the golden bears before leading the yearly low to $1,680.

Meanwhile, gold buyers managed to break through the $1,720 close barrier. However, they have a bumpy road to return. Also, a descending resistance line from mid-August precedes the 100-SMA at $1,724 and $1,727, respectively, to limit the metal’s short-term bullishness. Following this, the weekly resistance line and the 200-SMA near $1,731 and $1,751 will attract the attention of the market.

“Consolidation looks likely”

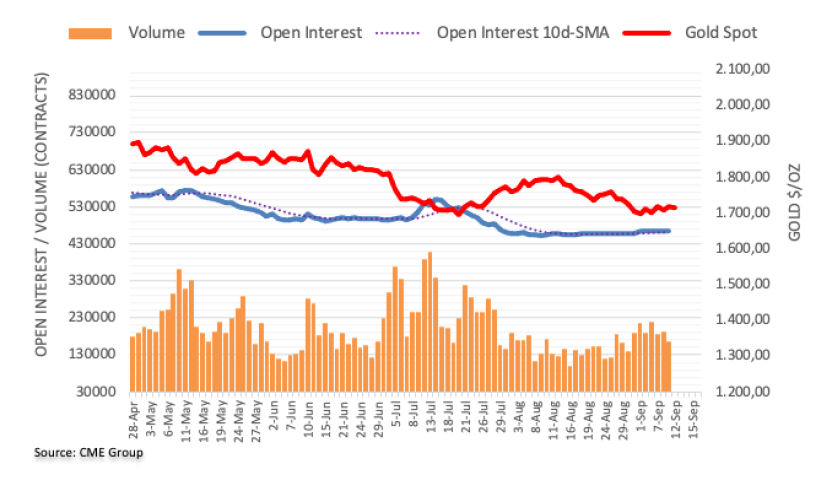

Open interest on gold futures markets rose by just 270 contracts this time, according to preliminary data from CME Group. Thus, it rose for the second consecutive session on Friday. Instead, the volume broadened the continued volatility. Accordingly, it contracted with approximately 26.8 thousand contracts.

Gold prices retested the upper end of the range around $1,730 on Friday. However, he later distributed some of these earnings. The move was accompanied by a small increase in open interest and a marked pullback in volume. According to market analyst Pablo Piovano, this is likely to allow for some extra gains in the very near term, although it has always been in the dominant range-bound theme. Meanwhile, the $1,680 zone still turns out to be good traction.