Last week’s powerful US employment data increased the likelihood of the US Federal Reserve by aggressive interest rate hikes. For this reason, the dollar and the US treasury interest rose. Gold prices remained stable on Monday after their losses in the last session. Analysts interpret the market and share their predictions.

Stephen Innes: This is a situation that should be negative for gold

Spot Gold, after 1 %in the previous session, the press remained constant at $ 1,775 time. US gold futures decreased by 0.1 %to $ 1,790.40. Stephen Innes, the executive partner of SPI Asset Management, makes the following assessment:

The market still digeshes the impact of the colliding employment report in the United States and the extent to what extent it will affect the FED. In this environment, gold made a calm start. I think that the increase in July in non -agricultural employment increases the likelihood of an interest rate hike of a third 75 basis in September. This is a situation that should be negative for gold.

The Fed gives 75 basis points signals for September

Traders are currently seeing the possibility of 73.5 %probability that the Fed will continue to raise 75 basis points raids for the next policy decision on September 21st. Due to the stunning US payroll report, stagnation views stepped back. The dollar index (DXY) has reached the highest level since July 28. This made the gold more expensive for other currency owners.

The benchmark US 10 -year Treasury interest rates, on Friday for more than two weeks of the highest levels of the highest levels. FED President Michelle Bowman said on Saturday that the Fed should consider the interest rate hike of 75 basis in the coming meetings to return to its inflation target.

Wang Tao: It is possible for gold to break $ 1,767 support

Although gold is seen as a precaution against inflation, rising US interest rates dull the charm of the ingot. Kriptokoin.comAs you have followed, this week’s focus will be US inflation data. The US CPI will be announced on Wednesday.

Analysts say the data will give more clues about the Fed’s interest rate hike path. According to Reuters technical analyst Wang Tao, it is possible to break a support of $ 1,767 on the technical front. Later, the yellow metal is likely to fall into the $ 1,748-1.756 range.

TD Securities: Golden Rally is ready for an important return!

Gold fell to levels near $ 1,772 after the US NFP data much stronger than expected. According to TD Securities strategists, traders are more and more likely to pricing an early Fed axis by moving away from the current hawk stance. Therefore, the golden rally is ready for an important return. In this context, strategists make the following assessment:

The last rally carried its gold from $ 1,681, the lowest level of July, to a high level of $ 1,795. In addition, money managers have recently reduced Long risks. Therefore, the rally is likely to be reversed to a large extent. The combination of hawk explanations from the Fed officials and more powerful data than expected is possible catalysts that can trigger additional sales in the coming days and weeks.

According to strategists, markets will soon follow the US July CPI data on Wednesday, especially because the core CPI, any stubborn inflation data in the system helps to refute the early pivot argument.

Pablo Piovano: Other gains seem limited

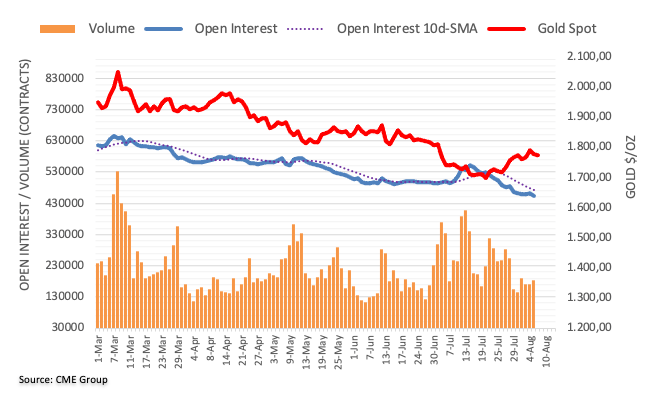

According to CME Group’s preliminary data, open interest to gold -futures markets remained unstable on Friday. Approximately 7 thousand contracts fell. On the other hand, volume reversed the two -day decline in a consecutive consecutive. About 13.3 thousand contracts increased.

Gold prices, in recent sessions, the key fell below $ 1,800. According to market analyst Pablo Piovano, the decline on Friday was behind the diminishing open interest. Analyst says that this means that more decreases are limited. He also notes that the close target is always at the level of $ 1,800.