Gold prices fell sharply on Thursday. The bullion outlook has been severely damaged by fears that the US Federal Reserve may raise rates more aggressively this month to combat rising inflation.

Ilya Spivak: Gold prices still bearish

Spot gold was down 1.3% at $1,712.69 at press time. U.S. gold futures fell 1.52% to $1,709. Meanwhile, the dollar remains stable near 20-year highs. This negatively affected demand for dollar-priced gold among buyers holding other currencies.

Indicator US 10-year Treasury rates rose by suppressing the zero-yield gold appetite. cryptocoin.com As you can follow, annual consumer prices in the USA rose to 9.1% in June. Inflation recorded its sharpest rise in more than four decades. DailyFX currency strategist Ilya Spivak comments:

CPI data created volatility but did not create a direction. Markets will now likely wait longer for the Fed’s preload rates. However, overall it doesn’t need to tighten any further. However, gold prices still have a bearish outlook.

“It would be foolish to say that 75 basis points is a pigeon”

The dollar, which rose after the inflation report sent gold prices to the lowest level in nearly a year on Wednesday. However, a pullback in the dollar helped bullion rebound sharply and finish the session marginally higher. On the other hand, gold prices saw a sharp decline on Thursday.

Now, a major rate hike of 100 basis points is on the agenda at the Fed’s policy meeting on July 26-27. Gold is seen as an inflation hedge. However, higher rates are hurting the attractiveness of non-interest-bearing bullion. Ilya Spivak says:

It would be silly to say that 75 basis points is dove. But there is a risk that the Fed will do something objectively big like 75. It also rally because the gold 100 wasn’t there. Gold now sees support at $1,715-1,717.

Bart Angel: These are likely to help under

Bart Melek, head of commodities strategies at TD Securities, says the CPI data guides the idea that the Fed is more likely than not to increase rates aggressively and possibly keep them there longer. He also notes that this situation caused gold to pull back as an initial reaction. In addition to this, Melek makes the following comment:

The decline in yields and the ensuing dollar are likely to help gold. Investors who shorted gold have now moved to the lows of the $1,700 encompassing lows.

Will the Fed reverse its hawkish stance?

Analysts say expectations for rapid rate hikes are likely to hold a tight leash on gold, even as economic concerns persist. However, in a note, City Index market analyst Fawad Razaqzada highlights:

The post-CPI response clearly shows that investors think the big inflation data will hurt the economy so badly that the Fed will not only halt interest rates soon, but reverse in the first quarter.

Pablo Piovano: Gold prices continue to decline in the very near term

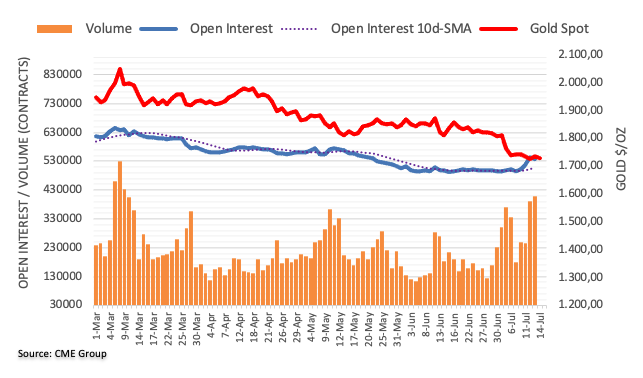

Open interest on gold futures markets reversed traders’ three-day gains. It also narrowed to around 5,000 contracts on Wednesday, according to advanced data from CME Group. Instead, volume increased with more than 19,000 contracts in the second consecutive session.

Gold prices posted good gains after dropping to $1,700 on Wednesday. However, the increase was behind the lower open interest rate, according to market analyst Pablo Piovano. However, it has somewhat dampened expectations for further earnings for the time being. Meanwhile, the $1,700 zone remains bearish in the very near term.