Gold price rose on Wednesday after two sessions of decline. It carried its earnings to the electronic trading session after the Fed’s decision to raise interest rates in line with expectations. Analysts are trying to determine the direction of the gold price after the Fed decision.

Adrian Ash: Gold clearly priced in rate hike

Gold futures ended on modest gains. It then rose even higher just after the US central bank’s monetary policy decision on Wednesday afternoon. Adrian Ash, BullionVault research director, said in a statement:

Gold has obviously priced in the rate hike. It traded rather sideways in a narrow range before and after the announcement.

cryptocoin.com As you follow, the Federal Open Market Committee announced on Wednesday the short-term benchmark interest rate, with an increase of 75 basis points. Thus, it raised the fed funds rate to the range of 2.25% and 2.5%. Adrian Ash comments:

But now the big questions come from the bond market. Because inflation over 9% and 2-year interest rates falling to 3% show how mixed the outlook is. Unless there is a collapse in inflation forecasts, such severe uncertainty will likely support, if not increase, investment flows in monetary precious metals.

Jeff Klearman: Both of these factors provide support for the gold price

Meanwhile, the Fed indicated that further rate hikes would be appropriate. Jeff Klearman, GraniteShares Portfolio Manager, who manages GraniteShares Gold Trust BAR, shared his views on the subject. It is unclear how much higher and at what pace the Fed will move forward, according to the analyst. In this context, the analyst makes the following comment:

As a result, the 10-year Treasury rate moved lower to 2.75%. Almost 50 basis points lower than a month ago. But more importantly, 10-year real interest rates also fell below 40 basis points after reaching levels above 80 basis points in mid-June.

According to Jeff Klearman, the fall in real interest rates indicates that investors believe the Fed should probably cut rates sooner than expected to combat slow growth and even recession. The analyst makes the following statement on this subject:

Ten-year inflation expectations also fell from their highest levels. However, continued high energy prices raises the possibility that high levels of inflation will continue, even with slower local and global economic growth. Both of these factors (low real interest rates and high inflation levels) support gold prices.

Gold technical analysis: Indicates more gains ahead

According to market analyst Sagar Dua, the Fed gave fresh blood to the gold bulls in a slightly hawkish comment at its monetary policy meeting on Wednesday. Meanwhile, the Fed forecasts interest rates at 3.5% by the end of 2022. This means there is now less room for buffer rate hikes. Moreover, it is a sign that the monetary policy will normalize in terms of interest rate hikes in September.

Meanwhile, the analyst expects the US dollar index (DXY) to show a fragile performance as Fed chairman Jerome Powell underlines the decline in individual demand. Going forward, US Gross Domestic Product (GDP) figures will remain in focus. According to market consensus, US GDP data will drop to 8% on a quarterly basis versus 8.3% in the previous release. However, the annual figure will improve significantly by 0.4% versus -1.6% in the previous version. The analyst analyzes the technical outlook of gold as follows:

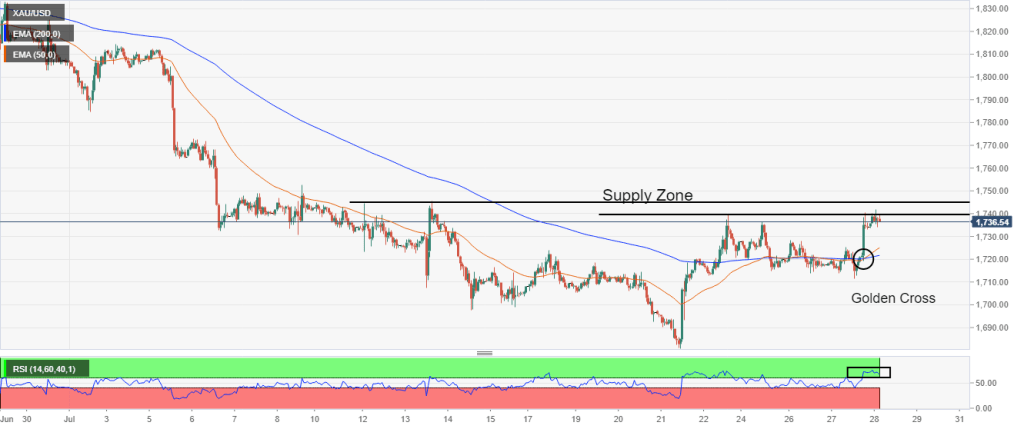

On an hourly scale, gold price is preparing for an upside break in the supply zone, which is in a tight range of $1,739.63-$1,745.03. A golden cross represented by the 50- and 200-period Exponential Moving Averages (EMA) at $1,720.00 increased the likelihood of a bullish reversal. Additionally, the Relative Strength Index (RSI) slipped into the bullish range of 60.00-80.00. This points to more gains in the future.

Pablo Piovano: Gold price seems somewhat restrained

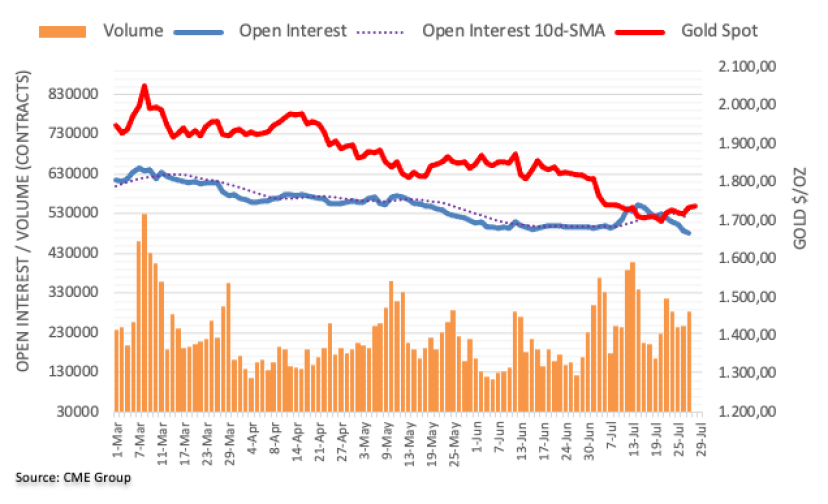

CME Group’s flash data for gold futures markets noted that open interest contracted for the fifth consecutive session on Wednesday, this time to around 5.5k contracts. Instead, volume increased by around 36.5k contracts in the second consecutive session.

Gold price rose on Wednesday after the FOMC event. With this move, the key reached the $1,740 level. But that move was amid falling open interest, according to market analyst Pablo Piovano. Therefore, the analyst notes that upside expectations are somewhat limited for now.