After rumors of the possible bankruptcy of Genesis, a subsidiary of Digital Currency Group, many investors began to experience greater fear. Assets like ADA and XRP tested local lows despite the latest recovery. Therefore, most assets have entered a further downtrend. So what’s next? Here are the expectations for Bitcoin and some altcoins…

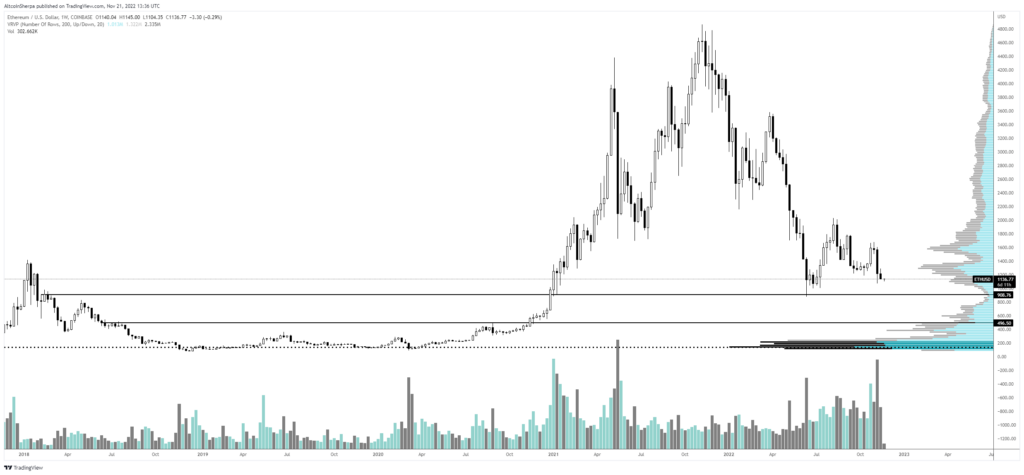

Ethereum prediction from Altcoin Sherpa

Altcoin Sherpa, a popular cryptocurrency strategist, shared his predictions for the two largest cryptocurrencies by market cap, Bitcoin and Ethereum. He also conveyed his expectations for Solana (SOL), who has been in trouble lately. The analyst mentioned the possibility that another major event, such as the leading firm’s filing for bankruptcy, could shake up the crypto markets.

He said that in such a case, Ethereum could see a 54 percent drop from current prices. He says there is still support above the $900 level in ETH, but remains below the $500 range. Altcoin Sherpa used the following statements:

ETH: Some broad timelines. I think if a big player like GBTC (Grayscale Bitcoin Trust) sells out, we will see something like $500-700 Ethereum. On a psychological (number) basis only, I think $500 is a good place to bid; but there is still a long way to go before that.

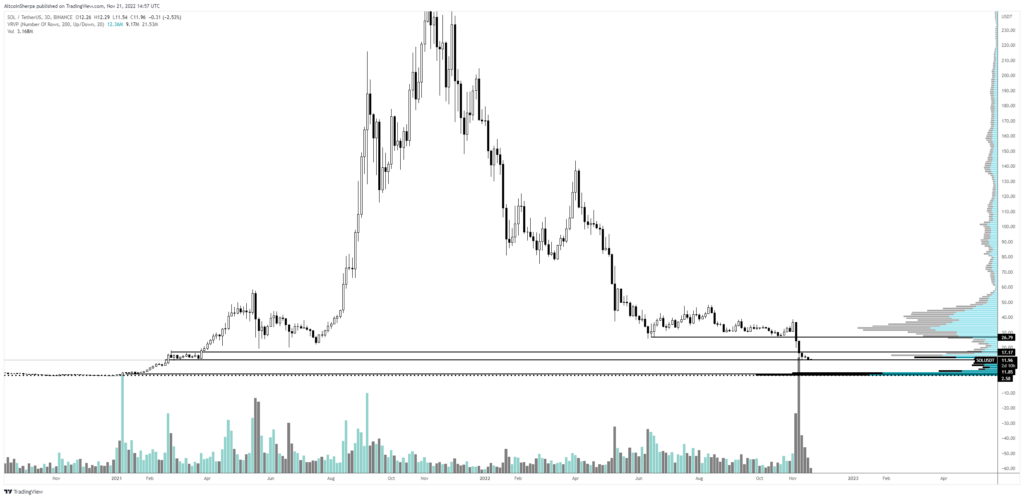

SOL could drop to $3, according to altcoin Sherpa

Next, Altcoin Sherpa looks to one of Ethereum’s biggest competitors, SOL. He says Solana could drop to $3 if current price levels don’t hold. The analyst uses the following statements:

LEFT: If these current areas go down, I think $3 is the next important area. In the long run I think the elimination of FTX/SBF (Sam Bankman-Fried) is probably a net benefit for the ecosystem, but in the short run, it’s still disastrous.

Solana is currently changing hands at $11.73. cryptocoin.com As we reported, the crypto exchange was hit hard by the collapse of FTX. The firm’s CEO, Sam Bankman-Fried, was one of the ecosystem’s biggest investors. Presumably, SOL will have to liquidate its assets as bankruptcy proceedings unfold.

Meanwhile, former Goldman Sachs executive Raoul Pal compared Solana’s performance to 2018, when Ethereum dropped 97 percent. He stated that at the time, Ethereum offered a great investment opportunity but no one cared. He added that the same is true for Solana at the moment.

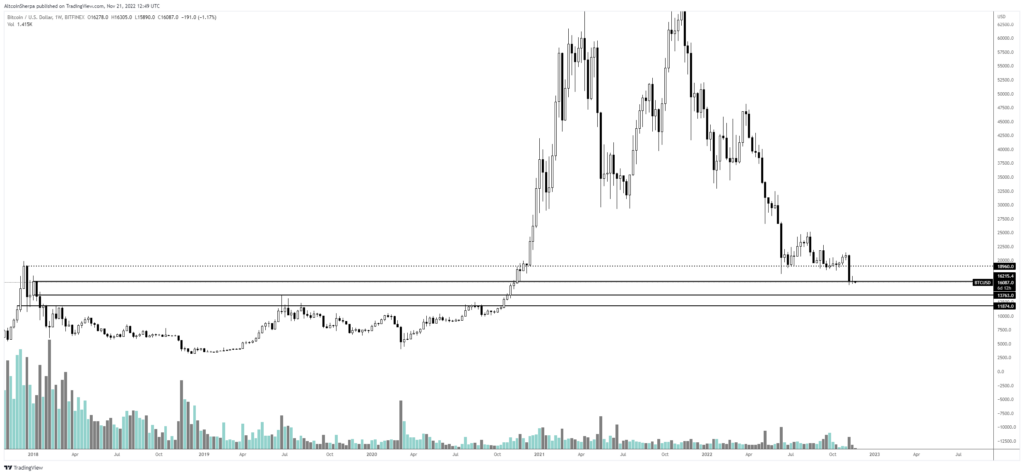

Analyst sets buy level for Bitcoin

Altcoin Sherpa also weighs in on Bitcoin and says that while BTC is lower to go, longer-term opportunities are starting to show themselves. The analyst used the following statements:

Wide time frame levels. I think $16,000/14,000/12,000 are great levels to buy in the long run. Most investors handle these three levels with only DCA (dollar-cost average). Put a 30 percent buy order on each of these and then walk away for a few years.

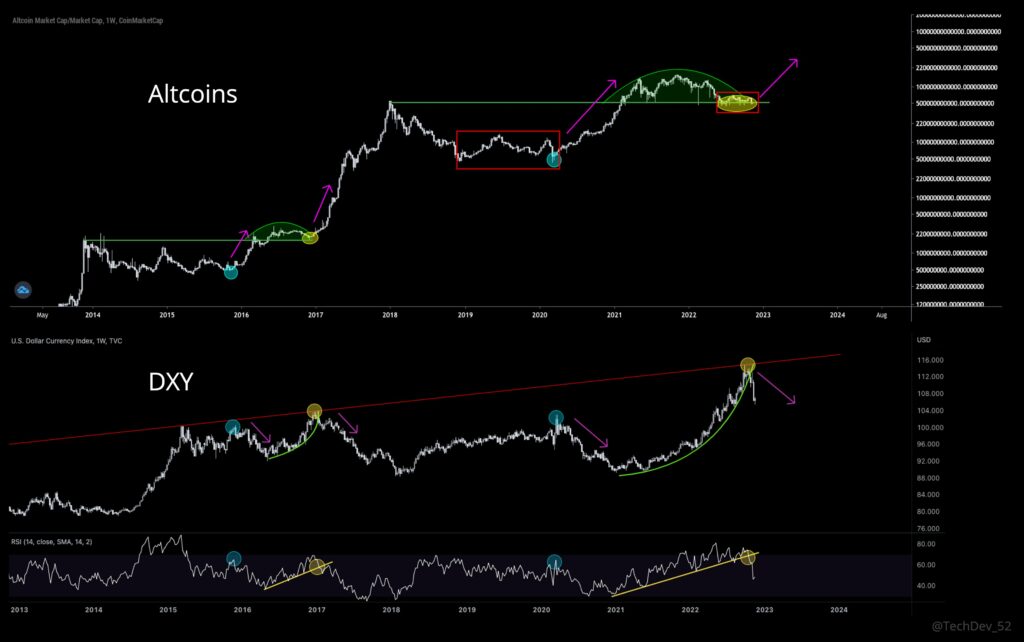

TechDev draws attention to Telcoin (TEL)

The analyst, known as TechDev, points to the possibility of Telcoin (TEL) rebounding after a critical Fibonacci retracement. TEL said it saw a weekly “big bull breakout” following the volatility squeeze. TechDev also talked about the overall market cap staying above 2017 highs. That’s why he says altcoins are ready to make more profits overall.

Holding critical support plus weakening US dollar index (DXY) could be a recipe for big gains in the future, according to the analyst. According to the analyst, who thinks that altcoins exhibit an accumulation structure, DXT also continues its parabolic breakdown. He states that his argument remains unchanged as long as both go on. He conveys that we are in a correction in a bigger move.

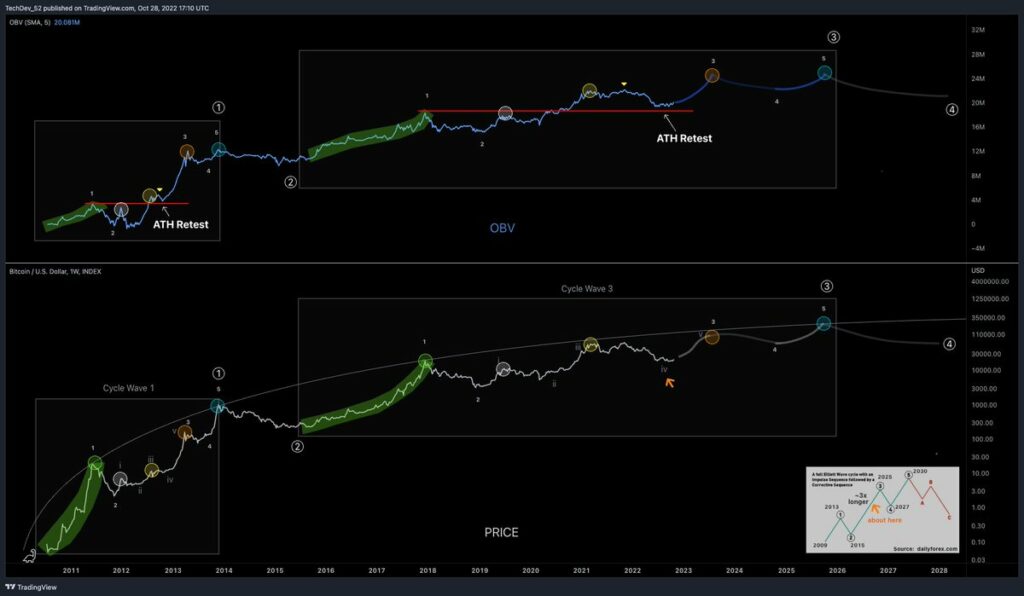

TechDev comments $100,000 for Bitcoin

When the popular crypto analyst looks at Bitcoin, he says that BTC is on a 20-year Elliott Wave cycle that could last until 2030. Elliott Wave is a technical analysis system based on the idea that price impulses occur in crowd-led wave. The theory states that a trend comes with five main waves. It assumes that each major wave consists of five smaller waves.

According to TechDev, BTC could target $100,000 to $120,000 at some point next year based on its interpretation of Elliott Wave principles. The analyst points to the following price points with the Elliott wave theory:

- Primary part of 3rd cycle: $100,000-120,000 [in] 2023

- The fourth part of the 3rd cycle: $25,000-45,000 [in] 2024

- Fifth part of 3rd cycle: $300,000-450,000 [in] 2025

Analysis for XRP, ETH

According to analyst Arman Shirinyan, there is a serious bearish trend in XRP. Behind this is a serious downtrend with gradually increasing selling pressure pushing the asset’s price to one-year lows. However, there is a hidden chart pattern that was created only a few days ago. Once the technical analysis pattern is formed on the chart, an upside break should be expected in the foreseeable future.

Meanwhile, a record was set in ETH. According to on-chain data, Ethereum net flow on exchanges has reached a value the market has not seen in five years: -42,273,066 ETH. The metric measures the amount of coins entering and leaving centralized exchanges. When net flow turns negative, the market loses liquidity and funds, as trading platforms have no choice but to empty their hot and cold wallets to close the retracement waves.

📉 #Ethereum $ETH Exchange Net Flow (1d MA) just reached a 5-year low of -42,273.066 ETH

Previous 5-year low of -35,979.104 ETH was observed on 05 January 2019

View metric:https://t.co/bKSV03bnsZ pic.twitter.com/kY2pk7ben1

— glassnode alerts (@glassnodealerts) November 21, 2022