Gold futures started the week slightly higher after prices briefly plunged below the $1,800 per ounce threshold. Gold rallied on Tuesday as a drop in the dollar bolstered demand for dollar-priced bullion and countered pressure from a recovery in US Treasury yields.

“Gold has fallen victim to strong US dollar and rising bond yields”

As we reported onKriptokoin.com , gold is the US dollar’s biggest hit in recent times. It dropped to session lows on Monday as it rose to higher levels. The Dollar Index (DXY) fell 0.2% after trading near a 20-year high on Friday. Commenting on the markets, City Index market analyst Fawad Razaqzada said in a note:

Gold has fallen victim to the strong US dollar and rising bond yields, making it less attractive to noninterest-bearing commodity yield seekers. came. Its performance surprised many market participants, including ourselves.

Rising bond rates are also putting pressure on gold. Earlier last week, Treasury yields traded near their highest levels in years before pulling back.

“Priority for gold is defending support around $1,800”

However, gold’s recent weakness, along with continued hot inflation data, is in the stock and crypto markets. He says the volatility seen is a surprise, expected to spur demand for safe-haven gold. The analyst explains:

Those who want to protect their wealth eroded by inflation should have been equally surprised to see the yellow metal price around $1,800. While it basically remains positive against gold, I just need to see a technical reversal pattern to confirm that prices have bottomed out. Such a scenario could be for gold to retrace the broken trendline and climb above the $1,850 resistance. But first thing first: It will need to defend the support around $1,800.

Oren Klachkin: We expect healthy manufacturing activity for the remainder of the year

The New York Fed on Monday said Empire, an indicator of manufacturing activity in the state State said its business conditions index fell 36.2 points to minus 11.6 in May. Economists had expected the index to drop slightly to 16.5, according to a poll by The Wall Street Journal.

Analyzing the data, Oren Klachkin, US economist at Oxford Economics, said in a note Monday, “One month’s data does not form a trend and we expect healthy production activity for the rest of the year and into 2023.”

“Longers can start positioning for a southward turn”

Gold, as the decline in the dollar supports the demand for dollar-priced bullion and the US Treasury It rose on Tuesday as it resisted pressure from a recovery in yields. Stephen Innes, managing partner of SPI Asset Management, comments:

Now that we have the much-needed liquidation in the gold markets, long-term investors can start positioning for the eventual southward turn based on harsh US economic data.

Wang Tao: Gold’s downtrend may be reversed

Reuters technical analyst Wang Tao, April 18 high of 1.998 He says that at $0.10, the downtrend may have reversed, with spot gold bouncing to the $1,840 to $1,849 range.

Pablo Piovano: Gold appears to be supported at $1,780

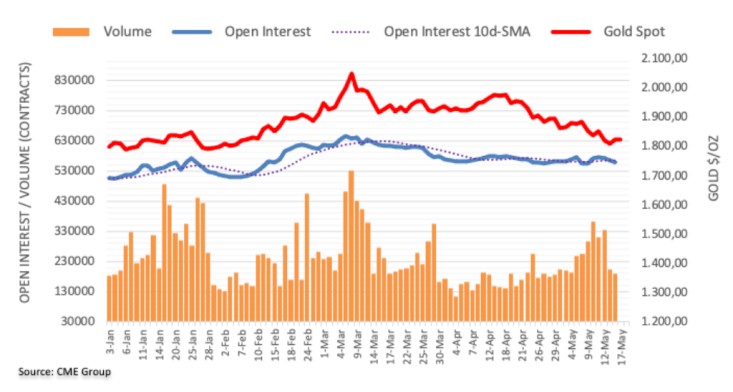

Gold futures markets are open for the third consecutive session this time on Monday, according to preliminary data from CME Group. It fell to 7.4 thousand contracts. On the same line, volume fell for the second day in a row and is now at around 15.3k contracts.

According to the analyst, the optimism in gold prices on Monday indicates that the continuation of the recovery, thanks to the lower open interest and volume, is not very positive in the near term. Meanwhile, the analyst thinks that the 2022 low so far at $1,780 will offer good support for the time being.