Gold prices slumped on Monday amid higher U.S. bond yields. However, expectations for a less aggressive US Federal Reserve rate hike trajectory weighed on the dollar. That kept gold near its three-week high. So, what levels will we see this week?

Gold rises as dollar declines

Spot gold is trading at around $1,760. The price of gold reached $1,767.79 on Friday. cryptocoin.com As we have also reported, this level was the highest price since July 6th. U.S. gold futures fell 0.3 percent to $1,776.50 an ounce, meanwhile. According to SPI Asset Management managing partner Stephen Innes, the lagging US dollar pushed gold higher. “Expectations converge around a rapidly slowing economy. It points to a less aggressive tightening,” he added.

Traders are currently pricing the current 75 basis point rate hike at 31 percent and a smaller half point increase at 69 percent at the Fed’s next meeting in September. Meanwhile, the dollar, which makes dollar-denominated gold cheaper for other currency holders, fell close to three-week lows against its rivals. Benchmark US 10-year Treasury yields, which limited gains on ounce of gold, moved away from a four-month low.

What are the resistance and support levels?

“Gold posted its biggest weekly gain since March amid speculation the Fed will slow the pace of rate hikes as the US economy slows,” ANZ analysts said in a note. Now the focus will be on the US jobs report, which could impact the Fed’s anti-inflation roadmap. The data will be released on Friday.

Meanwhile, disappointing Chinese economic data has dampened investors’ appetite for riskier assets. Spot gold expects a strong resistance at $1,770, according to Reuters technical analyst Wang Tao. On the other hand, it could retest the support at $1,756 per ounce.

CME Group draws attention to the futures market: $1,770 the limit?

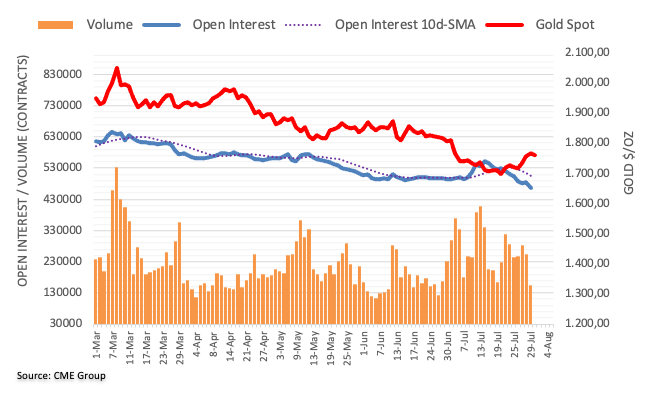

Finally, open interest in the gold futures markets decreased by about 18.8k on Friday, according to data from CME Group. Volume followed suit. The amount fell for the second session in a row, this time around 98.2k contracts. Gold prices rose for the third consecutive session at the end of last week. However, the positive price action has been paralleled by declining open interest and volume. It showed that further gains are not preferred, at least in the near term. So far, the recent recovery has faced resistance at $1,770 per ounce.