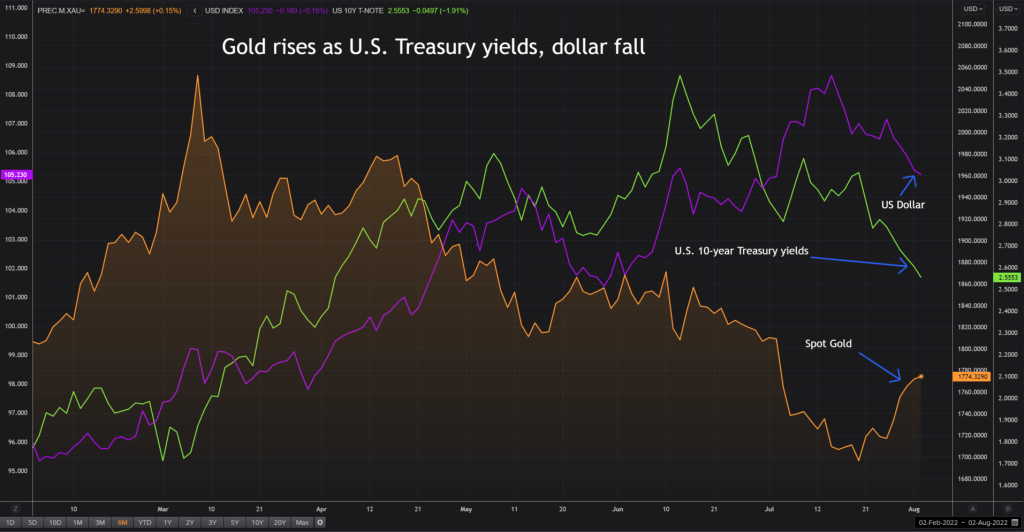

Gold prices hit a four-week high on Tuesday. While the US dollar and Treasury rates fell, concerns about the global economic slowdown increased. Gold extended its winning streak to the fifth session as demand for the safe-haven metal increased in this environment.

Edward Meir: Gold could rise to mid $1,800

Spot gold hit $1,787.91 during the day, its highest level since July 5. The yellow metal, which later declined, was trading at $1,775 at press time. U.S. gold futures rose 0.17% to $1,790.6.

cryptocoin.com As you can follow on , the dollar fell to a one-month low against its rivals. This made dollar-denominated gold cheaper for other currency holders. Benchmark US 10-year Treasury rates fell to a four-month low. This development also reduced the opportunity cost of holding interest-free gold. Edward Meir, analyst at ED&F Man Capital Markets, comments:

Gold is likely to rise a little more towards the mid $1,800 level. Because most of the macro figures in the US are starting to look worse. Therefore, the dollar will continue to weaken throughout August. If things continue to deteriorate, it’s possible that the Fed will stop raising rates, perhaps at some point to allow the economy to recover. More importantly, we may start to see some form of stimulus spending in Europe and China.

Daniel Pavilonis: This is a buy signal!

Recent weak US economic data point to a slowdown. The Fed is therefore likely to be less aggressive in its monetary policy tightening plans. The yellow metal, on the other hand, tends to appreciate on lower interest rates. The yellow metal fell to its lowest level in more than a year on July 21. However, he has since earned around $100.

Meanwhile, the Speaker of the US House of Representatives, Nancy Pelosi, is on a visit to Taiwan, despite objections from China. This, in turn, is likely to trigger a possible escalation in Sino-US tensions. Therefore, investors are also watching these developments. Daniel Pavilonis, senior market strategist at RJO Futures, comments:

Gold has more room for upside action as the dollar is facing some resistance and major issues with Russia, Ukraine and China. However, interest rates are still the biggest factor for gold. Meanwhile, the Fed is taking a break even if it doesn’t finish raising interest rates. This is a buy signal.

Han Tan: Golden bulls wait for new uptrend

The Fed raised interest rates by 75 basis points on Wednesday last week, in line with expectations. But President Jerome Powell’s comments raised hopes for a slower walkway. That hit the dollar. Han Tan, chief market analyst at Exinity, said:

Gold bulls are waiting to make sure expectations of a less aggressive Fed actually take root and to see if the shores are open for a fresh rise.

Rupert Rowling: Another drop in gold possible if this happens

On the other hand, strategists warn that the latest rally is due to the perception that the Federal Reserve is planning to slow rate hikes. Rupert Rowling, precious metals strategist at Kinesis Money, says it could reverse if investors back out of the view that the Fed is already trying to slow the rate hike in response to the slowing US economy. In this context, the analyst underlines the following:

Much of the recent rise in markets, which also benefited from gold, is based on the assumption that future Fed rate hikes will be smaller. If this proves to be a false dawn, a new drop below is possible.