Solana (SOL) is a Tier 1 blockchain, as we have also reported as Kriptokoin.com. It is also one of the most popular blockchains among its peers. Popular altcoin SOL, on the other hand, ranks as the 9th largest altcoin by market cap. In addition, Solana is currently a favorite of NFT projects.

In this article, we answer four questions that are constantly asked about this popular blockchain project.

1) What does Solana do?

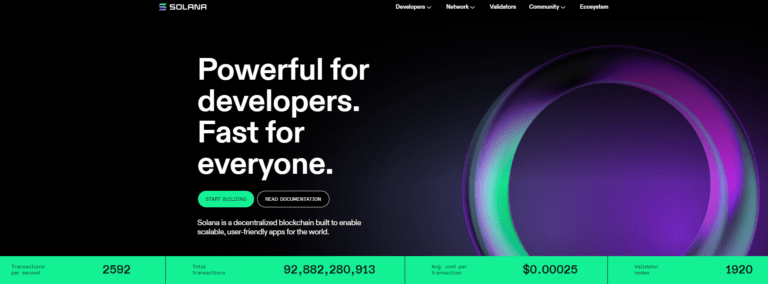

Solana is a proof-of-stake blockchain that offers fast and inexpensive transactions. It also has high scalability capacity. Like every proof-of-stake blockchain, Solana supports smart contracts that enable developers to build dApps. In this way, Solana became a competitor for Ethereum. Solana aims to process 65,000 TPS (transactions per second) to its full potential. This is the same TPS that Visa and Mastercard have. Today, the average TPS they process is between 2,000 and 3,000 TPS. This is still much faster than Bitcoin (5 TPS) or Ethereum (15 TPS).

Also, the average cost of a Solana transaction is $0.00025. This makes them one of the cheapest blockchains available. Therefore, the combination of fast and cheap makes it one of the leading NFT chains and makes it attractive in the NFT market. They also do well in DeFi. Likewise, according to DeFiLlama, they are in 6th place with a TVL of $1.5 billion with 77 protocols.

2) What network does Solana use?

We mentioned earlier that Solana is cheap and fast. However, it uses Proof-of-Stake or PoS consensus. But there is a break in it. They combine POS with Proof of History (PoH). PoH makes sure every transaction is in the right order and found by the right leader. To clarify, the leader is the validator. To save time, they elect a leader in advance. This gives each validator two tasks;

- Continuing to count, calculating time.

- Selected validators count transaction blocks.

Also, Solana uses verifiable delay function (VDF) for this. Similar to:

- They choose a validator that creates the next block with PoS.

- Working with VDF takes exactly five seconds. This takes them to their assigned slot. They can now produce a block.

- This process keeps repeating.

The main advantage of PoH is that it reduces latency. It also has a higher transfer rate. As a result, validators don’t have to wait to fill an entire block. Instead, they relay transactions to all validators in real time. Each incoming transaction can be stamped with a period. This is the POH value. Other nodes simply review these transactions and validate them as they arrive. This is what makes this blockchain so fast. It is also more durable and environmentally friendly.

3) How many knots does Solana have?

Solana currently has 1924 validator nodes. This is where Solana’s centralization comes to the surface. Only 25 verifiers hold a third of the collective stock. In other words, only a few validators control the chain. This means that they verify a third of all transactions. Also, token distribution adds another problem. From the initial token allocation, 48% went to people close to the project. For example, team, VCs and company. The Solana Foundation received another 13%. This is over 60% of all initial tokens held by a small group.

Crypto needs to decentralize.

Three major cloud providers are responsible for 69% of the 65% of @Ethereum nodes hosted in data centers.

Of the estimated 95% of @Solana nodes hosted in data centers, 72% are hosted with the same cloud providers as @Ethereum. pic.twitter.com/oK08c3G6Of

— Messari (@MessariCrypto) August 18, 2022

As a result, accusations were made about the lack of transparency. This came true when Solana had to admit that they had added 11 million SOL tokens to the market. The problem is, they didn’t tell anyone about it. At that time, the circulating supply was 8 million. This happened in November 2021. Anatoly Yakovenko, the founder of Solana, wrote about what happened. The explanation turned out to be reasonable. However, many community members were dissatisfied. They discussed the lack of transparency. Also, the addition of 11 million tokens to the market could affect investors.

4) Did you know these?

Solana has its own network. It also has its own native token SOL. You can use it for staking and thus secure the network. You can also use it to transfer value. Finally, the Solana network faces other problems as well. The network experienced five outages in 2022 alone. In January 2022, there was an outage of more than 48 hours. This resulted in many liquidations in the Solend lending protocol.

1/ 🧵Here’s what you should know regarding The Great Drain: #Solana Wallet Exploit:

— Kiyomi (104) (@kiyomiwallet) August 3, 2022

As a result, the SOL token has dropped drastically this year. It suffered a massive price loss from an ATH of $259.96 on November 6, 2021. With a market cap of $12.13 billion, SOL does not have a fixed maximum token supply. Currently, 349.1 million tokens are in circulation. Its current total supply is 508.1 million.