The bitcoin and altcoin market has been going through a period of volatility in recent weeks, with various macroeconomic factors contributing to the slowdown in the industry’s momentum. As we approach the week of February 27, 2023, analysts have identified five altcoin projects to watch. Here are the details…

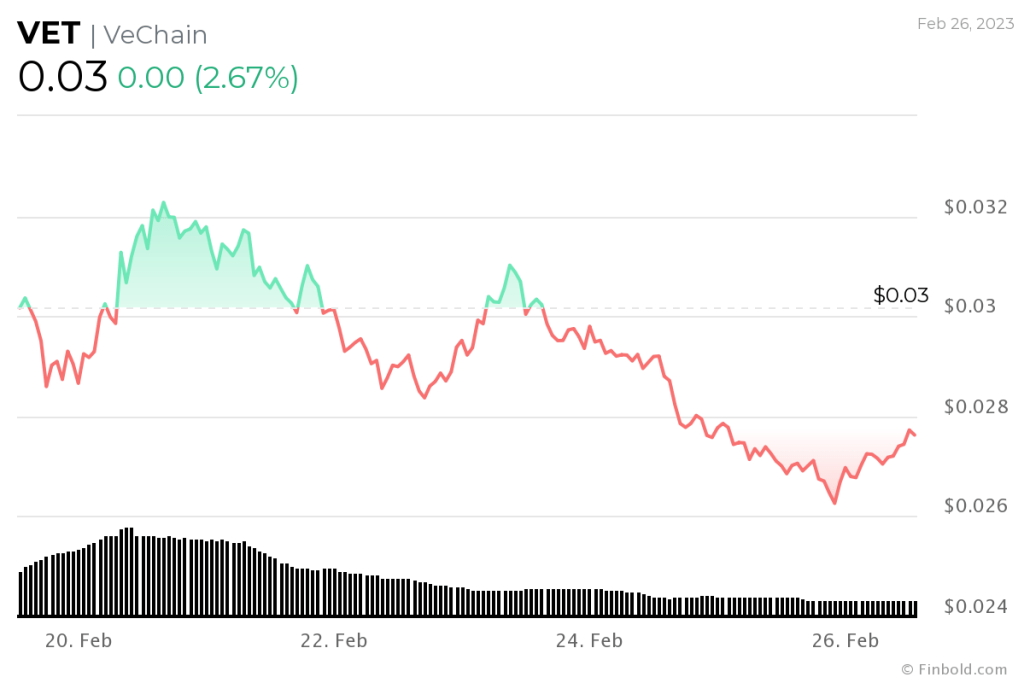

The first altcoin on the list: VeChain (VET)

According to analyst Paul L., the price of VeChain (VET) has been supported by bullish sentiments in recent weeks, mainly due to increased network activity and adoption. The recent interest in VeChain comes after the platform announced a new partnership with Stably, a gateway for stablecoins, to provide users with greater flexibility and accessibility in cryptocurrency transactions.

cryptocoin.com As part of the Collaboration, users will benefit from fiat launchers that enable the exchange of traditional currencies, including the US dollar and euro, for cryptocurrencies. With this move, VeChain and Stably aim to simplify the process of converting fiat currency to cryptocurrency, making it more user-friendly and accessible to a wider audience. This capability has been touted as a key driver for possible growth in VeChain price.

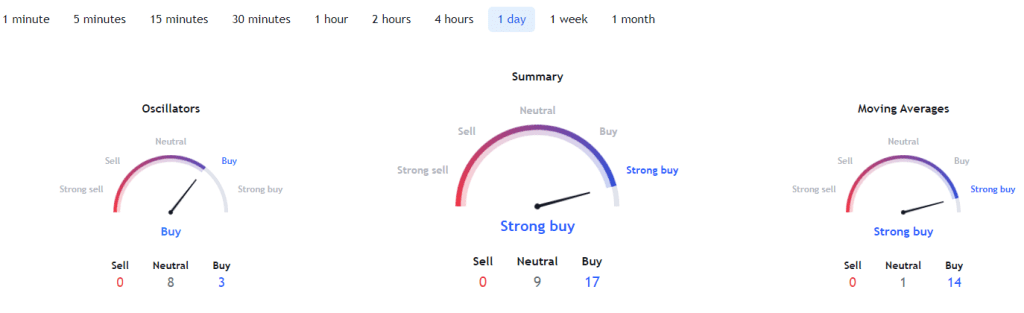

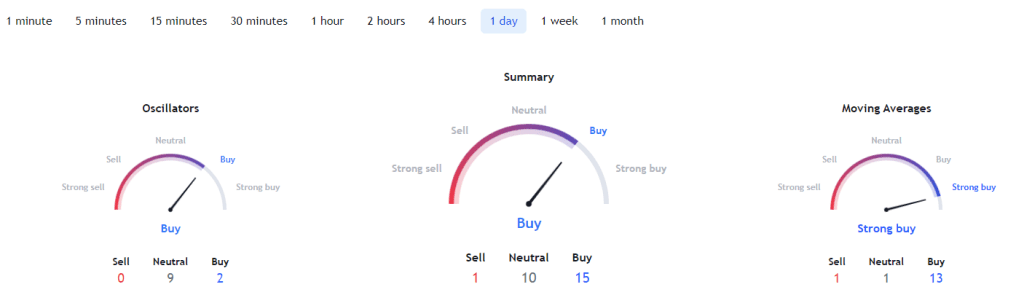

At the same time, investors are hoping for a revival of VET after launching a new decentralized wallet called VeWorld. Although VET has been experiencing bullish phases, the token has also had its fair share of volatility. In technical analysis, VET is bullish. According to the metric below, the summary aligns with “buy” sentiment at 14, while the moving averages include “bulk in” at 12.

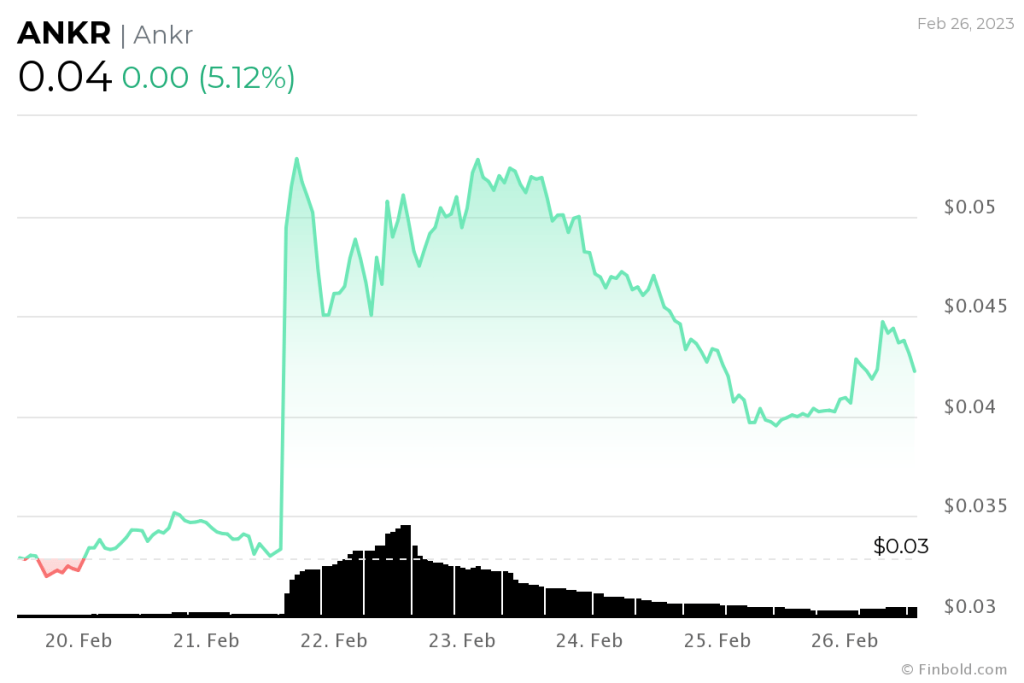

What’s next for ANKR?

Ankr (ANKR), a liquid staking token, has recorded double-digit gains recently as the network has experienced high-profile partnerships. Notably, the token remains in the limelight after a deal was announced with tech giants Microsoft and Tencent. Under the agreements, Microsoft provides support for the adoption of its enterprise Blockchain, while Tencent signed a Memorandum of Understanding with Ankr to develop a set of Blockchain API services.

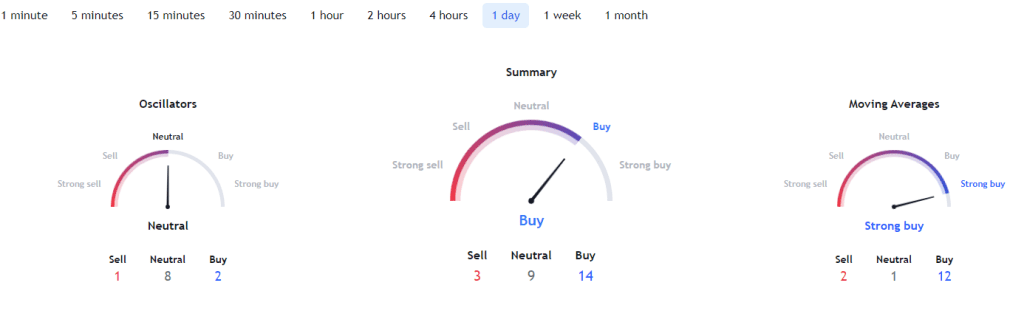

According to Ankr, the partnership is an important step towards upgrading the web3 infrastructure. Ankr will likely be followed closely as it is among the top assets in terms of weekly earnings. The upside price momentum for ANKR is also repeated in the technical analysis of the token. A summary of one-day indicators suggests “buy” at 15, while moving averages suggest “strong sell” at 13.

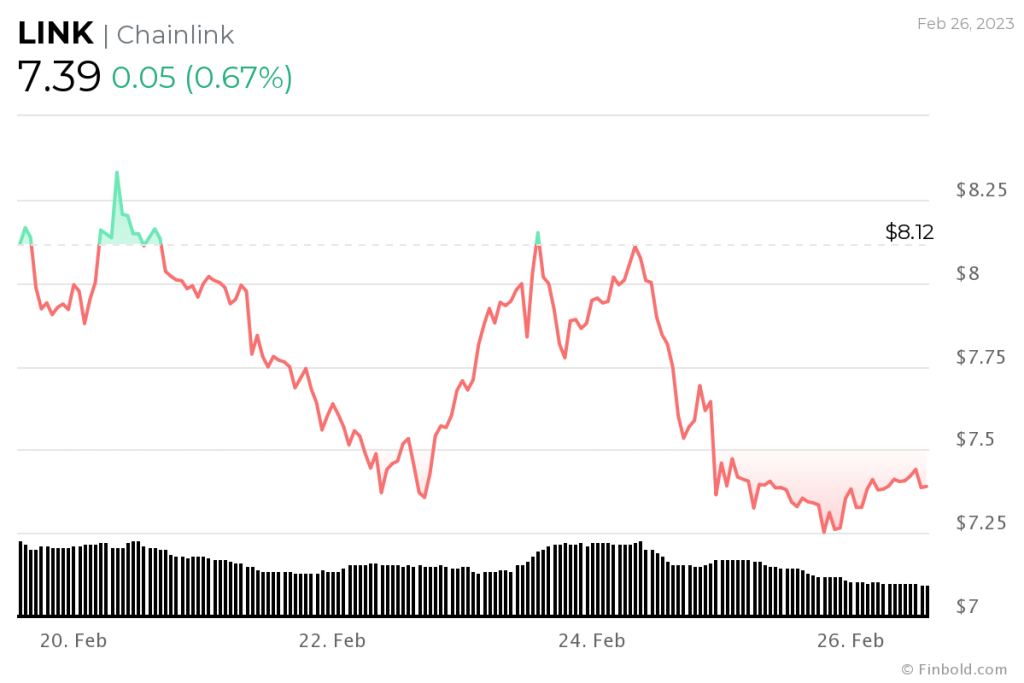

Chainlink drops on a weekly basis

Chainlink (LINK), a decentralized blockchain oracle network built on Ethereum (ETH), has recorded losses on its weekly chart, although analysts consider the token to be undervalued. However, there is some expected news. For example, Chainlink Oracle is now accessible on the StarkNet testnet. This development could enable ecosystem developers to create the next wave of DeFi applications. StarkNet, one of Ethereum’s most efficient Layer 2 protocols, is expected to become a more compatible platform for innovators with this integration.

Meanwhile, crypto trading expert and analyst Michaël van de Poppe suggested that if LINK successfully retraces $9, it will target around $20 levels. Despite witnessing significant losses on the weekly chart, the token’s one-day indicators on TradingView are mostly bullish. The summary of the metrics aligns with “buy” at 12, while the moving averages exhibit the same sentiment at 10.

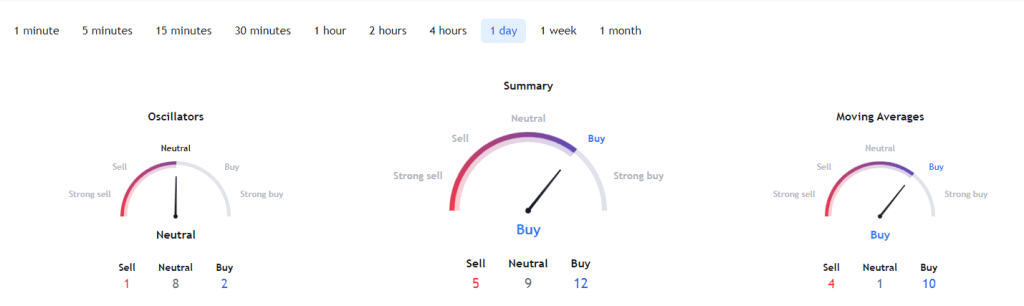

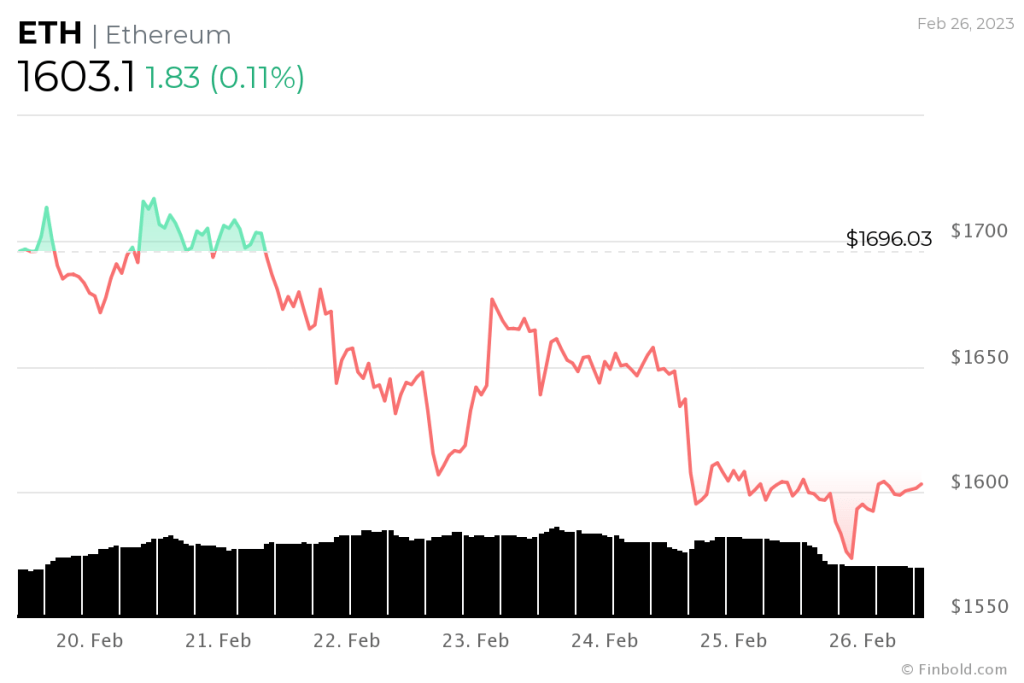

What do the metrics show for the leading altcoin Ethereum (ETH)?

Ethereum is returning to the focus of the crypto-asset market ahead of the Shanghai upgrade, which will allow stakers to access their ETH. In this regard, according to analysts, Ethereum is an asset to watch for next week, considering that the Shanghai update in Sepolia will take place on February 28. At the same time, Ethereum remains an asset to watch, especially with the US Securities Exchange Commission (SEC) increasingly focusing on staking activities.

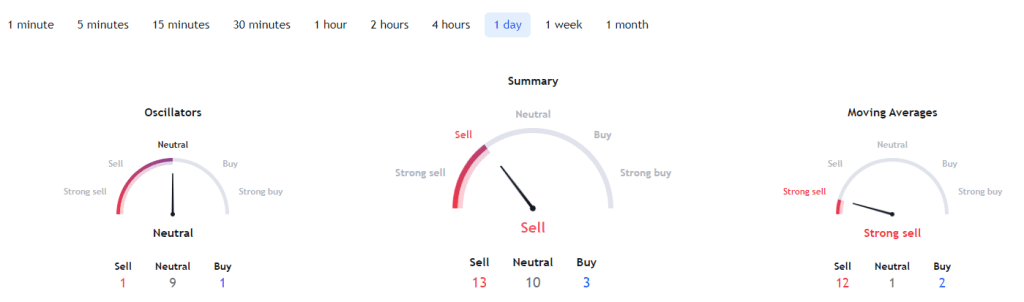

Meanwhile, Ethereum is also witnessing competition with other crypto projects in decentralized finance (Defi). This is highlighted by GitHub development activity, which continues to be dominated by projects like Cardano (ADA). Ethereum is bearish, according to a one-day technical analysis on TradingView. Indicators move for a “sell” at 13, while the moving averages move for a “strong sell” at 12. The oscillators, on the other hand, are “neutral” at 9.

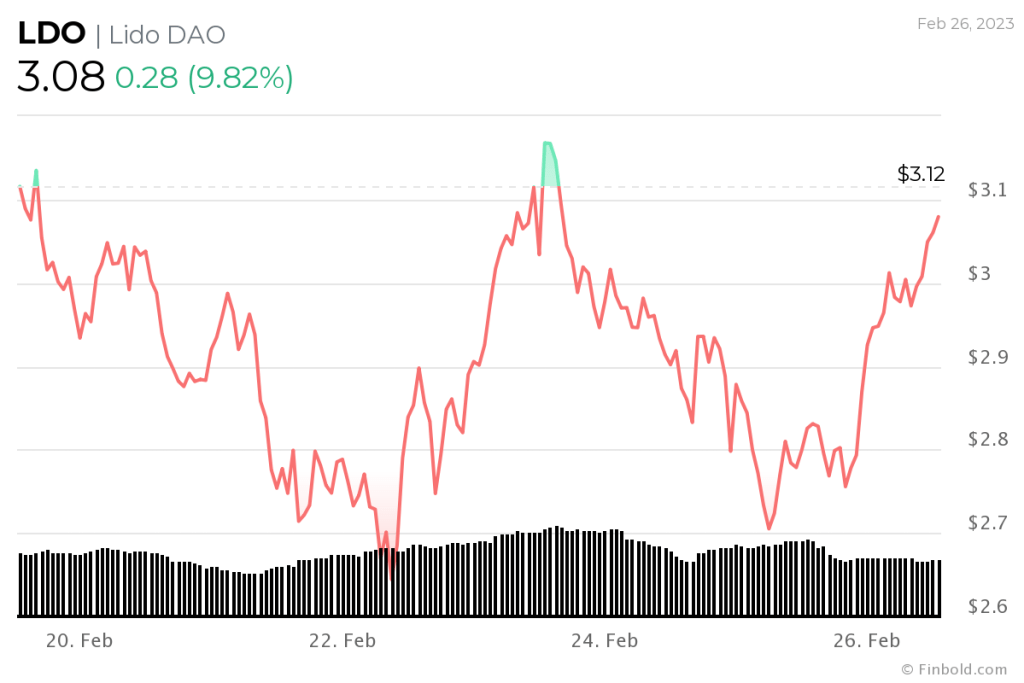

Last coin on the list: Lido Dao (LDO)

Lido DAO (LDO), a leading liquid staking platform for Ethereum and other assets, has seen a surge in popularity recently. The growth of the platform can be attributed to several factors, including the upcoming Ethereum Shanghai upgrade. One of the best staking solutions for Ethereum, Lido DAO is expected to benefit significantly after investors access their staked Ether after the start of the upgrade before March.

Despite the above regulatory concerns, Lido and other liquid staking platforms continue to gain popularity as investors look for ways to generate passive income from their crypto assets. In technical analysis, LDO is bolstered by bullish sentiment with a summary of one-day indicators and moving averages suggesting a ‘strong buy’ at 17 and 14 respectively. The oscillators give a “buy” signal at 3.