At the June 20 Wall Street opening, nervous traders were expecting a short-term trend decision. Because of this, the Bitcoin (BTC) price has been pretty stable. Currently, no one knows exactly which direction the leading cryptocurrency will go. However, some analysts are announcing their predictions about the future of BTC’s price action on every platform. Here are those analysts and their predictions…

Bitcoin has risen from the bottom

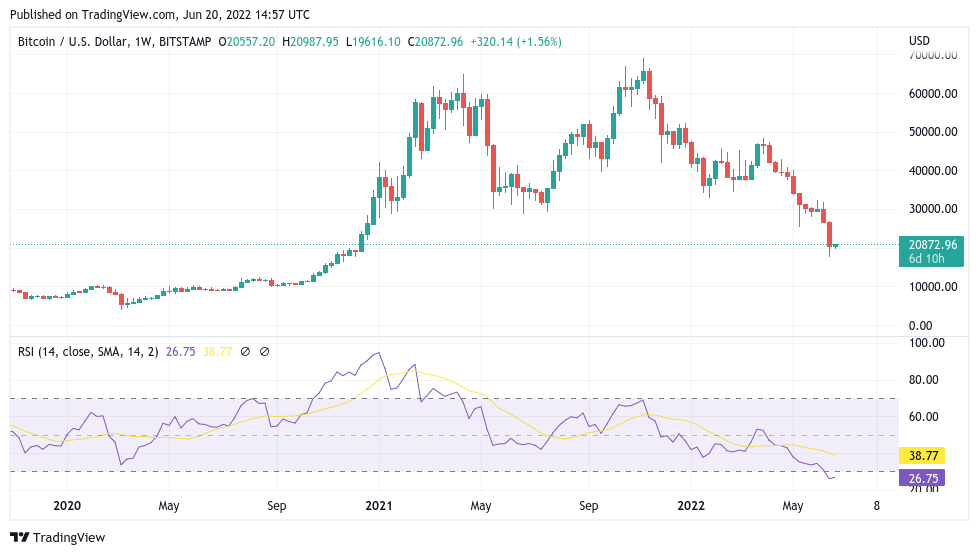

Data from TradingView reveals that the BTC price has soared to a three-day high of $21,000. In fact, the leading cryptocurrency scared off most investors in the market last weekend. Accordingly, speculators expected Bitcoin to drop to $17,600. This is significant as it is the lowest level since November 2020. Now, while US stocks were cold at the start of the week, double-sided calm has characterized the largest cryptocurrency. Popular trader Credible Crypto described the weekend price action as “a nice response from the bottom of our 16K–20K demand zone.”

“Bitcoin, the 12-hour drop at 2 p.m. has been erased. Still, there is no definitive confirmation that this is a reversal in trend. Focus on important and broad price levels. Also, don’t get too hung up on the 5 minute red candles because they can be erased instantly.”

Rekt Capital: “BTC is in macro bottom period”

The idea of focusing on HTF or broader timeframe price structures was shared by various commentators as the week began. “BTC is in the macro bottom of this cycle,” continued trader and analyst Rekt Capital.

“In the coming years, investors will be rewarded for buying this place. However, many are still waiting for BTC/USD to drop further to buy. It’s like we’re waiting for summer to come, it’s 33 degrees now, but we’re hoping for 35 degrees.”

Rekt Capital also sees the $20,000 BTC price as a gift for buyers. “BTC data science shows that anything below $35,000 has historically been an area with great ROI for long-term Bitcoin investors,” he tweeted. Meanwhile, on-chain analytics resource Whalemap also talked about BTC price. The platform said that below $20,000 is the bottom buy zone for whales.

PlanB: “Bitcoin is just oversold”

Meanwhile, Bitcoin is heading below the all-time high of the previous halving cycle. Also, the popular stock-to-flow (S2F) has increased the pressure on BTC price patterns. Market analyst Zack Voell openly called S2F a “scam” on social media. But analyst PlanB, who is the creator of S2F, claimed that the theory behind it remains solid. “Most indicators (S2F, RSI, 200WMA, Realized, etc.) are at extremes,” he wrote in a June 18 Twitter post.

“Does this mean that all indicators are ‘invalidated’ ‘refuted’? No. Investing is a game of probabilities and indicators provide situational awareness: BTC is oversold.”

In fact, Voell’s criticisms came after BTC/USD first fell below the second standard deviation band from the S2F forecast price. As PlanB noted, Bitcoin’s relative strength index (RSI) was at its all-time low over the weekend. This refers to the classic overbought and oversold indicator. The RSI essentially suggests that BTC/USD is trading much lower than its historical indicator.

Bitcoin hasn’t bottomed yet

Anastasia Amoroso, Chief Investment Strategist at iCapital, evaluated the BTC price action in a statement. The strategist said, “Bitcoin is moving under pressure. This is because it is not now seen as an asset to be used for inflation hedges. Rather, what he is trading is unprofitable technology,” she said. He then said, “I don’t think this invalidates Bitcoin. I think there is a price level. Maybe around $15,000, which roughly equates to the cost of production,” he added.

The cost of production is the price at which Bitcoin can be produced and create a breakeven or slight profit margin. This head-to-head number differs depending on the mining rig. cryptocoin.comAs we reported, the market has had several shake-ups, including the Fed’s tightening fiscal policy, the collapse of the leading algorithmic stablecoin TerraUSD, and the liquidity crisis.