The dollar remains close to its recent highs, with cautious investors awaiting comments from Fed Chairman Jerome Powell. In addition, the European Central Bank will announce its interest rate decision later in the day. Prior to these developments, gold prices remained flat on Thursday. Analysts interpret the market and share their forecasts.

Brian Lan: Gold investor stands on the sidelines

Spot gold is trading sideways at press time after rising nearly 1% on Wednesday. U.S. gold futures were little changed at $1,730. Meanwhile, the dollar index (DXY) held steady near the two-year high it touched in the previous session. Brian Lan, managing director of Singapore-based GoldSilver Central, said:

Many are looking to see if there are any views on what Powell has to say tonight and what the Fed will do at the end of the month. With the liquidations seen in exchange-traded funds (ETFs), gold has not really regained its shine as a safe-haven. Many investors stand on the sidelines as the Fed raises interest rates.

David Meger: Gold prices acted like a risk asset

Powell will attend a debate at the Cato Institute conference later in the day. This will likely be the last public comment before the policy meeting September 20-21. Also, Fed officials said on Wednesday they were still not convinced that the worst of inflation fears had passed. Therefore, they implied that the central bank’s aggressive rate hikes would continue.

High Ridge Future metal trade director David Meger notes that upside headwinds from the dollar and the Fed’s aggressive stance continue. In this environment, he attributes the movements of gold to “a combination of somewhat safe-haven demand and buying on the dips”. From this point of view, the analyst makes the following assessment:

Gold has recently acted more as a risk asset than a safe haven. The real question is, when will we see gold take on the role of a safe haven as economies begin to see slowdown due to these rising interest rate hike policies?

Rupert Rowling: Gold prices are hard to rise in this environment

cryptocoin.com As you follow, gold prices rose above $2,000 in March. However, it has since dropped above $300. Data released on Tuesday showed the US services sector rebounded last month. This provided the Fed ammunition for a 75 basis point rate hike.

Rupert Rowling, market analyst at Kinesis Money, says slowing growth prospects in China has helped keep the bottom above critical support levels. The analyst makes the following statement:

It’s hard to see gold gaining in such a hawkish environment. But there are some key supports for the metal that are keeping it at least around the $1,700 key threshold.

“It’s only a matter of time before gold reaches new lows of the year!”

The Fed is likely to raise interest rates by another 75 basis points this month, with Fed Chairman Jerome Powell’s commitment to lower inflation, The Wall Street Journal reported on Wednesday. Analysts at Sevens Report Research highlight in Wednesday’s news release:

If the latest dynamism continues, such as rising interest rates, a stronger dollar and falling inflation expectations, it’s only a matter of time before the yellow metal breaks the golden bulls’ ‘line in the sand’ at $1,680 and reaches new lows of the year.

Pablo Piovano: Another $1,680 test possible

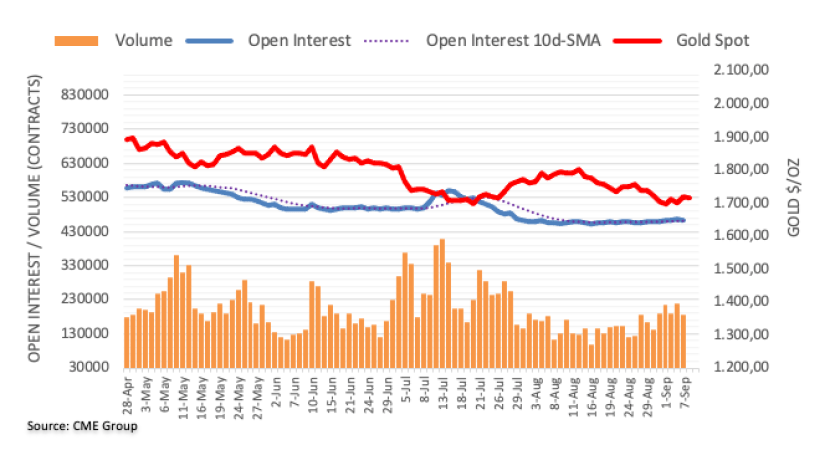

Open interest on gold futures markets remained volatile for another session on Wednesday. Considering CME Group’s advanced data, approximately 1.6 thousand contracts were reduced. Volume followed, with nearly 31.5k contracts lower, offsetting the previous daily formation.

Gold prices posted good gains on Wednesday. The yellow metal closed above the $1,700 level once again. However, the increase was behind declining open interest and volume. Market analyst Pablo Piovano therefore says a potential upside move will be limited in the very near term. On the downside, the big magnet for the golden bears emerges around the 2022 low of $1,680 (July 21).