Gold continued its decline in the fifth session on Tuesday amid rising US dollar and Treasury yields. However, there is a cautious mood in the market ahead of inflation data coming this week.

“Gold is currently stuck in the $1,658 to $1,676 range”

Spot gold fell to its lowest level since Oct. At the time of writing, the yellow metal was down 0.41% at $1,661.69. U.S. gold futures fell 0.27% to $1,670.3. Indicator US 10-year Treasury yields rose to 4%. The dollar index (DXY) rose 0.3%. Thus, it made gold more expensive for buyers with other currencies. City Index analyst Matt Simpson comments:

This is a technical level for bond yields and pushes the dollar higher. It also puts pressure on gold prices. Signals of a global recession from the International Monetary Fund (IMF) also triggered safe-haven flows to the US dollar. Gold is currently stuck in the $1,658 to $1,676 range.

“In this case, it is possible for gold to gain altitude”

cryptocoin.com As you can follow, US workforce data came in stronger than expected. After that, the market’s focus is on Thursday’s inflation data. Markets expect stubbornly high inflation to reinforce the Federal Reserve’s hawkish rhetoric. Stephen Innes, managing partner of SPI Asset Management, comments:

If the still very resilient US economy starts to soften, it is possible for gold to gain altitude. But there should be clear signs that the Fed is willing to step off the rate hike pedal and reduce inflation.

“Gold will remain under downward pressure”

Rising interest rates and a strong U.S. dollar continue to weigh on gold, says David Meger, director of metals trading at High Ridge Futures. It also notes that it is currently suppressing any safe-haven demand stemming from the recent escalation in the Ukraine crisis.

Chicago Fed chairman Charles Evans on Monday countered arguments that the Fed is pushing the world and the United States towards a potentially sharp decline. In this context, he noted that even if the Fed continues to raise interest rates, it can manage to reduce inflation without a sharp rise in unemployment. Fed funds futures are priced at a 92% chance of a 75bps increase at the next Fed meeting. Ross Norman, an independent analyst, shares his prediction:

We are back to the $1,680 level again. Gold will remain under downward pressure in the short term.

“Place for more fall under”

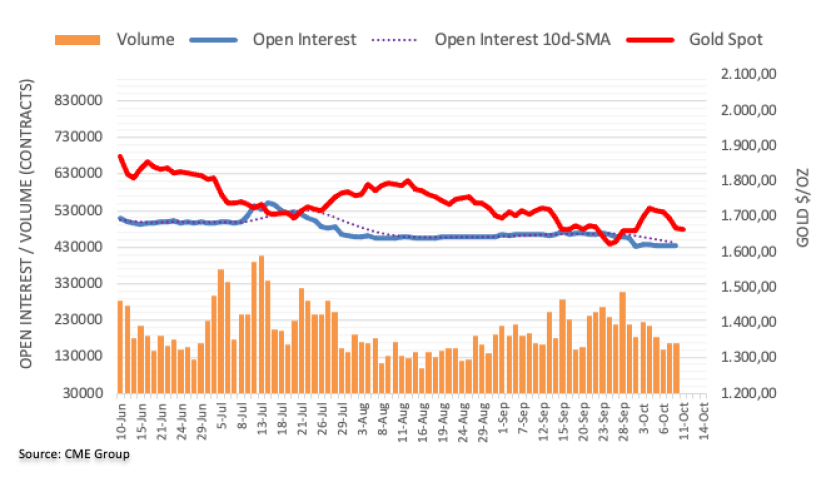

Flash data for the gold futures markets from CME Group noted that open interest rose for the third consecutive session on Monday. This time the increase was about 1.8 thousand contracts. Instead, the volume continued its downtrend. Thus, 1.6k contracts fell after the previous day’s formation.

According to analyst Pablo Piovano, there is a deeper pullback for bullion in the very near term. It declined once again at the beginning of the week with the increasing open interest to support this. However, there is still a possibility that the bullion could revisit 2022 lows near the $1,615 level.