The crypto market has entered the consolidation phase after a run. However, there is a risk of further deepening of the decline. The leading crypto Bitcoin, which determines the direction of the market, has recently lost its position of $ 28 thousand, but is struggling for $ 27 thousand. Analysts are trying to determine the next route of BTC.

Santiment: One Bitcoin metric has given an ‘alarming’ signal

A leading crypto analytics firm is warning that an important metric for Bitcoin (BTC) is flashing bearish. Santiment says that Bitcoin’s funding rate may be on the verge of turning negative, which would signal a market downtrend. Crypto investors can take leveraged long or short positions on futures contracts that never expire. Periodic payments based on the difference between the perpetual contract market and the spot price, known as the funding rate, are required for markets to sustain funding. Santiment explains:

On Binance, the largest platform for perpetual contract rates, we can only zoom in on Bitcoin’s funding rate. Currently, traders are looking long, as they have consistently over the past month. Given that prices have historically moved in the opposite direction of funding rates, this is somewhat worrying once enough time has passed.

Source: Santiment

Source: SantimentSantiment also monitors social media trends, which can provide useful data that some investors use to predict Bitcoin’s price movements. In this context, Santiment makes the following assessment:

Looking at the social data first, we see a trend you’d want to see if you’re a crypto bull. Over the past five weeks, investors have become less and less optimistic towards the most important assets in crypto. We’ve retrospectively tested years of data and found that prices have historically moved in the direction the crowd least expected. Investors are becoming more and more skeptical, increasing the likelihood that price increases will continue.

Source: Santiment

Source: SantimentMike McGlone is pretty bullish on Bitcoin, but…

Senior Bloomberg commodity analyst Mike McGlone says the long-term prospects of Bitcoin (BTC) are promising. McGlone says Bitcoin is “very bullish” but warns that risk assets like BTC face significant headwinds ahead. In this context, the analyst makes the following statement:

I’ve been bullish on Bitcoin for the main reasons: Its supply is very low, and in the early days of its adoption, you need to stay long over time. But it also trades 24/7 and is a very important leading indicator and looks like it rolled over at $30,000. I don’t see how we’re going to achieve what I see as a significant contraction in risk asset prices before BTC, which is still a risk asset, falls.

According to a Bloomberg analyst, BTC’s recent price increases can “definitely” be attributed to a “bear market rally”. McGlone says that in the event of a recession, when the value of other associated assets begins to decline, Bitcoin will follow. It records the following:

I’m afraid what’s happening with Bitcoin is that people are looking at it like the bank crisis helped. It will go that way and be traded more like gold and long-term bonds. But I think this year more everything is on the rise and Bitcoin is the fastest horse in the race. It was also the fastest on the way down, the fastest on the way up this year…Bitcoin has increased almost 80% over the year and this increase can continue. It is trading 24/7, clearly a leading indicator. Bitcoin, if the markets go down, which I expect, BTC should probably be the first asset to lead this because it’s still a risk asset.

Bitcoin could explode by over 50% according to one chart!

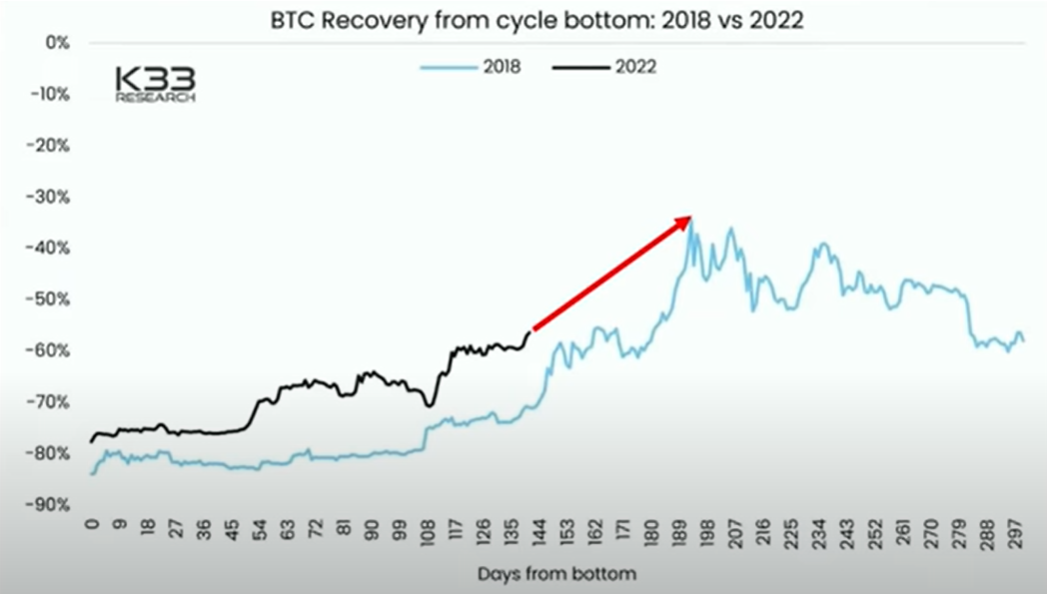

A widely followed crypto analyst and anonymous server of InvestAnswers expresses his bullish sentiment on Bitcoin (BTC) based on historical precedents. The analyst says that if history repeats itself, Bitcoin could explode by about 54% from current levels to $ 45,000. Citing a chart published by crypto research firm K33 showing that Bitcoin is currently exhibiting a pattern similar to that seen during the 2018/2019 bear market, the popular crypto strategist says Bitcoin could hit its price target about a month from now. He expresses his views as follows:

If this pattern repeats and we reach this level where I add a small red arrow… that means we could hit $45,000 again by May 20 or about a month from now. After that, there will be some respite, some horizontal movement, some consolidation.

Source: InvestAnswers/YouTube

Source: InvestAnswers/YouTubeThe anonymous server of InvestAnswers has this to say on what long-term holders of BTC can do next compared to what they did during the 2018 bear market:

Right now, I think long-term holders are much more stable than they were four years ago. And despite the 60% decline we experienced, they still don’t want to sell… Just as we saw that the crises in the banking system actually fed Bitcoin, the regulatory bottleneck also fed BTC. If this continues, who knows, there could be another bank crisis – which could push Bitcoin up even faster.

The metrics mark the end of the BTC bear market!

According to crypto analytics firm Glassnode, a number of on-chain metrics indicate that a Bitcoin (BTC) bear market may be in the rearview mirror. The analytics firm admits that “no one really knows” whether the BTC bear market is really over. However, Glassnode says there are a few key metrics that suggest the market may change.

The analytics firm states that BTC’s price (RP) for most of 2023 is above its 200-day moving average (MA). RP records the value of all BTCs at the last purchase price divided by the number of coins in circulation. Glassnode also says that Bitcoin is witnessing an increasing momentum in terms of network usage with the increase in active addresses and fee pressure. Also, according to the analytics firm, traders are taking profits in BTC and the market is absorbing those sales. There is also a balance of wealth in favor of long-term holders, another potential indicator that the bear market is over.

Analyst warns things are not looking good for crypto

Widely followed crypto analyst Justin Bennet warns investors to be prepared for the challenging months ahead as the markets pull back. The analyst says that the total crypto market cap (TOTAL) is falling.

Source: Justin Bennett/Twitter

Source: Justin Bennett/Twittercryptocoin.com As you know from TOTAL, it is a measure of the market value of the entire digital asset space, including Bitcoin (BTC) and altcoins. Bennett also sees warning signs for crypto markets in traditional financial markets.

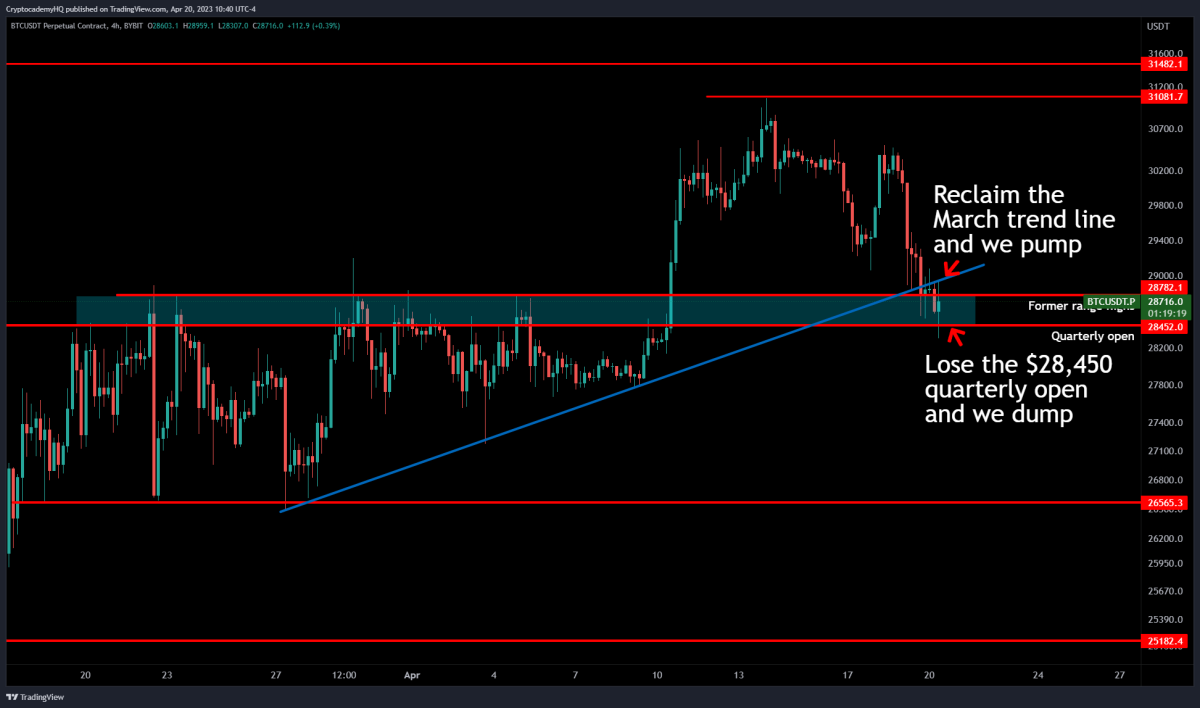

Diving deeper into leading crypto in particular, Bennett reveals two possible scenarios for the future of BTC in a new chart. “The current state of BTC,” the analyst shares this chart.

Source: Justin Bennett/Twitter

Source: Justin Bennett/Twitter