Gold prices rose on Wednesday as the dollar retreated. Sino-US tensions helped counter pressure from a rise in US Treasury rates after Federal Reserve officials’ hawkish comments on rate hikes.

“Gold becomes a little more attractive when geopolitical concerns increase”

Spot gold was up 0.4% at $1,766.59 at press time. Gold bullion hit a one-month high near $1,787.79 on Tuesday. However, it later closed the day down 0.6%. U.S. gold futures fell 0.5% to $1,780.80. The dollar fell 0.2% against its rivals after rising 0.8% overnight. Hence, it made dollar-denominated gold cheaper for other currency holders. DailyFX currency strategist Ilya Spivak comments:

Gold tested resistance near $1,785-1,790 overnight and was rejected. Also, markets have become a little more skeptical of the reversal of tightening from the Fed. Meanwhile, gold becomes a little more attractive when geopolitical concerns rise. That’s why we need to keep an eye on the situation in Taiwan.

Economic and geopolitical risks are increasing

The US is experiencing the highest inflation since the 1980s. On the other hand, the tightening of the Fed slows down the economic activity. Three Fed policymakers signaled on Tuesday that they will continue to raise interest rates, although they will curb economic activity more significantly. These statements pushed the benchmark US 10-year Treasury rates to 2,774% overnight.

By the way cryptocoin.com Nancy Pelosi, Speaker of the US House of Representatives, addressed the Taiwanese parliament on Wednesday. Pelosi’s visit to the island infuriated Beijing. Despite this, Pelosi will meet with the president and human rights activists during her trip.

“This is an additional supporting factor for gold prices”

David Meger, director of metals trading at High Ridge Futures, said lower expectations for interest rate cuts and a marked slowdown in the U.S. economy have been significantly bolstered. Meger interprets the developments as follows:

Nancy Pelosi’s visit to Taiwan increases tensions between the US and China. This is an additional supporting factor for gold.

“The next big test for gold prices is around $1,800”

Looking at the technical outlook for gold, OANDA senior market analyst Craig Erlam points out the following levels in a note:

The next big test for gold prices will be around $1,800 on the upside. However, a resistance near $1,780 is possible.

“Rising tensions will not support risk appetite anytime soon”

Gold and other safe-haven assets also benefited from a different headwind on Tuesday. This was the visit of Speaker of the House Nancy Pelosi to Taiwan. Pelosi’s visit, which followed a tense and “candid” phone call between President Biden and President Xi Jinping, has rekindled fears of strained bilateral relations between Washington and Beijing. Edward Moya, senior market analyst at Oanda, comments:

Rising tensions between the world’s two largest economies will not bolster risk appetite anytime soon.

“A deeper pullback for gold prices seems unlikely”

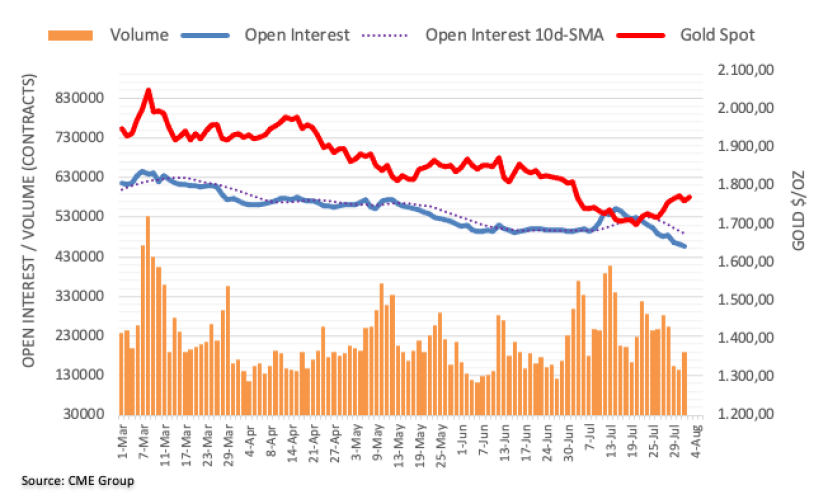

Flash data for CME Group’s gold futures markets noted that open interest contracted for the third consecutive session on Tuesday, this time to around 5,000 contracts. Instead, volume reversed three consecutive days of decline. Accordingly, approximately 45.8 thousand contracts increased.

Gold prices rose to around $1,800 on Tuesday and then pulled back. It then closed the session with moderate losses. Market analyst Pablo Piovano says the decline is behind the lower open interest rate. According to the analyst, this suggests that the extra losses have been overlooked for now.