Five famous billionaires made important statements for Bitcoin and cryptocurrencies. In a sense, what they say is indicative. Let’s look at the details.

Bitcoin preference from Robert Kiyosaki

Robert Kiyosaki, author of Rich Dad Poor Dad, makes important statements. Accordingly, he disagrees with the Wall Street Journal’s report claiming that the US economy is strong. Kiyosaki believes that the stock market surge is mainly due to the recent increase in the debt ceiling. On the other hand, he argues that America’s debt has risen and the stock market has risen as a result. Kiyosaki prefers gold, silver and Bitcoin as assets to hold wealth.

Kiyosaki thinks the dollar is going to die. Accordingly, he expresses his concerns that trillions of dollars will flow back into the United States and trigger high inflation. Based on this view, he also forecasts Bitcoin price. Accordingly, he believes that BTC will reach $120,000 by the end of 2024 and $500,000 by the end of 2025.

Bitcoin advice to young investors from Galaxy Digital CEO Mike Novogratz

Mike Novogratz tells what young investors with a higher risk tolerance should do. Alibaba shares suggest they focus on buying assets like silver, gold, Bitcoin and Ethereum. Novogratz thinks these assets could be exploited because of the excitement surrounding the AI industry.

For investors with a lower risk tolerance, Novogratz recommends that they allocate 30% of their portfolios to riskier assets and 70% to products such as bonds and index funds. It should be noted that Novogratz has been a longtime advocate of Bitcoin and cryptocurrencies.

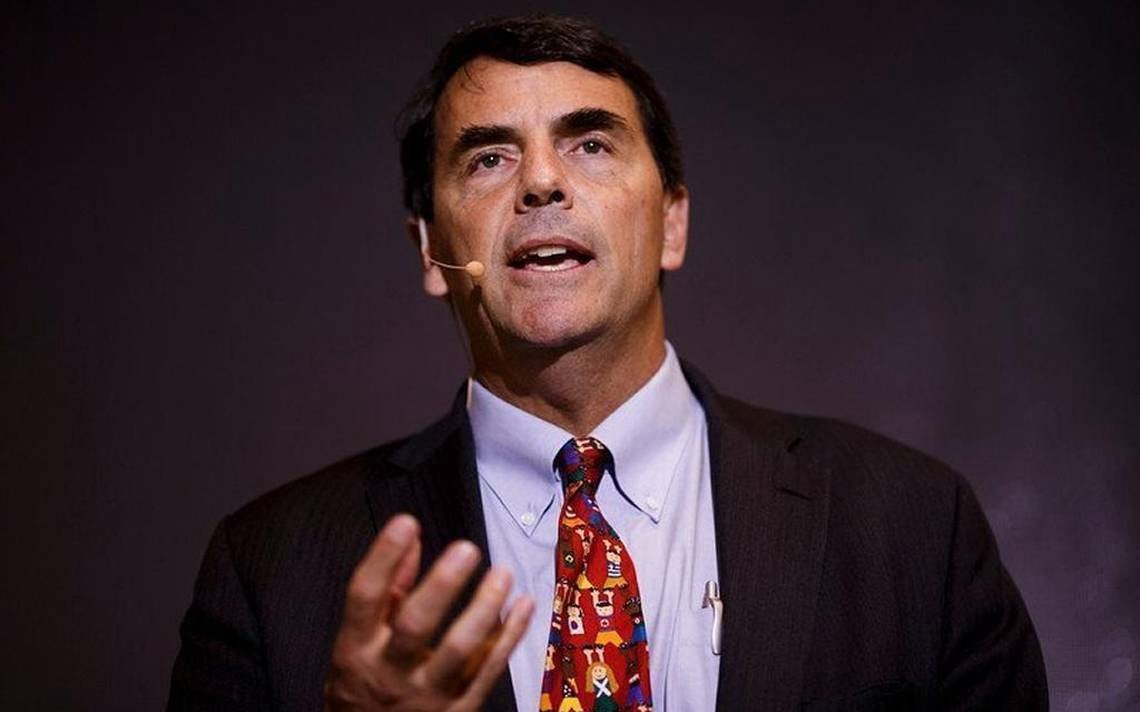

Tim Draper explains his approach

Tim Draper, an American venture capital investor and staunch believer in Bitcoin, reiterated his long-term prediction that the Bitcoin price will reach $250,000. Draper emphasizes that Bitcoin is a better and safer technology. He also states that eventually the world will appreciate his worth. On the other hand, he compared Bitcoin’s growth trajectory to that of the internet.

Draper thinks that Bitcoin is following a similar path as the internet. Accordingly, he believes that it will become an integral part of the world’s financial environment. He also sees the current transformation in currencies and trade as one of the most exciting developments in his life. Draper emphasizes the benefits of avoiding traditional banking fees and credit card charges. For this reason, he also underlined the global acceptance of Bitcoin as a form of payment, which is increasingly being embraced by traders.

Jihan Wu takes his next step

Jihan Wu is launching the Bitdeer Green Bitcoin Fund, which aims to invest in the mining industry in Bhutan. The fund will be overseen by Bhutan’s investment department. Wu also plans to generate 600 megawatts of energy, with a targeted hashrate of 20 exahash per second. The duration of the fund will be 6 years and the minimum investment required for participation is $5 million.

The project aims to raise $80 million in the first phase. Jihan Wu previously operated significant Bitcoin mining facilities in Bhutan. He also publicly criticized China’s ban on cryptocurrencies and mining before leaving Bitmain.

Michael Saylor unveils gold’s digital successor

Michael Saylor thinks that Bitcoin has superior qualities compared to gold. He sees Bitcoin as the digital successor to gold. He also claims that it will appreciate in value faster than gold, which he believes will eventually become worthless. Saylor’s company, MicroStrategy, has been buying Bitcoin regularly since August 2020. On the other hand, it is also getting a return on its investments due to the significant price increase of the cryptocurrency.

Saylor, cryptocoin.com Looking at it as a whole, it highlights the significant price performance gap between Bitcoin and traditional assets such as stocks, gold, silver, fiat currencies, and bonds. He sees Bitcoin as a successful anti-inflation and store of value. Saylor cites limited supply and decentralized blockchain network as key factors that attract him to invest.