A strong US dollar and prospects for aggressive rate hikes by major central banks to rein in inflation weighed on the yellow metal. In this environment, gold prices hit a six-week low on Thursday. Master analysts interpret the market and share their forecasts.

Clifford Bennett: Gold prices could drop as low as $1,600

Spot gold was down 0.3% at $1,706.23 at the time of writing. Earlier in the day, bullion hit $1,701.10, its lowest level since July 21. U.S. gold futures fell 0.5% to $1,717.40. Clifford Bennett, chief economist at ACY Securities, comments:

Now I understand that gold will weaken for a while. The long-term outlook for gold prices is positive. But first it will suffer the same overall leverage loss as stocks. Meanwhile, gold will likely fall as low as $1,600.

Edward Moya: This is not good for gold prices

Krypokoin.com As you follow, the US Federal Reserve has signaled to keep borrowing costs as high as necessary to quell inflation, even if it’s a bit of a pain for households and businesses. In this environment, gold prices gave their longest monthly losses since 2018. Thus, the yellow metal recorded its fifth monthly decline in August.

Eurozone inflation hit a record high last month. This reinforced the situation for more aggressive interest rate hikes by the European Central Bank. Gold is seen as a hedge against inflation. However, higher interest rates raise the dollar and increase the opportunity cost of holding bullion. Meanwhile, DXY has held steady near its twenty-year high earlier this week.

OANDA senior analyst Edward Moya says it has become much clearer that central banks will be aggressive in tightening due to unprecedented inflationary pressure. From this point of view, the analyst notes that this is not good for gold.

“Bullion response at key $1,700 will show remaining support”

Loretta Mester of the US Federal Reserve said the central bank should raise interest rates to just over 4% early next year. In a note, Kinesis Money analyst Rupert Rowling highlights:

Bullion’s response as it approaches the key $1,700 level will show the amount of support remaining for the metal amid fears of a global recession and a Ukraine war.

Adam Koos: By this time, precious metals will fall

According to Adam Koos, president of Libertas Wealth Management Group, two precious metals have lost wars in the “drawer” game between gold and silver prices at one extreme and high interest rates and a strong US dollar at the other. In this context, the analyst makes the following statement:

I think we will continue to see lower metal prices until we see interest rates relax, the dollar falls and a ‘true’ recession rises above the surface. These metals have been on the combat bus since the beginning of March. Once weak hands start hitting the sell button, they’ll be the camp with their own church if someone doesn’t. The larger, more devoted fanatics are, without a doubt, the congregation of the church of the golden bugs of late.

Rupert Rowling: Fed was the catalyst for gold’s decline

Powell’s speech on Friday raised Treasury rates and the dollar. On the other hand, it reduced the brightness of the yellow metal. Rupert Rowling, market analyst at Kinesis Money, comments:

The catalyst for gold’s reversal was the Federal Reserve’s shift to a more hawkish monetary policy in April. Also, as a result, it has caused a series of interest rate hikes in recent months, as well as a reduction in the amount of debt. Gold and silver closed down for the fifth month in a row.

Pablo Piovano: A deeper pullback for gold prices!

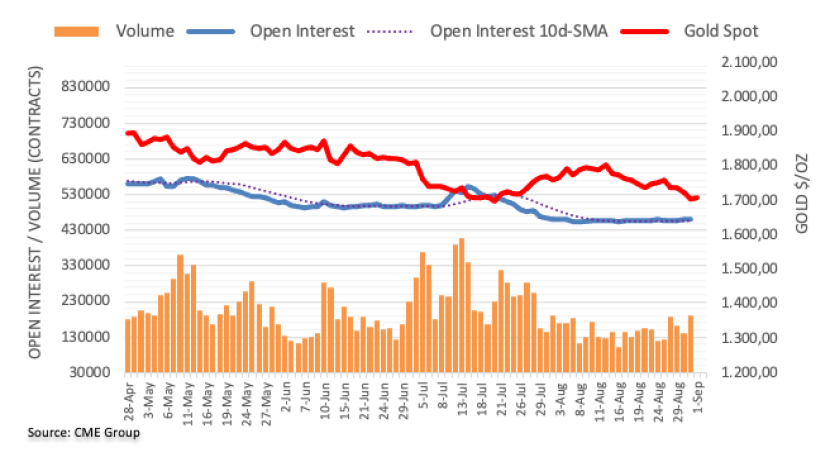

The latest data from CME Group for the gold futures markets noted that traders increased the short trend by just 399 contracts on Wednesday. Along the same lines, volume increased by approximately 49.1k contracts after two consecutive days of pullbacks.

Gold prices accelerated their decline Wednesday amid rising open interest and volume. According to market analyst Pablo Piovano, this indicates that the current downtrend has not changed for now. Against this, the analyst notes that the $1,700 region is still a good area of contention.