Bitcoin price performance worries market participants in the short term. But there are signs of broader Bitcoin accumulation. BTC starts the new week above $30,000. But the multi-month trading range is not going anywhere, refusing to change. Here are 5 things to watch this week.

Bitcoin price action

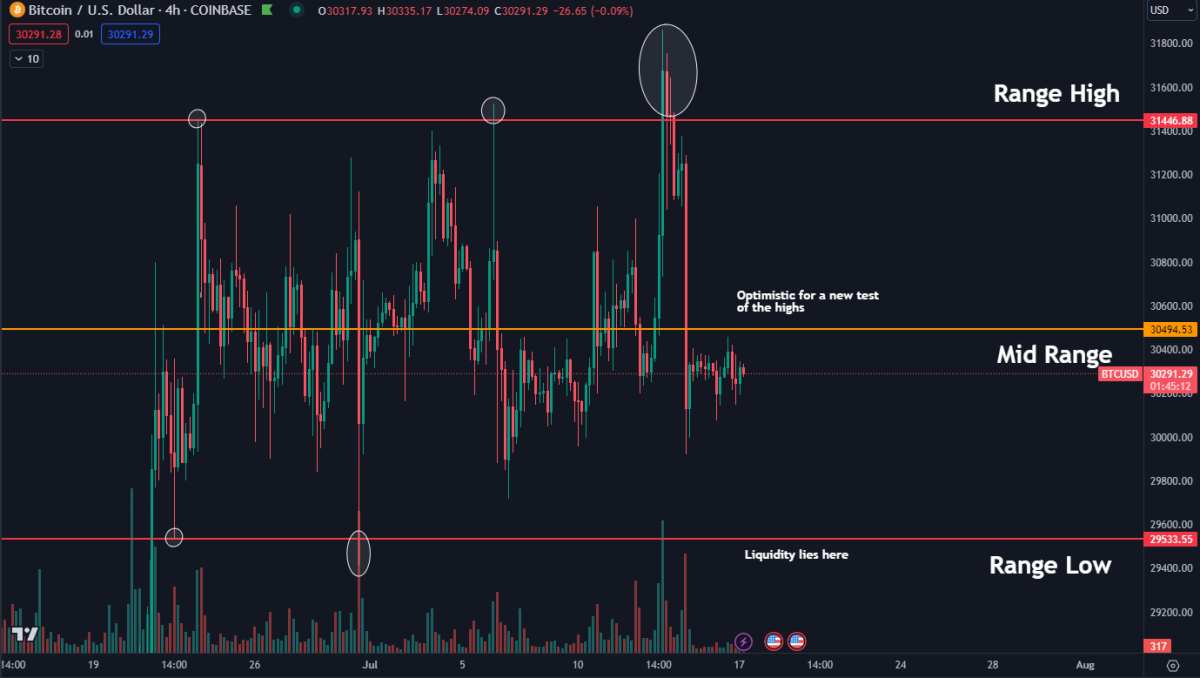

BTC price action gives little more than a frustrating feeling of déjà vu as traders wonder what it might take to change the trend. There is a difference in lower timeframes. It would be more accurate to say that what Bitcoin doesn’t quite have is a trend. The biggest cryptocurrency is moving before it can decide whether the bulls or the bears will win. Accordingly, it exhibited upward and downward movements for weeks. This struggle continues with predictable regularity. But neither macroeconomic data, institutional participation, nor anything else changed things.

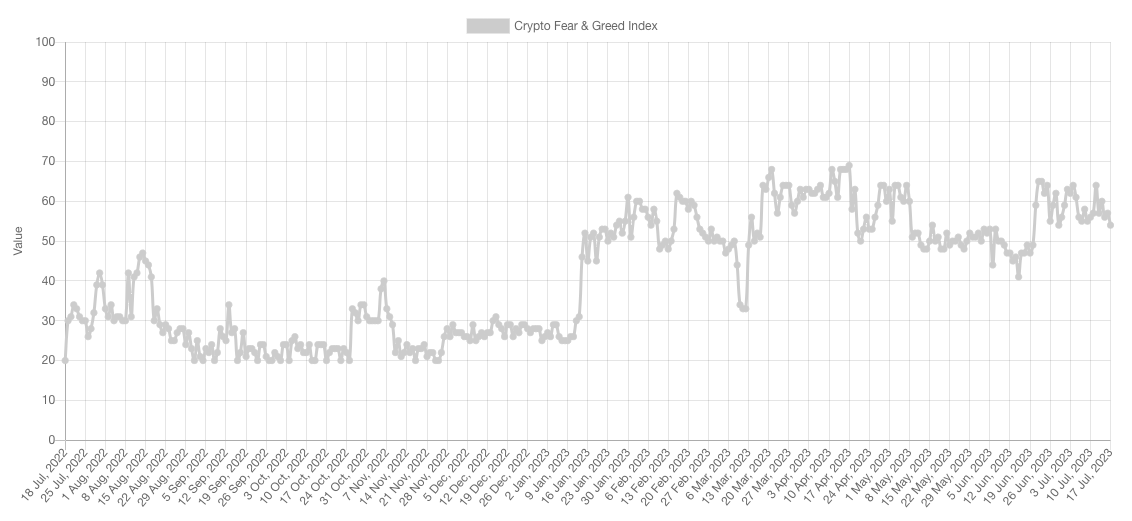

Let’s move on with this in mind. Next week’s data from the United States or the Federal Reserve is unlikely to affect the cryptocurrency market. Bitcoin on-chain data indicates a re-accumulation phase among the investor base. On the other hand, it probably reflects the “calm before the storm” mentality before a more significant market move. Crypto market sentiment is “neutral,” according to the crypto fear and greed index. It is currently at its lowest point in July.

Bitcoin weekly close keeps volatility at bay

Refreshingly, Bitcoin’s weekly candle close chose to abandon the volatility.

Normally, it is a period of irregular short-term price movements. However, there are few glitches in closing. On the other hand, even $30,000 support remained undisputed. BTC/USD thus remains within a tight “mini-range” since last week, when a move towards upward liquidity resulted in new year highs and then a dramatic drop. Popular trader Daan Crypto Trades said, “I think at this point anyone can see this range with their eyes closed.” says.

Others have similarly approached the idea that new local lows could come for Bitcoin as the bulls failed to break the range for long. For Trader Credible Crypto, the return to $27,400, an area that hasn’t been seen in a month, is not off the table.

Ladies and gentlemen, I present to you the 6 month inversion FVG EQ.

Quote tweet confluence. https://t.co/GY0AgGbAnn pic.twitter.com/XqrpimIJRa

— Crypto Chase (@Crypto_Chase) July 17, 2023

On the other hand, trader Crypto Tony suggested a potential downside target area around $28,300. He also added that this “continues to be his bias.”

This remains my main bias this week unless the bulls can reverse this quickly. The downside escalates once we lose support at $29,800

Do not rush into a position and remain patient pic.twitter.com/gRk9MQlkdI

— Crypto Tony (@CryptoTony__) July 17, 2023

In terms of strength at local price points, trader Jelle makes a point. He states that there is an ongoing battle in Bitcoin’s relative strength index (RSI). He also highlights that the price trajectory has shown a bearish trend lately. Jelle is acting as part of her final analysis. Accordingly, “Bitcoin tried to eliminate the bearish divergence last week. But it quickly took a hit.” makes the comment.

Earnings season leads US data disclosures

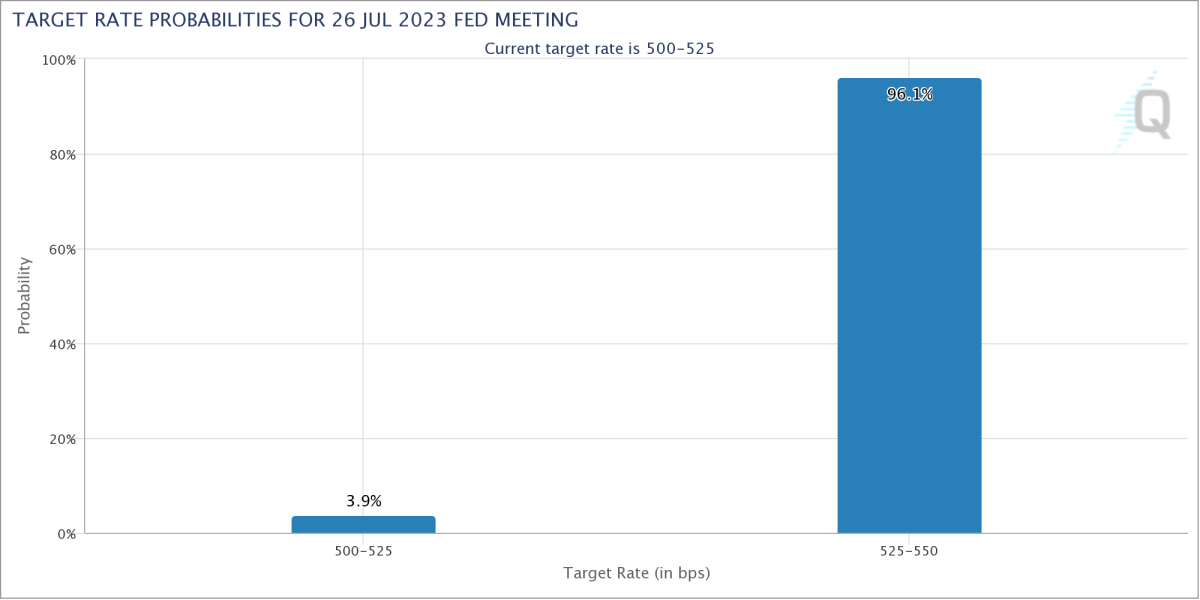

Those expecting a macro-inspiring risk-asset jolt will be disappointed this week by the lack of key data from the US. The most important data will be the earnings of technology companies and unemployment claims on July 20. However, volatility is on the horizon as the Fed’s decision to raise interest rates is about two weeks away.

Financial commentary resource The Kobeissi Letter made an interesting sentence in part of a recent social media analysis. Sentence “Earning season continues at full speed. The focus is on the July Fed meeting. It will be a busy few weeks.” was in the form.

Key Events This Week:

1. Retail Sales data – Tuesday

2. Building Permit data – Wednesday

3. Existing Home Sales data – Thursday

4. Jobless Claims data – Thursday

5. $TSLA $NFLX $GS and $MS earnings

6. ~10% of S&P 500 reports earnings

We're 10 days out from the Fed meeting.

— The Kobeissi Letter (@KobeissiLetter) July 16, 2023

According to current forecasts from CME Group’s FedWatch tool, markets continue to believe that the Fed will continue to raise interest rates despite positive data showing that inflation is falling faster than expected. As of July 17, the probability of a 0.25% increase reached almost unanimous 96.1%.

Meanwhile, another index to watch is the US Dollar Index (DXY), which is currently trying to retrace the 100 level after falling below it for the first time in more than a year. Bitcoin has previously exhibited a strong inverse correlation with DXY. However, this has decreased significantly in 2023.

Whales are back in the game

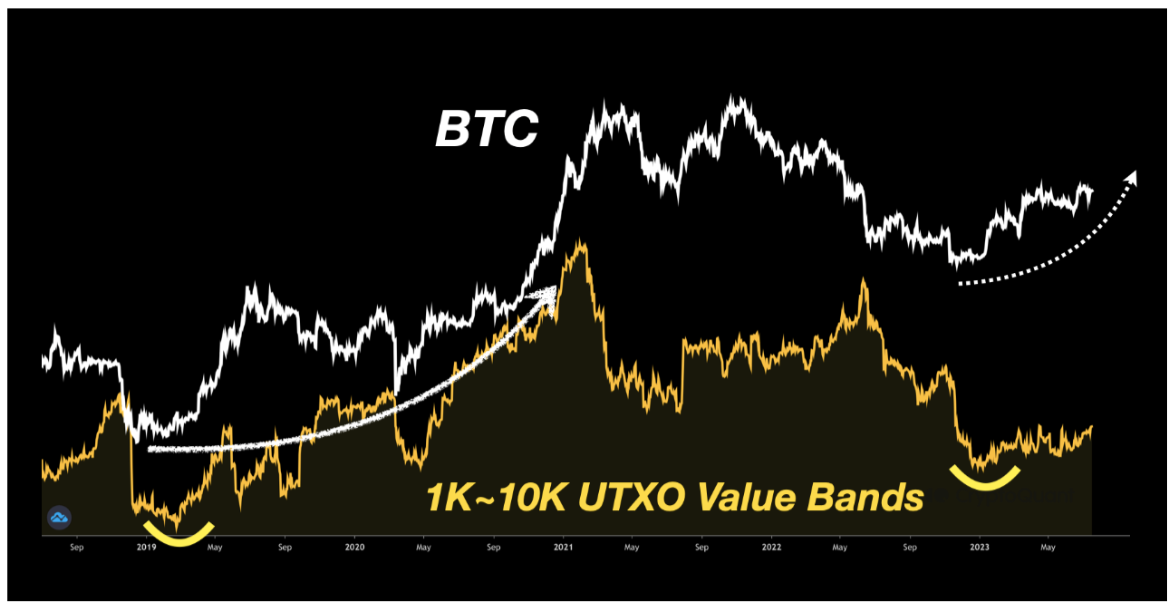

Returning to on-chain data, the reawakening of the Bitcoin whales is getting the on-chain analytics platform CryptoQuant excited.

As contributing analyst SignalQuant points out, unspent transaction output (UTXOs) reflecting large slices of coins are increasing this year in classic bull market fashion. SignalQuant cited the UTXO Value Bands metric, which shows whales gradually returning to life in 2023 after a rapid retreat in the second half of 2022. There’s an interesting comment in one of CryptoQuant’s July 16th Quicktake blog post. While the ‘whale group’ increased with its price in 2019, it is gradually increasing with its price in 2023. If its indicators gradually increase, we can be more confident that 1) its price at the end of 2022 is a long-term bottom and 2) its price will continue to rise.” he wrote.

Supply dynamics repeat early bull market signals

The latest on-chain data shows that the BTC supply is moving more around $30,000 than at other price points. It also reflects a critical point of interest in the investor base. According to the on-chain analytics platform Look Into Bitcoin, there is mobility. Accordingly, 3.8% of the total supply moved in the region around $30,200 in total.

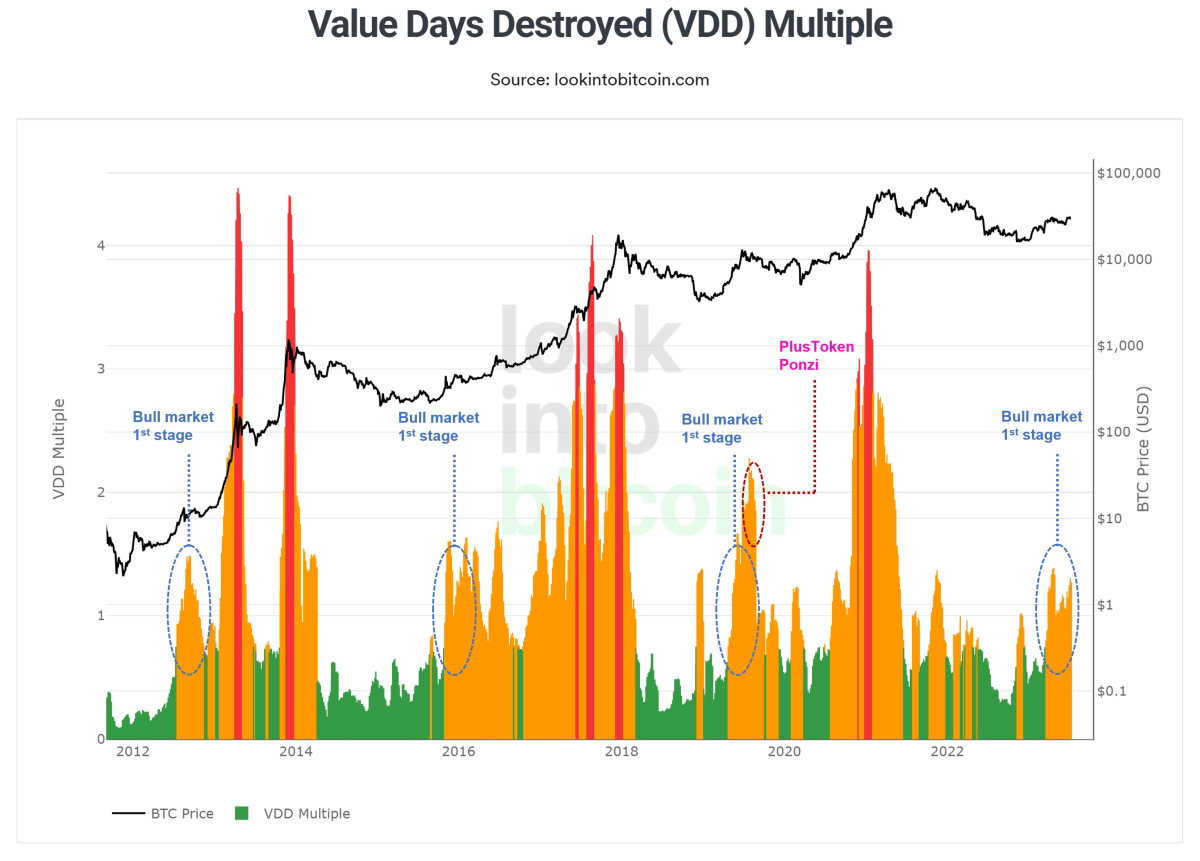

At the same time, the older, long dormant supply is also coming back to life. According to Philip Swift, creator of Look Into Bitcoin, there is a different side to this situation. It has been characteristic of the early stages of every Bitcoin bull market to date.

“Greed” disappears from crypto markets

Few things show the indecisive nature of the average crypto investor better than the classic sentiment metric, the Crypto Fear and Greed Index. Albeit a little belated, Fear & Greed captures the rapidly changing mood among market participants, even within established trading ranges. This is the case around the key $30,000 border, with sentiment significantly improving above and worsening below.

Currently the index is in neutral territory, but at 54/100 its July low. Extremes of fear or greed tend to serve as a forewarning of market rebounds or pullbacks, respectively.