The cryptocurrency market is holding tight in its current ranges. The news that crypto bank Silvergate Capital (SI) was potentially investigated by the US Department of Justice and delayed its annual report created market volatility late last week, but it may not have a significant impact. Overall, we have entered a moderate week for Bitcoin and altcoin projects. According to analyst Rahul Nambiampurath, this week should examine Maker (MKR), Synthetix (SNX), XDC Network (XDC), ImmutableX (IMX), FET and EOS (EOS). Here are the details…

Important for 6 altcoins this week

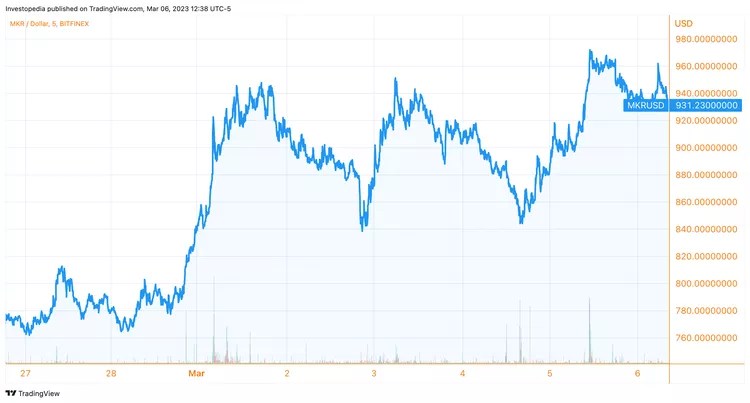

Maker (MKR)

cryptocoin.com As we reported, Maker (MKR) was one of the top earners of the week thanks to a potentially big development. Maker is a decentralized finance (DeFi) project that provides an ecosystem with various financial products, including the stablecoin DAI. There are reports that the MKR governance token used for voting may soon be allowed to be used to borrow DAI by holders who have delegated management powers. This news likely boosted the MKR altcoin project by more than 20 percent, according to the analyst. The MKR was priced at $768 seven days ago. It went up to $ 929 during the day.

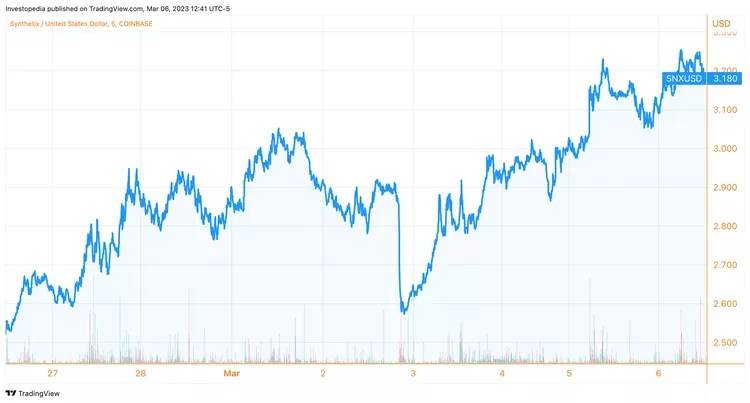

Synthetix (SNX)

Altcoin Synthetix (SNX) has risen nearly 20 percent recently, possibly in response to the news that 22 new cryptocurrencies have been added to the perpetual futures contract market, according to the analyst. The market allows the trading of perpetual crypto futures contracts that take advantage of the decentralized technology. Synthetix also released version 3 of its platform at the end of February, adding more use cases and better performance to the platform.

The Synthetix protocol allows publishing synthetic assets (or tokenized derivatives) on the open-source Blockchain Ethereum and offers many other derivatives. SNX was priced at $2.62 last week and has gone up to $3.15 in the last 24 hours.

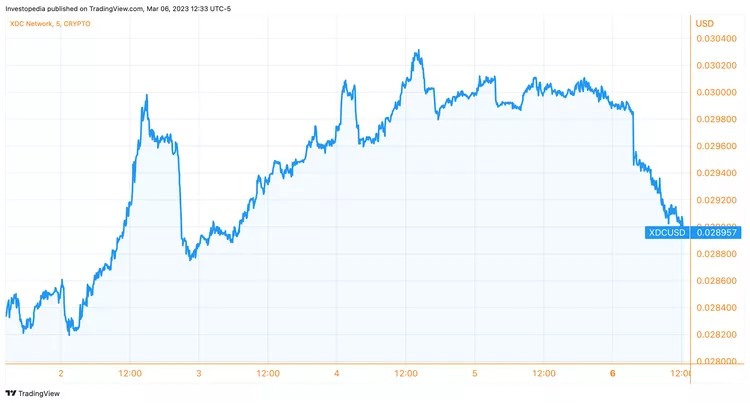

XDC Network (XDC)

According to the analyst, XDC Network’s coin rose 15 percent, possibly due to the announcement of a partnership with sustainable liquidity protocol Fathom. The partnership will include crypto platform Fathom, which offers a way for users to borrow and earn XDC coins, as well as real-world assets that will act as collateral to borrow Fathom’s FXD token.

The premise behind the Fathom partnership is to provide higher returns than other lending platforms. It is also expected to increase the utility and liquidity of XDC. XDC was worth $0.026 last week. Now it has risen to about $0.030 in the last 24 hours.

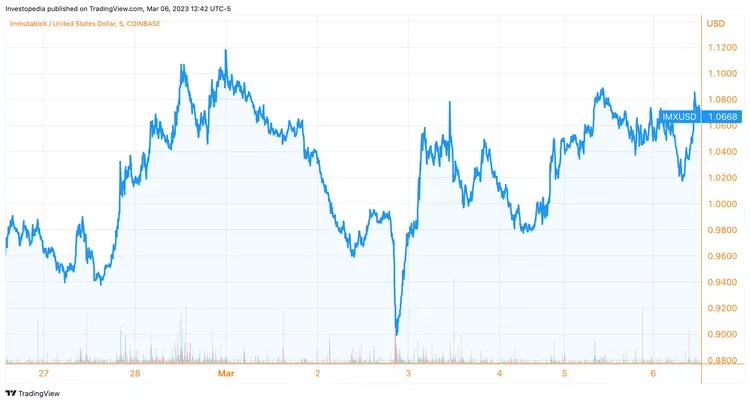

ImmutableX (IMX)

ImmutableX (IMX) is up nearly 10 percent after Wagyu Games executive Grant Haseley launched the Kill to Earn game called “Undead Blocks” on the network. The game allows players to earn ZBUX tokens, a cryptocurrency that can be used to get rare weapons and character skins in the game, or NFTs as special weapons to kill zombies. Haseley said the game saw a huge turnout when it was in beta mode with over 100,000 players in the last quarter. ImmutableX is a popular platform for Web3 games and uses layer two scaling (a layer built on top of the original Blockchain) to improve transaction performance.

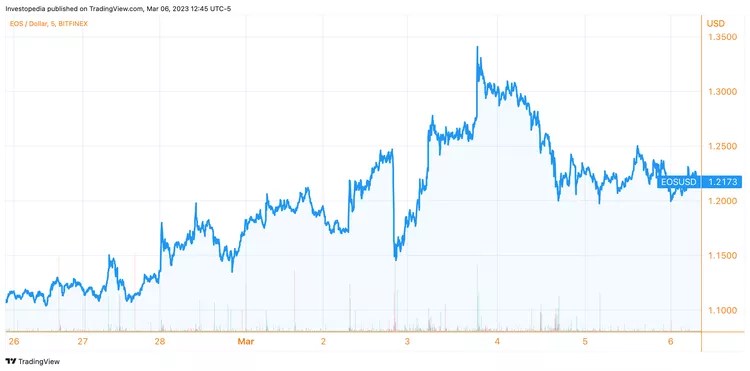

EOS (EOS)

Seen as a competitor to the Ethereum Blockchain, the EOS network is experiencing a potential comeback amid various developments in its ecosystem. EOS is a platform for decentralized applications using the Delegated Proof-of-Stake (PoS) consensus method known for its scalability for transaction processing. The token has gained about 8 percent in the last week.

The EOS Foundation has outlined plans for the ecosystem that include upgrading to the consensus mechanism, the way a Blockchain state is decided by the participants. The network is also experiencing a surge in daily transactions, increasing to 1.3 million year-to-date and 38,000 daily active addresses, according to crypto analytics platform Messari. EOS registers an average of 1,785 new addresses per day. However, this marks a decrease compared to 2022 (when an average of more than 2,600 new addresses are registered per day) and 2021 (when about 13,000 new addresses are registered per day).

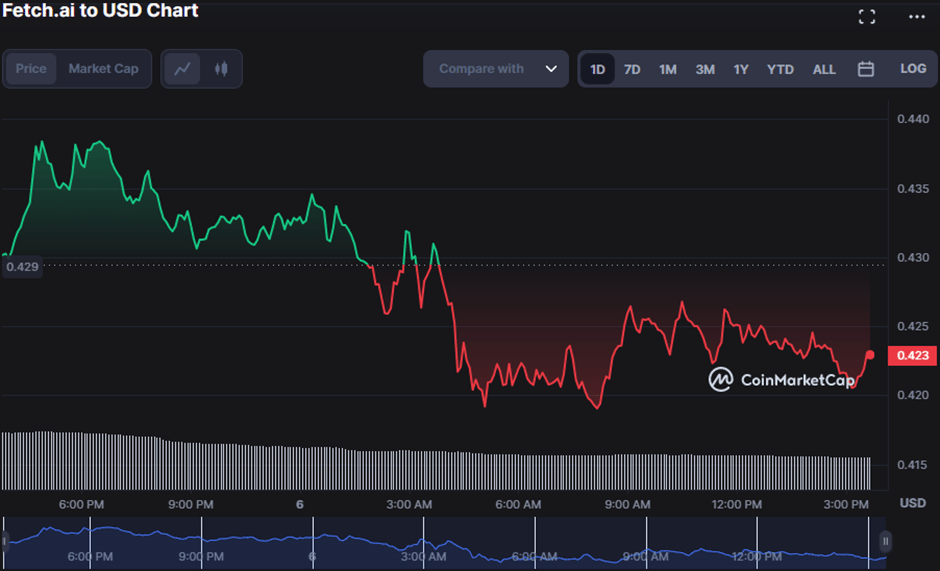

Fetch.ai (FET)

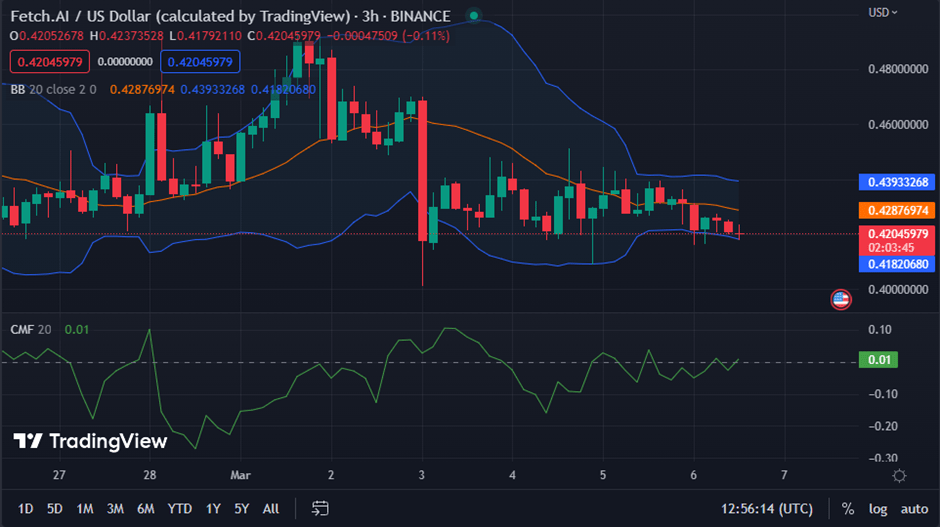

The bull dominance of the fetch.ai (FET) market has stalled recently after encountering strong resistance at the intraday high at $0.4385. As a result of this development, FET price slumped as low as $0.4183, but the market soon recovered. FET’s price is stabilizing around $0.42 as the bulls attempt to break the $0.43 resistance level. As a result of the decline, the market cap dropped to $346,434.876 and the 24-hour trading volume dropped to $59,128,282.

In light of recent market volatility, this action may indicate that investors are only willing to make significant trades when conditions improve. During the current retracement, the Bollinger bands on the FET price chart have moved down, reaching the upper band 0.43924691 and the lower band 0.41837824. With the upper and lower bands serving as potential resistance and support levels respectively, this action indicates that FET price is currently in a bearish trend.

Chaikin Money Flow (CMF) is trending upwards and is currently at 0.01 crossing into positive territory, indicating buying pressure is building. The 50-day MA data is at 0.44295490 and the 100-days MA is touching 0.43989049. The downside trend in the FET market may be decreasing as the short-term moving average is higher than the long-term moving average. This change shows that buyers are gaining momentum and may continue to push the price higher soon, but volume and possible resistance levels should be watched closely. With data at 12.85 on the Stochastic RSI followed by a move below the indicator’s signal line, the market is in the oversold zone.