Robust US data and hawkish Fed comments pointing to further rate hikes dampened the lure of the bearish yellow metal. Therefore, gold is on its fifth straight monthly decline on Wednesday. Analysts interpret the market and share their forecasts.

“Fed has no intention of easing significantly in the near term”

Spot gold was down 0.75% at $1,711 at the time of writing. The yellow metal is heading below $1,700, which it saw on July 20. Bullion has lost around 2.4% so far in August. U.S. gold futures fell 0.1% to $1,723.01. DailyFX currency strategist Ilya Spivak comments:

The Fed has no intention of easing significantly in the near term. Their focus is on inflation and maybe that’s what they want to do. Perhaps they want to create some two-pronged risks around policy prospects under some less clear forward guidance. This adds to the weakness of gold and the strength of the US dollar.

“Fed’s pressure on gold continues”

cryptocoin.com As you follow, the influential chairman of the New York Fed said on Tuesday that the Fed will likely need to take the policy rate “slightly above” 3.5% and keep it there until the end of 2023. While gold is seen as a hedge against inflation, rate hikes raise the opportunity cost of holding bullion while boosting the dollar.

Recent data showed that employment gaps in the US widened in July. Also, there was a larger-than-expected recovery in consumer confidence in August. These, in turn, supported expectations that the Fed will maintain its aggressive policy stance. A number of European Central Bank policymakers have also called for rapid rate hikes ahead of next week’s policy meeting. David Meger, director of metals trading at High Ridge Futures, comments:

Fed Chairman Jerome Powell made comments last week that raised expectations for a more aggressive Fed. The pressure on gold continues. The fact that gold is a non-interest bearing asset will cause more competition. If the economy starts to slow down, gold will eventually leave. That scope will see some safe-haven flows at some point.

“This level will excite the gold bulls once again”

Craig Erlam, senior market analyst at OANDA, highlights the following in a note:

A move above $1,765 will likely excite the gold bulls once again. But if there is something that needs trading in the last few sessions, it may be easier said than done.

“Golden faces a more hawkish, stern-voiced Powell”

GoldSeek president Peter Spina said in a statement that gold is at its lowest level since July. However, he adds that the yellow metal is well supported above summer lows. In this context, the analyst makes the following statement:

The rise in interest rates and the US dollar helped dampen the energies of gold with Powell’s comments on Friday. Gold, like markets, faces a more hawkish, hard-voiced Powell that will have to hold its stance and raise rates another 75 basis points at the next meeting. This is now reflected in the market.

Still, Spina says, “the biggest risk for gold right now will be a sudden market crash where those in need of liquidity are selling their holdings for cash.” According to the analyst, this is especially true for fully worn gold miners. However, Spina said, “The good news is that the summer woes are coming to an end. “There will be some fresh capital and interest in the coming months,” he says.

“If this happens, it is possible for the gold to stop bleeding”

According to Edward Moya, senior market analyst at OANDA, investors continue to see the wrath of high inflation data, which supports the argument for the global central bank to tighten further. Therefore, the analyst notes that the difficult patch of gold will probably continue for a while. Based on this, Moya makes the following assessment:

A weaker dollar and an escape to safety are possible. If the European Central Bank doesn’t disappoint and delivers a massive 75 basis point rate hike and equities fall as earnings prospects collapse, gold could stop bleeding. Geopolitical risks and the impact of the global energy crisis on growth should eventually lead to safe-haven flows for yellow metal.

“There is room for further decline in the price of gold”

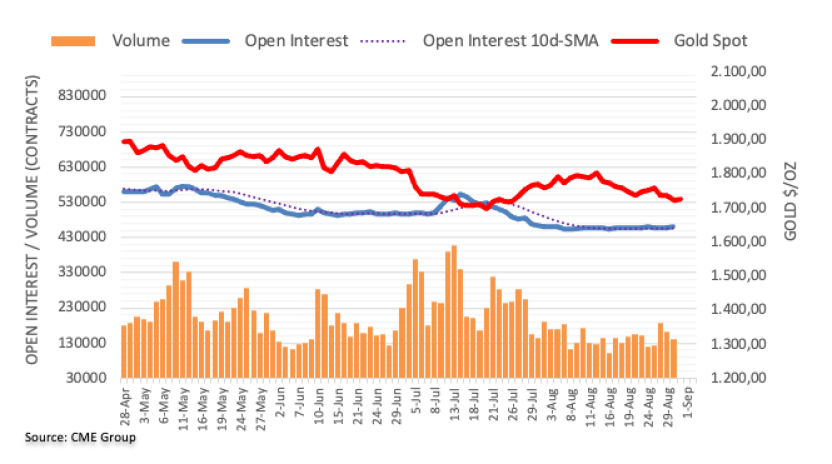

Open interest on gold futures markets increased its uptrend on Tuesday, this time, by around 1.6k contracts, according to advanced data from CME Group. Instead, volume fell for the second consecutive session, now with around 22.5k contracts.

Gold prices fell further on Tuesday amid rising open interest. According to market analyst Pablo Piovano, this is also an indication that the downtrend should still continue. In contrast, the analyst notes that there is an initial support at $1,711 ahead of the key $1,700 level.