Gold prices swayed with volatility on Thursday as the dollar hit a 20-year high. Thus, support from low Treasury rates was offset after monthly US inflation data indicated that the Federal Reserve will stick to its aggressive rate hike roadmap. After the latest developments, we have compiled the market comments and expectations of the analysts for our readers.

The pressure of the strong dollar on gold prices is increasing

As you can follow from cryptokoin.com news, the US dollar has reached its highest level in nearly two decades. A milestone that the dollar has set many times and has been circulating recently continues to put pressure on demand for dollar-priced bullion. US consumer price growth slowed sharply in April as gasoline fell from record levels. That means inflation is likely to have peaked, but is likely to stay warm for a while and the Fed is likely to keep its foot on the brakes.

As inflation data force the Fed to ease its extremely expansionary pandemic-era monetary policy, last week’s decision to raise the benchmark overnight rate by an aggressive half a percentage point (the biggest increase in 22 years) came right after. Despite being seen as an inflation hedge, gold bullion pays no interest and is highly sensitive to rising US short-term interest rates and bond yields. City Index senior market analyst Matt Simpson underlines in a note:

With inflation expectations soaring and evidence of money flowing into gold, we wonder if a significant low above $1,830 was formed yesterday (Wednesday).

“Gold may provide some support when restrictions are lifted in China”

Indicator 10-year Treasury rates fell in the fourth consecutive session, but lowered the opportunity cost of holding gold. Brian Lan, managing director of the GoldSilver Central dealer, says there may be some support in the near term as investors know there could be more support for precious metals demand once restrictions are lifted in China.

“Inflation report shows Powell made a mistake”

Gold prices bounced Wednesday after a three-month low as traders digested hotter-than-expected inflation data closed the day high. Edward Moya, senior market analyst at Oanda, comments:

Today’s inflation report proves that Fed Chairman Jerome Powell made a mistake last week by removing the option to raise rates by 75 basis points at his next policy meeting. But for most of Wall Street, the general implication is that the Fed is ready to offer consecutive half-point increases at the June and July FOMC meetings.

Jim Wyckoff: Data supports the camp of Fed hawks

Gold is under pressure as the US dollar rises sharply against its main rivals. Rising Treasury rates, which pulled back from their highest level in 3 and a half years this week, could also be a headwind for gold. Senior analyst Jim Wyckoff comments in a note:

Gold prices fell slightly from moderate gains seen just before the CPI report was released. The data supports the camp of US monetary policy hawks who want to see a more aggressive rate of US interest rate increase from the Federal Reserve.

BofA Global researchers wrote in a client note Wednesday that commodities other than the dollar and gold and copper are showing a positive trend amid the turmoil and uncertainty plaguing the markets. Analysts state that the gold trend is now neutral after being positive for most of the year.

“Gold prices supported by 200-day SMA”

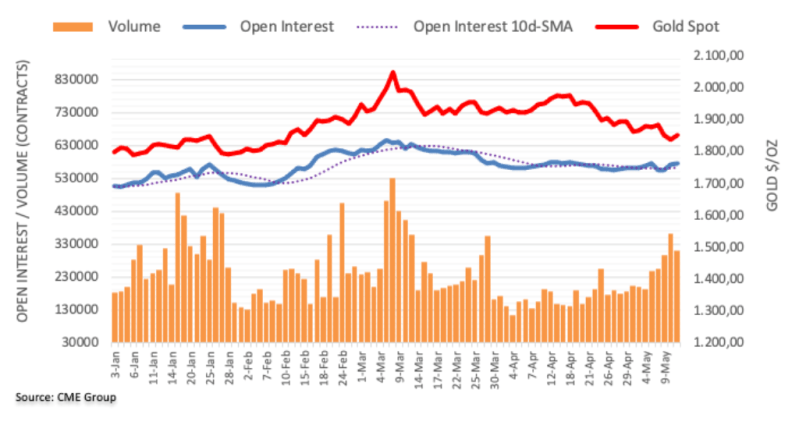

CME Group’s latest data for gold futures markets, this time around for the second session in a row on Wednesday. 4.7 thousand contracts showed an increase in open interest. Instead, volume reversed the four-day structure and shrunk by around 52.8k contracts.

Gold prices partially reversed recent selling on Wednesday after once again visiting the $1,830 region where the 200-day SMA sits. According to market analyst Pablo Piovano, the daily recovery came amid rising open interest, which is supporting further upside in the very near term. Just on the upside, the analyst notes that the 100-day SMA emerged at $1,883 before the May high of $1,909 (May 5).