Bitcoin and altcoins turned red again yesterday. On August 30, the US dollar rose strongly and tried to test its 20-year high. The dollar’s rise has put downward pressure on financial markets around the world.

Bitcoin prediction that scares 6 analysts

After the dollar strengthened, Bitcoin (BTC) fell below the psychological $20,000 support. The leading cryptocurrency saw the daily level of $ 19,575. Therefore, the bulls have frantically repositioned themselves to avoid further declines. Then, analysts updated their BTC price forecasts in light of the new data. we too cryptocoin.comWe have shared these price estimates with you.

“Bears are still strong”

Senior market analyst Jim Wyckoff was one of them. Wyckoff said the bulls are trying to “stabilize prices and break the price downtrend that is still in effect on the daily chart.” However, this appears to be a bigger challenge than anticipated. Wyckoff notes that “the bears still generally have the short-term technical advantage.”

“A pullback is possible at these prices”

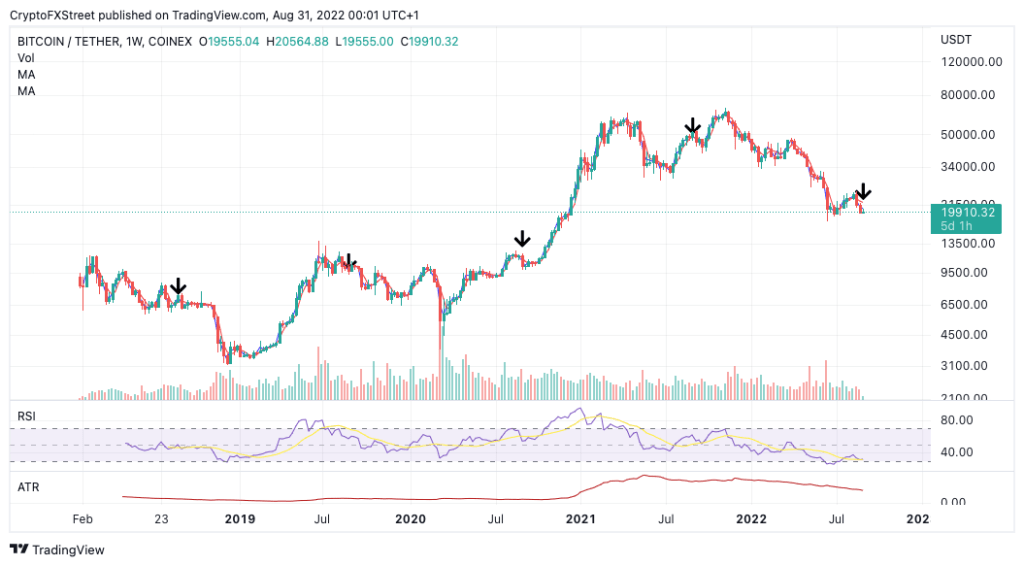

Cubics Analytics Senior Market Analyst Caleb Franzen has offered some insight into where its price might head. He then published the chart below. “I feel Bitcoin has a history in the red range below between $17,800 and $18,900,” the analyst said. Franzen explained that a pullback to this range is by no means guaranteed. But he added that this is “definitely something to watch.”

“Bitcoin is barely holding $20,000”

On-chain data firm Glassnode has released a new bulletin. This bulletin strengthens the perspective of those who think the crypto market has been painful in the past month. According to Glassnode, the capital outflows last month are historical. The firm only says its 2018 capitulation is greater than last month’s exits. He also states that investor losses in recent weeks have reached 0.28% of the daily market cap.

The firm is responding to critics of the recent surge in sales as BTC struggles to break above $20,500. Glassnode said, “Given this fact, it should come as no surprise that investors are willing to buy. “There’s every rally and profit they can get,” he says. Also, the firm finds it surprising that $20,000 can still be held due to the current bear market and low Bitcoin active addresses.

“BTC offers a buying opportunity”

Not all traders in the market are pessimistic about the forward outlook for BTC. Market analyst Rekt Capital said, “It has been 300 days since the Bitcoin bull market peaked at $65000. So this bear market is pretty close to ending,” he says. Historically, bear markets “tend to bottom about 365 days after the previous bull market peak,” according to Rekt Capital. This is why many crypto analysts suggest that it’s fine to buy BTC at the current $20,000 price.

“Prices will continue to fall”

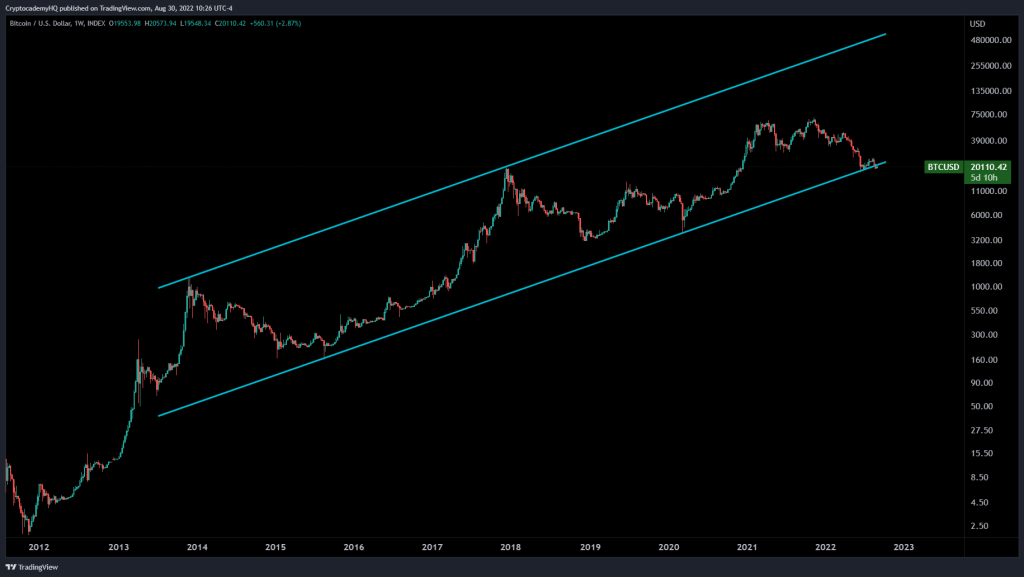

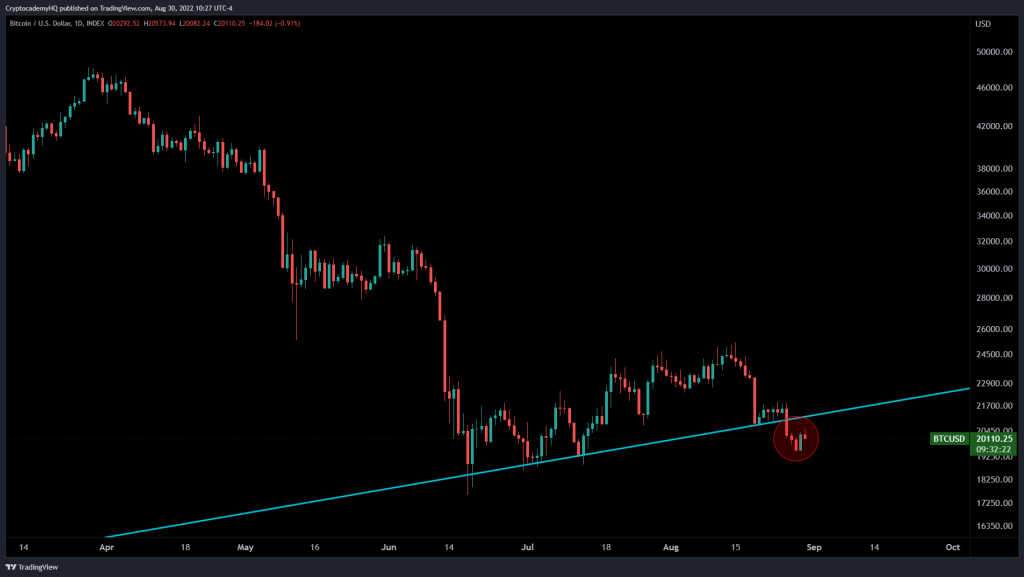

Bitcoin and altcoin analyst Justin Bennett also evaluated the BTC price action. Bennett told his 107,100 Twitter followers that he expects crypto prices to continue falling. He then stated that the recent recovery could be a bull trap. According to him, investors should not believe that an incorrectly expanded rally has begun. Bennett shared two charts showing Bitcoin dipping below the ascending channels. One of them has been going on since 2014, while the other appeared in April 2022.

“Technical data predicts decline for September”

Since August 1, Bitcoin has dropped 20%. As today’s trading session is close, technical data is pointing further down for September. Historically, the cryptocurrency market has not been performing well during the month of September. Accordingly, September in the past four years has brought negative returns for investors. The Volume Profile Indicator shows an uptick in trades as BTC price breached and re-entry from the $20,000 barrier was denied. The last-minute spike has the potential to be the catalyst to push BTC price to $18,800 in the short term.

Last week’s bearish pattern is still in motion and unconfirmed. Accordingly, the BTC bearish target is at $18,900 and the invalidation level is at $27,000. Additionally, a breach of the $27,000 zone has the potential to start the next crypto bull run with mid-term targets around $34,000. Such a move would result in a 60% increase from the current Bitcoin price.