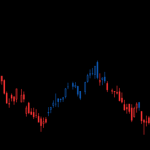

US May inflation figures came in warmer than expected. After that, gold prices closed high on Friday as investors turned to safe havens. However, it briefly dropped to three-week lows at the start of the session.

US CPI peaked, gold prices rose sharply

Spartan Capital Securities chief market economist Peter Cardillo shared his views on gold prices. The analyst made the following assessment:

Normally, as is the case today, a strong dollar and higher bond yields provide less support for gold. But today, the opposite is happening due to the actual ugly inflation data we get.

Stocks fell hard in afternoon trading on the S&P 500 SPX after the US May inflation report on Friday. CPI data noted that the cost of living in the US rose 1% in May due to higher rents, gas and food prices. It also showed that the US kept the inflation rate at its highest level in more than 40 years.

Louis Navellier: Market reaction was swift and fierce

Headline data, 8% YoY, surpassing the peak of the previous cycle seen in March It came with .6. Gold prices rose +0.94% on Friday. Investors are scrambling for security over concerns about economic spillover from the rising cost of living and possible Fed reaction. Navellier co-founder Louis Navellier highlights the following in a daily client note:

Confirmation of peak core inflation smashed hopes. The market response was swift and violent.

“Gold is ready for the continuation of some technical purchases”

Senior analyst Jim Wyckoff, whose views we have included in the news of Cryptokoin.com , also commented on the developments. The analyst said:

Gold prices hit a three-week low earlier today. However, he then reversed course. Then, it technically led to a bullish ‘extraday’ up on the daily chart and also technically a weekly high close. Now, the bulls have regained momentum. Therefore, early next week, gold is ready to continue some of its technical buying.

Economists at Barclays think the Fed will respond to high inflation data. Next week, the Federal Reserve will pull the trigger at its policy meeting on June 14-15, with an increase of 75 basis points from 50 basis points, according to economists.

Tai Wong: Gold prices took a crazy roller coaster ride

Rising US inflation data support bets on aggressive rate hikes. Therefore, the focus turns to economic risks. Gold prices managed to close with an increase in fluctuating transactions on Friday.

Gold prices first fell to $1,824.63, their lowest level since May 19th. But as investors weighed the economic repercussions, the safe-haven asset soon wiped out losses. Meanwhile, University of Michigan research showed that US consumer sentiment fell to a record low amid rising gasoline prices in early June. After that, gold bullion prices rose even more. Tai Wong, an independent metals trader in New York, comments:

Gold had a crazy roller coaster ride. It slumped to monthly lows before rallying sharply in the CPI report and rebounding in the worst consumer sentiment report on record.

High interest rates often reduce the attractiveness of bullion as it increases the increased opportunity cost of holding the asset that pays no interest. Tai Wong added that the fate of gold next week depends on the Fed meeting.

Suki Cooper: Yellow metal highly resilient

Gold’s recovery also came despite the strength in the dollar and higher US Treasury yields. Standard Chartered analyst Suki Cooper said:

Gold prices have been rather resilient amid concerns that inflation could outpace rate hikes. We see this in interest rate hike expectations and a softening physical market.

“Gold prices will tend to drop below $1,800”

This week, physical gold discounts in India hit a seven-week high While reaching, it has deterred buyers in China due to Covid-19. In a note, TD Securities analysts said:

Policy rates are rising sharply. However, gold will likely give up all these gains and tend to fall below $1,800.