Bitcoin traders watch below $19,000 BTC price and warn of ‘hot’ CPI in February. According to analysts, there could be a few weeks of testing for Bitcoin and risk assets with Fed Chairman Jerome Powell as the triggers kick off on March 8.

The ‘breakdown target’ for Bitcoin is $19,000

cryptocoin.com As you follow, Bitcoin failed to react as consensus formed around a potential breach of $20,000 at the March 6 Wall Street opening. Data from TradingView shows BTC holding above $22,400 at press time. BTC, which was dormant over the weekend, offered few trading opportunities as concerns arose over the impact of macroeconomic data from the US.

$BTC 4-Hour

Good luck trading this. pic.twitter.com/nc99kF8HbS

— The Wolf Of All Streets (@scottmelker) March 6, 2023

In particular, Analyst Venturefounder says the Consumer Price Index (CPI) February data, which will be released on March 14, is expected to be ‘hot’ or above expectations. In a Twitter post, the analyst records:

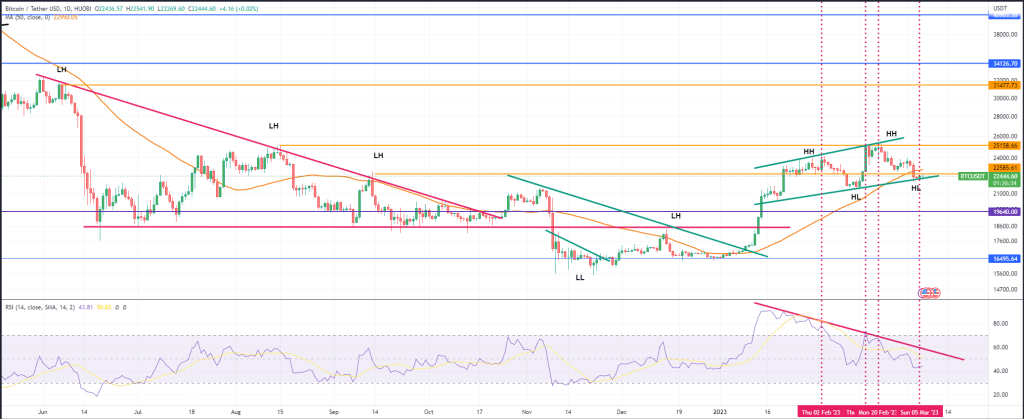

New Bitcoin higher bottom and bearish RSI divergence continues. March could be a bad month for risky assets, including BTC, with a hot CPI figure coming in and the FOMC meeting later this month. A breakout from this level would target $19k BTC.

An accompanying chart reveals the potential path below $20,000. It also highlights the bearish trend in Bitcoin’s relative strength index (RSI), which occurs when the metric’s trajectory goes in the opposite direction (up and down, respectively) in price.

BTC caption chart / Source: Venturefounder/Twitter

BTC caption chart / Source: Venturefounder/TwitterCPI data tend to trigger short-term volatility among risky assets. However, this is still usually short-lived and the Bitcoin spot price then returns to previous levels. In the sequel, popular trader Crypto Ed similarly expresses his belief in $19,000 marking the next local BTC price floor. In part of his Twitter comment, the analyst wrote, “Biggest trap ever, but the bottom is inside. Enjoy the coming months and don’t be fooled by the lower TFs!” is warning. US dollar ranks important test

$BTC 4-Hour

Good luck trading this. pic.twitter.com/nc99kF8HbS

— The Wolf Of All Streets (@scottmelker) March 6, 2023

Turning to macro markets, analyst Game of Trades draws attention to what he calls ‘heavy resistance’ against the strength of the US dollar. The US Dollar Index (DXY), which has traditionally been inversely related to Bitcoin, is now facing a major trendline retest. Game of Trades said, “DXY is approaching a heavy resistance zone after reclaiming the macro uptrend line. The reaction here will be very important for all markets,” he said.

US Dollar Index (DXY) caption / Source: Game of Trades

US Dollar Index (DXY) caption / Source: Game of TradesMeanwhile, popular trader Crypto Chase says he sees a narrow trading range in the S&P 500 that mimics the lack of momentum in Bitcoin.

Currently utilizing the framework discussed in last night's video. I'm allowing price to do whatever it wants around here.. let it deviate, you're not missing anything.

A deviation of 4060.75 followed by a reclaim is one entry trigger (denoted by the down arrow on chart).… https://t.co/LA3vCTFuWR pic.twitter.com/ItDw1cUgBb

— Crypto Chase (@Crypto_Chase) March 6, 2023

Focus will be on Federal Reserve chairman Jerome Powell’s speech before the US Congress on March 7 for clues to future monetary conditions.

According to the logarithmic chart, $70,000 is possible for BTC!

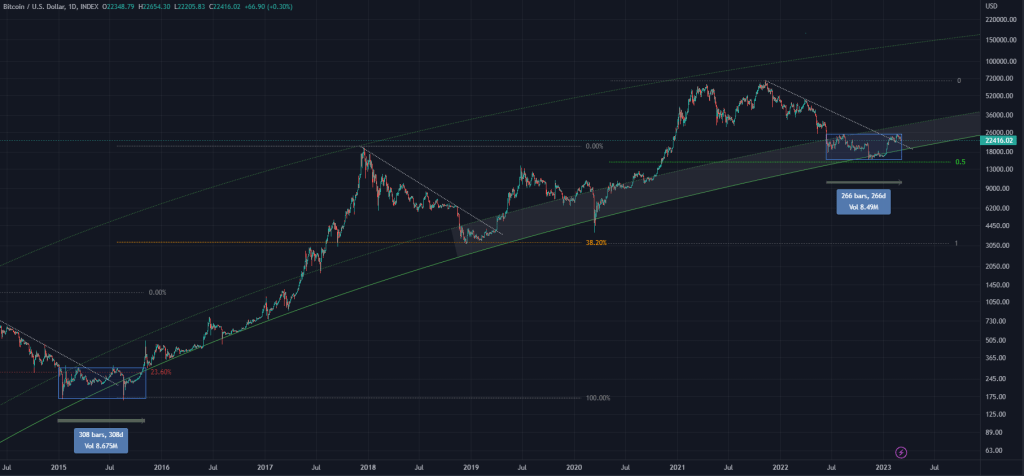

Bitcoin has been sideways for the past few weeks and some investors are getting increasingly impatient to wait for a new bullish cycle. However, according to some analysts, Bitcoin’s current price action may be forming a fractal that could trigger a move similar to what we saw in 2015, when BTC was trading below $500.

The long-term consolidation we are seeing now could be the basis for a massive price increase in the future. Even after Bitcoin’s rally in 2017, the coin entered a consolidation channel for about a year. This consolidation was eventually followed by a massive rally that took Bitcoin to an all-time high of nearly $20,000.

Source: TradingView

Source: TradingViewThe fractal that analysts observed on the chart shows Bitcoin’s price action following a pattern similar to what we saw in 2015. If this fractal continues, it is possible to see Bitcoin price heading towards the $70,000 threshold. It is important to note that technical analysis is not an exact science and fractals are not a foolproof way to predict price movements. That said, it’s always interesting to see patterns emerge on the chart that could indicate a potential trend.

When analyzing the Bitcoin chart, there are two types of charts that traders usually use: normal and logarithmic charts. Normal or linear charts are the most common chart type, and they show an asset’s price movement over time on a linear scale. Logarithmic charts, on the other hand, use a logarithmic scale to show price movements. This means that each dot on the chart represents a percentage change in price, not an equal change in price.