The cryptocurrency market is melting with a hawkish Fed stance and new bankruptcies stretching into 2022. Total market capitalization (TOTAL) again fell below $1 trillion. Let’s take a look at what 6 Bitcoin analysts expect from the BTC price that lost $20,000 in the short term…

US interest rate hikes, Biden budget, Silvergate bankruptcy, Bitcoin’s major bearish catalysts

Nicholas Merten, analyst at YouTube channel DataDash, warns that the Fed’s recent decision to raise interest rates and reduce its bond-buying program could cause a significant downturn in the crypto market.

According to Merten, the actions of the Fed could lead to reduced liquidity, increased competition with traditional markets, negative sentiment towards cryptocurrencies and uncertainty. As a result, investors may hesitate to invest in cryptocurrencies, causing demand and prices to drop.

Merten adds that the Fed’s plan to raise interest rates again to combat inflation could do much more damage to the cryptocurrency market. He predicted that the Fed’s new liquidity traps, implied in the latest statement by Fed Chairman Jerome Powell, will cause the Bitcoin price to drop below $20,000 very soon.

Analyst prepares Bitcoin bulls for new lows

While Merten’s prediction is met with skepticism from within the industry, he still advises crypto investors to be prepared for a potential market disaster. He said that Bitcoin bulls should be content to buy BTC between $13,000 and $14,000, as the past weeks have shown how intertwined crypto is with traditional markets.

In general, investors should carefully monitor the situation as it unfolds and take measures to mitigate their risks. Bitcoin (BTC) is currently trading at $22,095 and has been in the $22,000-$22,100 range for the past few days.

Lower levels could be opportunity for Bitcoin bulls

The crypto analyst and trader nicknamed Smart Contracter is of the opinion that several major altcoins are about to see a rise soon. First, the analyst claims that Bitcoin and Ethereum, which are currently under bearish control, will likely see a relief rally in the next few weeks. Therefore, he believes that now is the time to take the right long position on several altcoins.

unlike last weeks bear flag breakdown on btc and eth this one is getting immediately bought back up indicating fakeout.

Maybe were due for a few weeks of relief, might be time to long some of the alts that just got obliterated#btc #eth pic.twitter.com/h2zAtPkU34

— Bluntz (@Bluntz_Capital) March 7, 2023

Smart Contracter also notes that near the $22,000 area, Bitcoin is showing a bearish pattern. However, he also believes that these are signs that BTC is heading towards a strong support area.

bearflagging again pretty much straight away after breaking down from a bigger bear flag last week.

definitely not looking good, ez mode from the last few months looks like its over for now.

queue the multi-month chop pic.twitter.com/pl3ur8fJZX

— Bluntz (@Bluntz_Capital) March 6, 2023

“Bitcoin could be stuck between $30,000 and $13,000”

Another crypto analyst, Altcoin Sherpa, claims that there is an opposite move against the market. According to Sherpa, Bitcoin will mostly trade between $30,000 and $13,000 over the next few months.

$BTC: This could be your trading range for the next several months. If it is, expect both ends of the range to get tapped (ie. 15k), with some deviations on both ends (basically 30k->13k would probably be the range). #Bitcoin #BTC pic.twitter.com/jh1qAuO14X

— Altcoin Sherpa (@AltcoinSherpa) March 7, 2023

It’s not just Bitcoin, Altcoin Sherpa also has an opposite stance against altcoins. This is because the analyst is of the opinion that altcoins will follow the bear move once Bitcoin drops to the area of around $21,000.

But while both analysts have contradictory claims, Bitcoin price action will mostly depend on upcoming macroeconomic events.

$BTC: Things looking shaky overall; we saw those lows get run but is it sustainable? The next several hours should provide decent insight if we hold this region or not.

Lots more volume in the 21ks. Alts continue to die if we go there. #Bitcoin #BTC pic.twitter.com/57nmTHOugu

— Altcoin Sherpa (@AltcoinSherpa) March 7, 2023

Jason Pizzino sets levels to watch out for in the short term

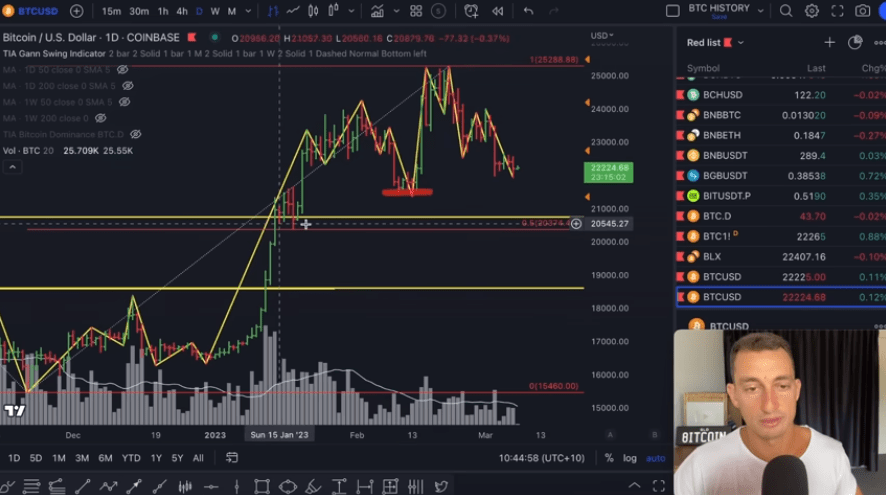

Elsewhere, popular crypto analyst Jason Pizzino is optimistic about Bitcoin’s long-term direction, but warns that it could potentially fall below $19,000 in the short-term, down about 15% from current levels.

The analyst pinpoints mid-level support levels of $21,500, $20,000 on the daily chart and perhaps $18,000 in the worst-case scenario. Pizzino suggests there is a solid buying opportunity below $22,000, emphasizing that Bitcoin remains bullish on its long-term prospects.

Pizzino believes that prices below $22,000 for Bitcoin present an opportunity for accumulation. At around $20,500, he states that Bitcoin can only reach halfway, and advises investors to keep this in mind if they are looking for a long-term dollar-cost average in Bitcoin. The analyst also warns that if the price drops below $18,500, Bitcoin’s long-term positive thesis will be proven wrong.

Benjamin Cowen says he expects tough times for Bitcoin investors

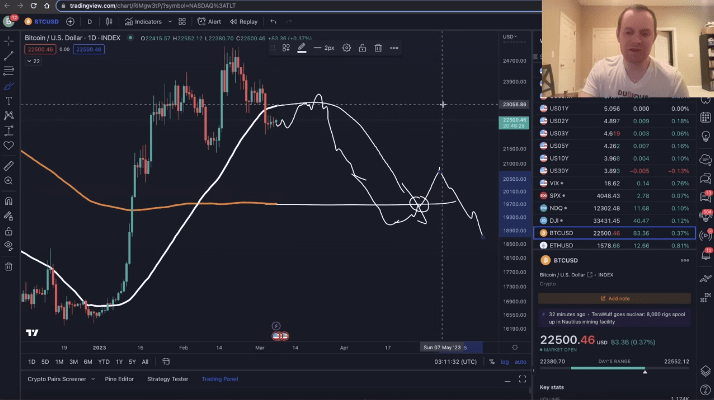

Bitcoin analyst Benjamin Cowen has warned that both bulls and bears will suffer in his 2023 Bitcoin price predictions. In a recent strategy session, Cowen said that similar to 2015 and 2019, the Bitcoin price will fluctuate for the rest of the year after the bearish market in 2022.

Cowen believes both bulls and bears in the market will be doomed this year. He noted that the years following these down markets in 2015 and 2019 were relatively turbulent, causing both sides to suffer significant losses. He added that some wanted the market to be more complex than that, but thought it was no different this year.

Cowen predicts that the market will be quite volatile, which will destroy both the bulls and the bears. However, he emphasizes that the bears have already suffered significant losses at the beginning of the year and he expects the same to continue for the rest of the year. The analyst said that he wanted to see if Bitcoin could hold its price above $22,200, and could test some previous levels around $25,000 from this channel.

Bitcoin walks away from $22,000 after FUD news

On Thursday, the announcement that Silvergate Bank would cease operations and the threat of higher interest rates had a negative impact on crypto prices as many traders pushed out and turned to the safety of stablecoins until the latest turmoil erupted. cryptocoin.comAs we reported, the drop caused by the Fud news caused a double-digit drop on crypto giants such as BTC and ETH.

Jim Wyckoff, senior technical analyst at Kitco, commented on the current market situation, “The bears gained a slight short-term technical advantage amid the incipient price downtrend on the daily bar chart. Sellers still have some momentum to suggest more sideways-low trades in the short term.”

“The amount of negative news in the last few hours is record-breaking,” popular crypto analyst Michaël van de Poppe said during the recent sales. The crypto analyst highlighted $20,400 as a potential point to open a long position before the afternoon drop. BTC stretched this level to the $19,500 region during the day.

https://twitter.com/CryptoMichNL/status/163391055584966658

Following the pullback, Poppe observed that “almost a month ago people wanted to get into Bitcoin and ran over each other” but now rush for the exits as the price has dropped 20% since then. Current levels, according to the analyst, “the time you should start accumulating is not when the market is rebounding massively. Trade your feelings.”

Rekt Capital was among analysts predicting the drop

Republishing the tweet below last Friday, market analyst Rekt Capital issued a call for calm, highlighting the possibility of a correction below $20,000. While such a move would leave BTC in the macro range where it has been trading for a while, Rekt Capital has warned that BTC still faces a possible macro downtrend in the coming weeks.

#BTC still resides in the ~$19500-$23400 range (orange)

Range High resistance is confluent with Macro Downtrend

Range breakout would tie in with a Macro Downtrend breakout

BTC can consolidate in range but will have to face the Macro Downtrend again soon$BTC #Crypto #Bitcoin pic.twitter.com/apldP4QXDG

— Rekt Capital (@rektcapital) March 3, 2023

Meanwhile, amid the general correction in the market, the most valued altcoins were Huobi Token (HT) down 28.88%, FLOKI (FLOKI) 20%, and Onyxcoin (ONX) 15.77%.