Bitcoin analysts point out and date two main trend lines for the next bull run. Will we see a bull market in 2023? Analysts answer….

Historical data supports 2023 Bitcoin bull

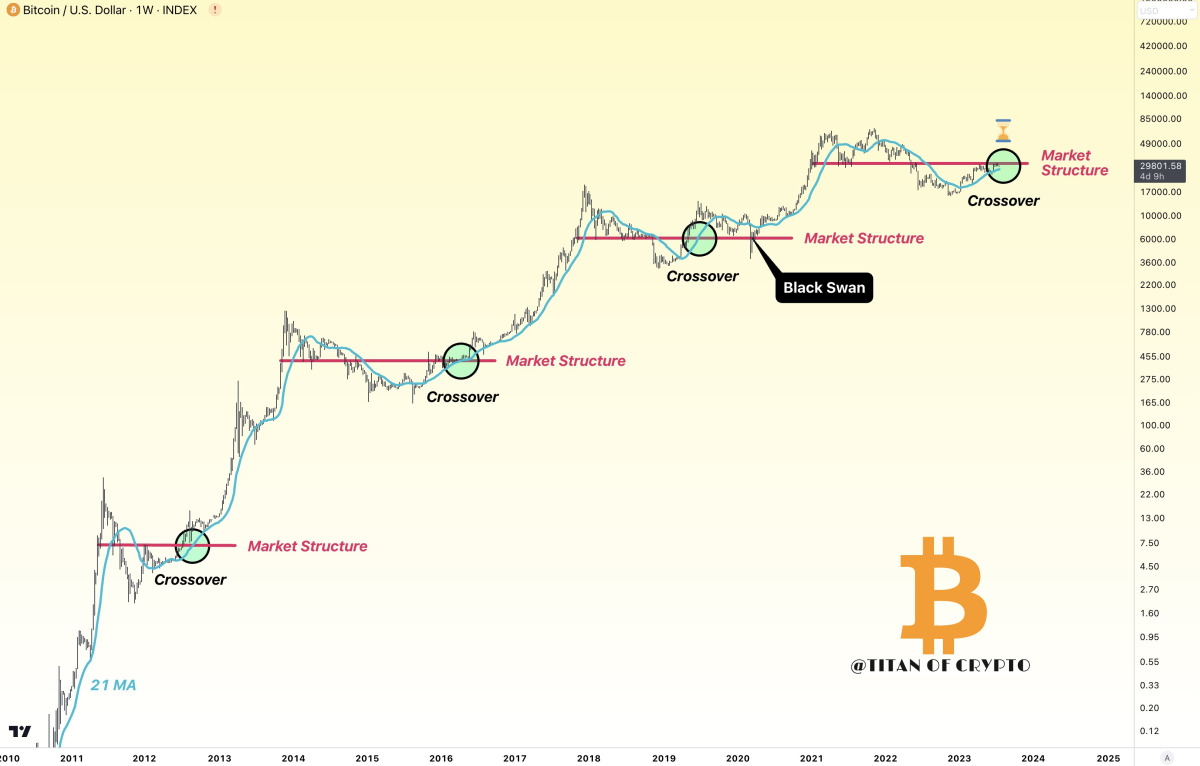

Closely followed analysts Mustache and Titan of Crypto have revealed an under-construction BTC price in the latest analysis. According to Titan of Crypto, Bitcoin closely follows previous price cycles. The technical analyst draws attention to the historical performance of the BTC/USD pair, noting the $27,900 crossing with the 21 SMA.

When BTC price breaks this spot price range upwards, it generally tends to be bullish. The 21-week SMA is also called the “bull line”. Titan of Crypto describes this phenomenon as a “bull market start.” His analysts also include encouraging predictions such as “Get ready, it’s getting closer”.

6 Bitcoin Traders Said ‘Get Ready’ and Gave Levels!

6 Bitcoin Traders Said ‘Get Ready’ and Gave Levels!Bitcoin’s last such MA crossover occurred four years ago, in early 2019. This level is the same anchor point as today’s price action during the previous cycle. This helped it approach that year’s local high of $14,000. March 2020 saw the crossover briefly undone thanks to the COVID-19 crash, which Titan of Crypto referred to as the “black swan.”

It points to the 20-month SMA at $28,585

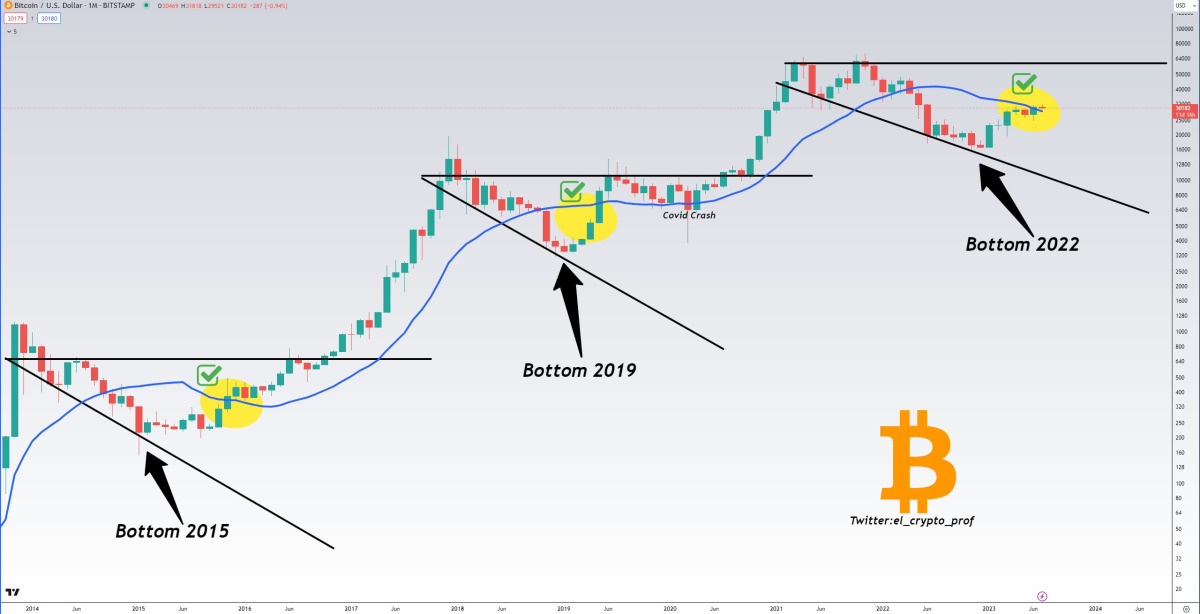

Another trendline on the radar relates to longer timeframes – the 20-month SMA. This price heralded every previous Bitcoin bull market, according to Mustache – a close monthly candle above the 20-month SMA saw every subsequent candle close above it until the cycle top. Here again, March 2020 is a temporary exception to the rule. “Imagine a bearish trend with BTC hovering above the 20 monthly SMA line,” commented Mustache. The analyst also drew attention to historical data:

Once Bitcoin closed above it, it NEVER fell below it until it reached the top of the cycle. That’s exactly how it was in 2016-2018 and 2019-2021.

Rekt Capital says Bitcoin price will repeat halving cycle

Another well-known analyst, Rekt Capital, says that Bitcoin will likely repeat a historical pattern after halvings that occur every four years. It also says that only months from now its price will rise. The next Bitcoin halving will take place in April 2024, when the miners’ rewards are halved. According to the analysis of Rekt Capital:

We now know that Bitcoin tends to enjoy lower prices ahead of the halving… In the months immediately after that, we are breaking through the ATH resistance.

The same thing will happen here after halving. As we have seen in the past, we will break the $55,000 region in the post-halving months. So the pre-halving prices will always be lower than the post-halving prices.

Looking at its chart, the analyst shows that if Bitcoin loses the support at $29,887, it will likely drop to $29,225. BTC is currently trading above the $30,000 support it reclaimed today.

Tom Lee featured an ambitious Bitcoin prediction

Tom Lee, managing partner of Fundstrat Global Advisors, predicts that BTC will experience a significant rally in the next five years. In a recent CNBC interview, Lee suggests that the Bitcoin price could rise by over 500% from its current level to reach around $200,000.

Lee argues that the value of Bitcoin lies in its usefulness. He especially believes that the financial system in the US works well for those who already have wealth. That said, he says Bitcoin has significant potential to offer financial benefits.

Two main catalysts for Bitcoin rally, according to Tom Lee

Lee stated that the first factor would be a spot Bitcoin ETF authorized in the US. He suggests that such a confirmation could have a significant impact on Bitcoin’s market cap. According to his analysis, the multiplier effect could be as high as four to one. So each dollar of entry into the ETF will result in a $4 change in Bitcoin’s market value. In other words, a request for $100 billion or $200 billion through the ETF could potentially translate into an $800 billion increase in Bitcoin’s market value.

As another catalyst, Lee highlights the organic growth power of Bitcoin along with the ETF. cryptocoin.comThe Santiment reports, which we quoted as ETF news, showed that the June rally was effective.

Jason Pizzino sees impending volatility

Elsewhere, in a recent Youtube post, Jason Pizzino claimed that the Bitcoin market is poised for a significant burst of volatility in the near future. Specifically, he emphasized that the macro price action for Bitcoin is currently following an uptrend channel. It also showed that a bullish breakout is imminent despite the possibility of a short-term correction.

Pizzino also observed that for his market to continue to recover, the stock market must experience a correction after its upswing in the past few months. In addition, the analyst emphasized that institutional money plays a crucial role in driving the crypto price action, especially after the recent Bitcoin ETF craze.

From a short-term perspective, Pizzino remains optimistic about Bitcoin’s price trajectory as increased demand appears to support the cryptocurrency above the critical $20,000 level. While there are concerns that demand for BTC could drop below 50 percent, the analyst does not anticipate that the price will drop below $20,000 under current market conditions.

Bitcoin stock market entry suddenly spikes

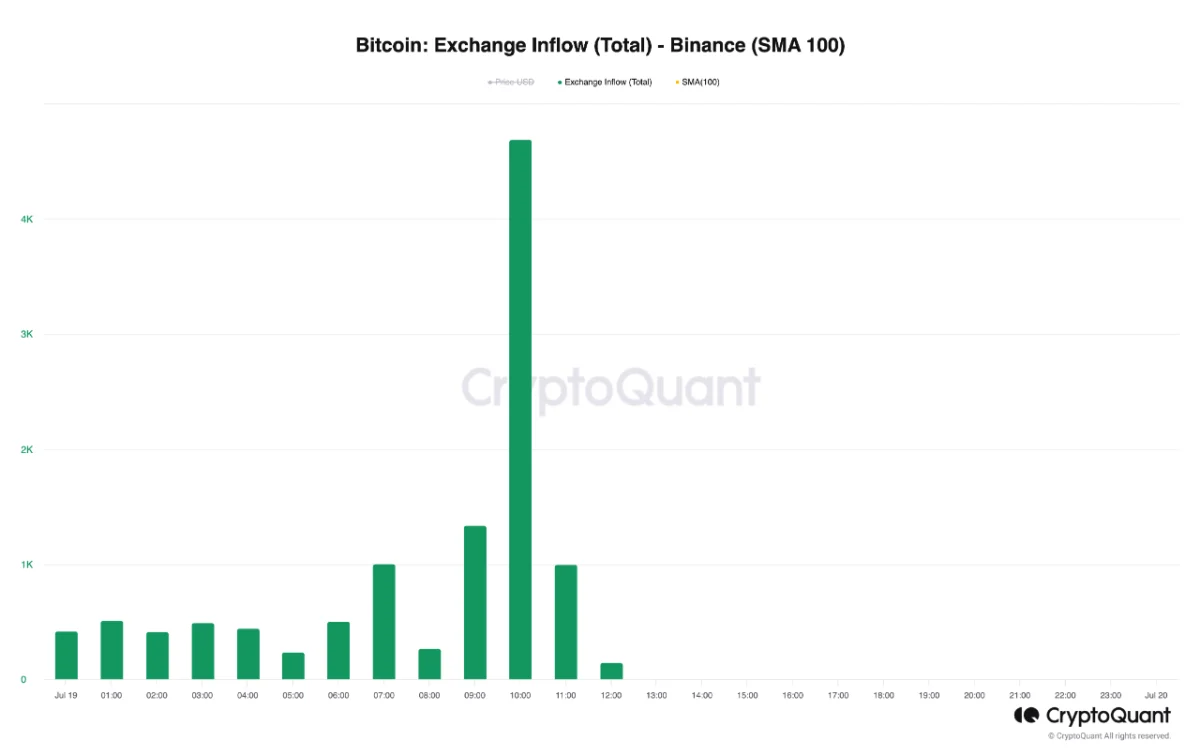

High bar expectations are on the air, and it is very important how much whale and individual investors will support this. Current CryptoQuant reports suggest a whale is opposing this trend. Accordingly, a huge whale deposited a large amount of money on Binance. The relevant indicator here is the “stock market entry”, which measures the total amount of Bitcoin that investors send to a particular centralized exchange.

As the chart above shows, Bitcoin stock market entry for Binance has seen quite a surge in the past day. With this deposit, approximately 4,451 BTC (worth $ 133 million) entered the wallets of the platform. However, as another metric explains, deposits are meant for the derivatives side of the exchange, not the spot platform.

“This large category of wallets is rarely moved directly to derivatives exchanges,” says one CryptoQuant analyst, given that the size of the wallet in question is in the 10,000+ BTC range, the largest class of whales on the network.