Leading cryptocurrency analysts made 6 critical predictions for the leading cryptocurrency Bitcoin (BTC)! Here are the details…

Bitcoin (BTC) may drop to the level of 23 thousand dollars!

Bitcoin (BTC) price dropped below the neckline of the head and shoulders pattern on May 11, confirming the completion of the pattern, signaling a strong decline, according to an analysis by crypto analysts. Although the price recovered the next day with a pin bar with a very long lower wick, it was again rejected by the neckline (red arrows) on May 15 and May 18. This is a bearish signal pointing to strong selling pressure at higher levels. Therefore, BTC seems poised to drop towards its target of $23,300 calculated by projecting the height of the pattern to the breakout point. This target is also aligned with long-term rising support, so it is likely to provide a bounce when reached. The daily RSI indicator supports the possibility of further declines as it moves down with a descending resistance line and sits below 50.

On the other hand, BTC has formed a bearish structure on its daily price chart, which indicates that the mainstream is in a bearish trend. BTC price formed a bullish pin bar on May 17 (blue ellipse) and regained the horizontal support area at $27,100, providing hope for a rally to the short-term descending resistance line of $28,500 before continuing the downtrend. However, BTC price created a bullish pin bar candle on May 17 (green ellipse) and regained the horizontal support at $27,100, giving hope for a rally to the short-term descending resistance line of $28,500 before continuing the downtrend. However, the price fell sharply the next day and breached the pin bar candle low at $26,548 (dashed blue line), eliminating the potential for a recovery. It is currently in the process of confirming the $27,100 level as resistance once again. If successful, a strong decline can occur.

Michael Van de Poppe pointed to the rise!

Popular cryptocurrency analyst Michael van de Poppe told his 657,000 Twitter followers that he expects BTC to retest the 200-week moving average (MA) as support. According to Van de Poppe, a successful retest of the key technical indicator may indicate the end of the Bitcoin correction. The words of the famous analyst are as follows:

Going back in history, retesting the 200-week MA is a great time to save. Over the past six months, Bitcoin has been trading at low levels for an extended period of time, making it the lowest value since its existence.

Make it or break it next week. Fast break upwards -> end of correction.

Furthermore, van de Poppe says that the recovery of a significant support level in the lower timeframe could ignite the bullish momentum for BTC. If that doesn’t happen, Bitcoin could drop as low as $26,000 before a jump takes place. However, the expert name points to the classic fluctuating formation for Bitcoin, stating that for a continuous momentum in BTC, it should break $ 27,200 and turn it.

Michael J. Kramer predicts a potential drop below $20,000!

Another prediction for Bitcoin came from Michael J. Kramer, one of the well-known analysts of the cryptocurrency market. Kramer expressed his concerns about the possible price drop of Bitcoin and underlined that Bitcoin is an important leading indicator for risk assets in general. He predicted a potential drop below the $20,000 level for BTC and stated that he believes this will have negative implications for the stock market.

In light of these developments, Kramer predicts a significant collapse as Bitcoin struggles to surpass the $27,000 level. The tremors in the Bitcoin market coincided with the pigeon comments from US Federal Reserve Chairman Jerome Powell. Powell hinted at the possibility of the central bank easing a series of rate hikes due to troubles in the banking sector. Such an environment of relaxed monetary policy and low interest rates has historically been favorable for risky assets like the crypto king, according to the expert name. However, the current trend indicates a marked deviation from this norm. The link between Bitcoin’s health and the performance of risk assets underscores the interconnectedness of cryptocurrency and traditional markets. The chart shared by Kramer signals an uncertain future not only for Bitcoin, but also for risk assets whose performance could potentially impact.

Nicholas Merten draws attention to the level of 12 thousand dollars for BTC!

On the other hand, analyst Nicholas Merten conveyed his analysis that Bitcoin will fall further in his statements to his 511,000 subscribers. The expert points to $12,000 for BTC, saying, “We are getting very close to the turning point where the price of Bitcoin may set for a short period of time, where we will get a turn on the weekly timeframe on our key momentum indicator.” in his words.

On the other hand, Merten emphasizes that although BTC has historically been associated with technology stocks, it is now lagging behind. According to the crypto analyst, the price of BTC is falling while tech stocks like Microsoft and Nvidia are on the rise. The words of the expert are as follows:

Bitcoin has certainly made some good moves in the last few months. However, the question you have to ask yourself is whether this will continue. Even if you bought it in November or are considering buying it now, ask yourself: Will Bitcoin still be the leading horse in the race? Because what we’ve seen over the past few months is very similar to what we’ve seen in price action, the same range that was previously used as support in the last bull market is acting as resistance as it was here in May. We didn’t even get to the upper band around $32,000 – $33,000, which many people set as their exit target. People tend to set their expectations too high, constantly change their goals, and in the end they fail to make a profit and are caught.

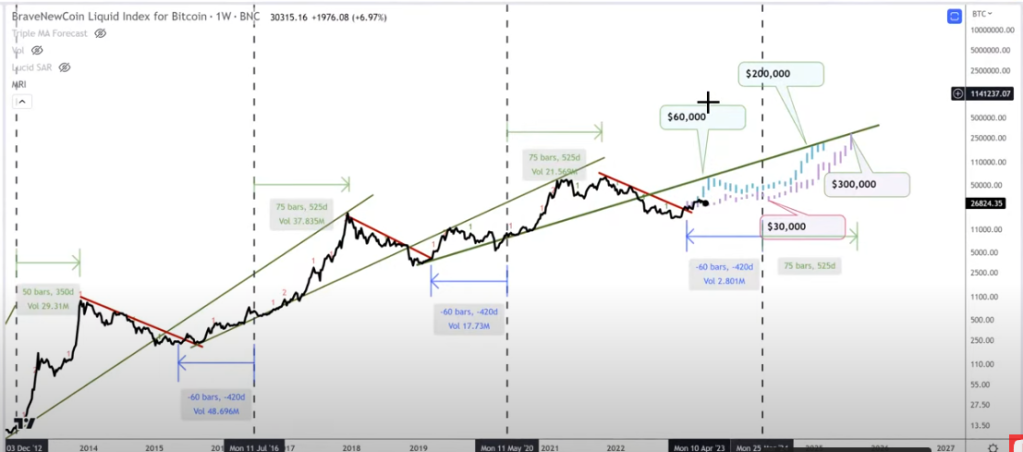

Tone Vays: Bitcoin could rise to $34,000 in the short term

Another BTC prediction is Tone Vays. Tone Vays suggests that BTC is preparing for a long bull cycle. In a new analysis, Vays addresses his 123,000 subscribers, saying that BTC’s current consolidation is a sign that BTC is likely on a path to an expanded bull market. As you may recall, Tone Vays announced his year-end estimates for BTC as $60 thousand in March, while he stated that it could reach $200 thousand in 2025. According to Vays, BTC can instantly rise to $ 300 thousand. Vays’ words are as follows:

We continue to consolidate. It continues to be frustrating. I am a Bitcoin user and it is very, very clear that the leading crypto has chosen the purple path. I have two ways for bitcoin. One is a little higher with a lower high ($200,000), and the other is a little more bearish over time with a slightly lower high ($300,000).

On the other hand, in his views on BTC, Vays points to $34,000 for BTC by the end of the year, and the probability of a random upside swing straight to $34,000 is much higher than a random downside crash where we hit $22,000.” in his words and quotes the following words:

We’re sitting here at $27,000, so $34,000 is easier to come by. I think plus $7,000 is much more likely than $5,000 down from here. I just think the down side is very limited.

Santiment data says bullish for Bitcoin

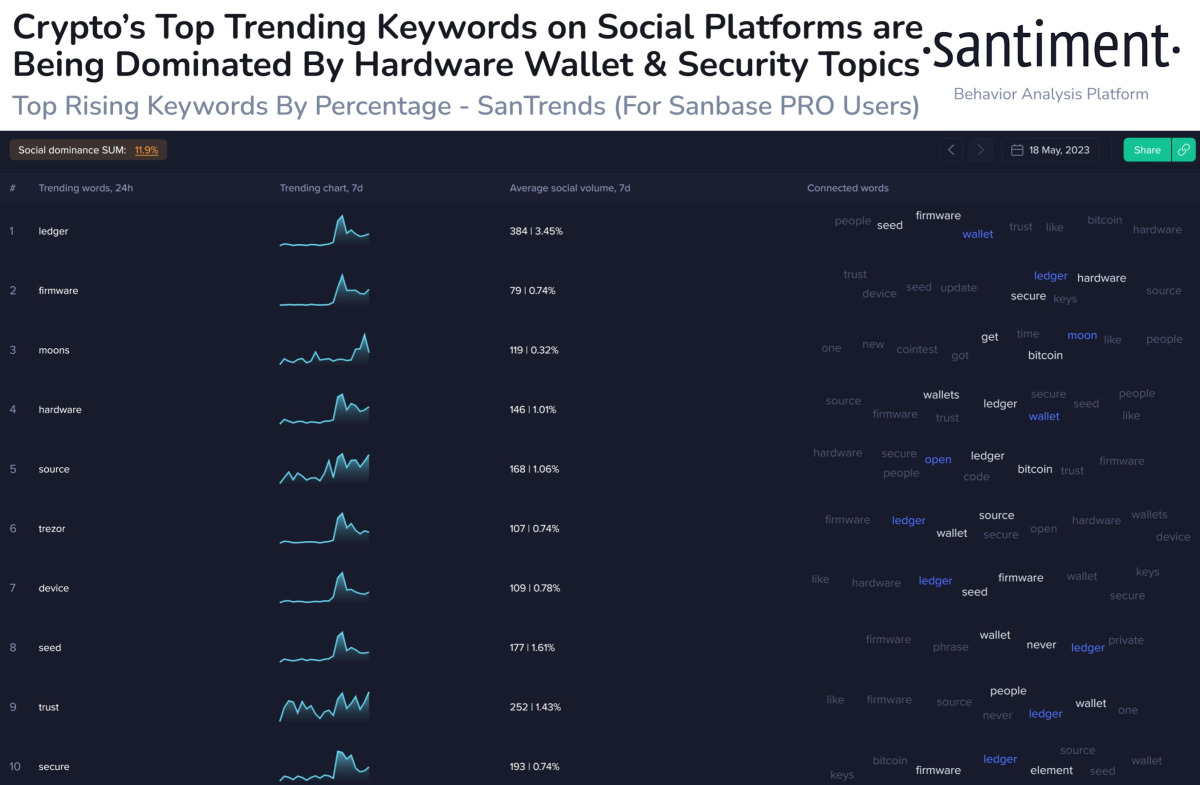

Blockchain analytics platform Santiment says one key metric is bullish for Bitcoin (BTC) as it happened in November 2022. Based on trending crypto terms, Santiment says the level of fear in the digital assets space is similar to the time after FTX crashed last year, proving that it was a market bottom at the time. Santiment’s words are as follows:

One of the main signs of fear is that almost all of the top trending crypto keywords are related to hardware wallets and security. We saw similar security concerns from investors in November after the collapse of FTX. This signaled that the market had bottomed out.

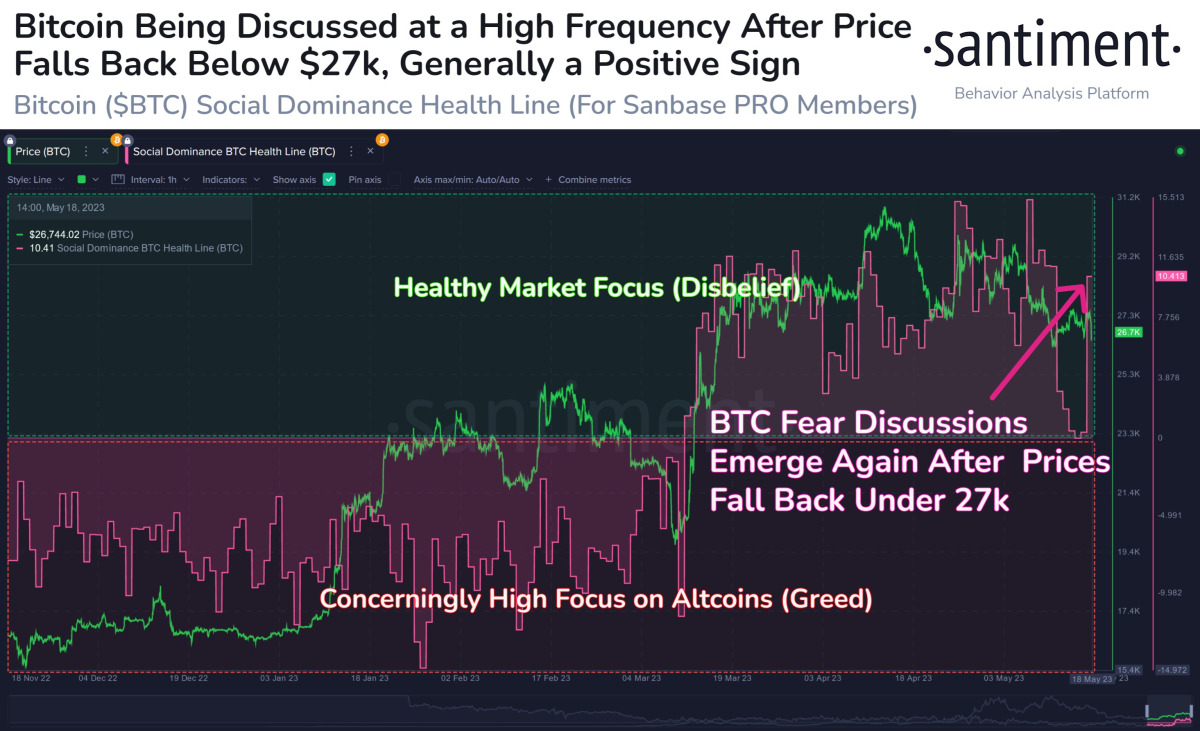

Santiment also stated that while the price of Bitcoin has recently dropped to the level of $26,000, the amount of conversation about the leading crypto on social media has increased, which is another signal that BTC may bounce off in the near term.

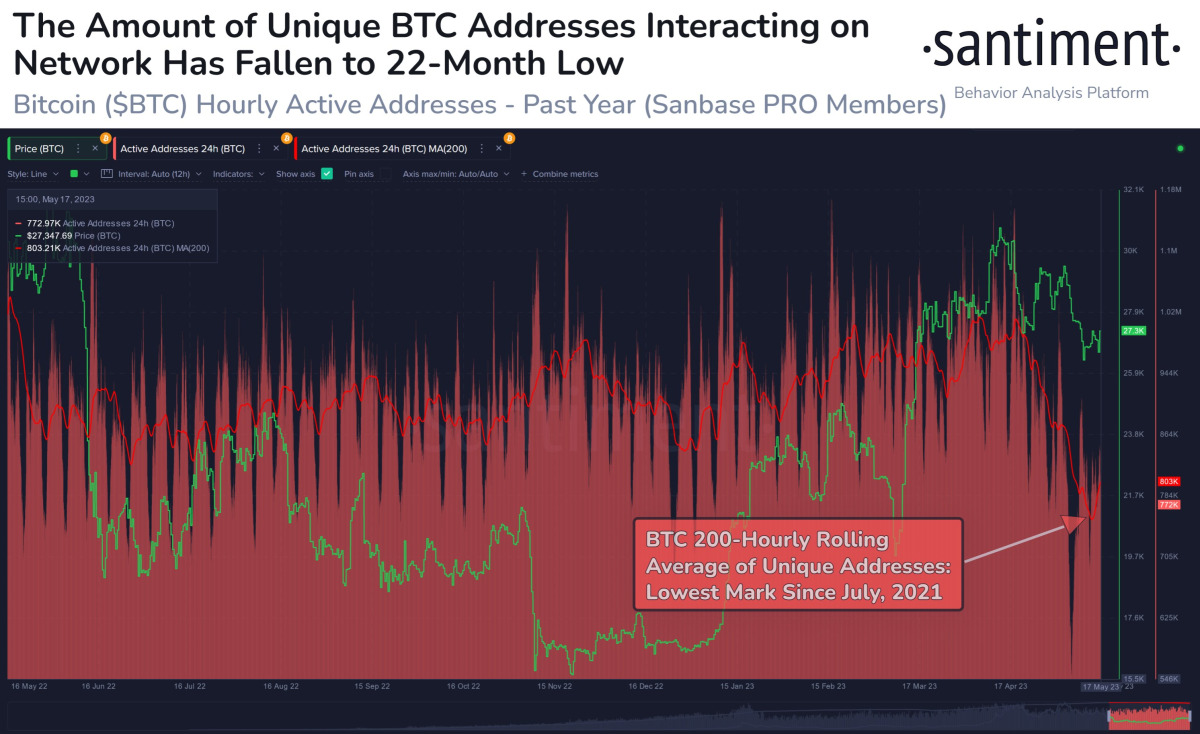

Finally, Santiment says that leading crypto Bitcoin transactions last dropped to the lowest level seen 22 months ago in July 2021, when Bitcoin bottomed around $29,000 before hitting an all-time high of around $69,000.