We have prepared 6 different Bitcoin predictions. Let’s see what levels analysts have marked this week. Let’s examine it in details.

Bitcoin approach by Todd Horwitz

BubbaTrading.com’s Chief Market Strategist Todd Horwitz made important statements. He recently voiced his criticisms of the US fiat monetary system. He also described this system as fraudulent. However, he sees potential in Bitcoin being included as an important asset to support the US dollar.

In a fascinating interview, the discussion centered around Bitcoin’s (BTC) role as both a currency and a commodity to support the US dollar. The idea started to gain traction when 2024 presidential candidate Robert Kennedy Jr. advocated backing the dollar with fixed assets such as gold, silver, platinum and Bitcoin. Kennedy points out that this move will stabilize the economy. He also believes it will curb inflation and usher in a new era of American financial stability and prosperity.

Bitcoin prediction

Horwitz acknowledges the potential benefits of backing the dollar with fixed assets. However, it called for a benchmark for determining the value of the currency relative to the basket of commodities. The feasibility of backing the US dollar with gold, silver or other commodities has been debated. On the other hand, Horwitz pointed out the original gold support. But he acknowledges the difficulty of determining the ideal ratio for support.

The interview also touched upon the inclusion of Bitcoin in the fixed assets basket proposed by Robert Kennedy. Horwitz states that he sees Bitcoin as a currency of the libertarian movement. He also expressed his appreciation for the increasing recognition by regulatory bodies such as the CFTC. Horwitz believes that Bitcoin could be a strong candidate for inclusion in the basket of assets that will support the US dollar.

Switching to Bitcoin’s price outlook, Horwitz expressed his optimism. Horwitz states that the next indicative price will come to $35,000 in the next six months. On the other hand, he predicted an upward trajectory, expecting it to reach $40,000.

After months of consolidation and uncertainty, a different situation emerges. Accordingly, Bitcoin (BTC) is showing signs of an upside momentum, leading to market optimism. Market analysts are calling for bullishness with the possibility of new highs if certain key levels are breached.

Bitcoin prediction from Michael van de Poppe

The leading cryptocurrency continues to trade above the $29,800 level. On the other hand, market analyst Michael van de Poppe predicts that new highs may be on the way for Bitcoin. A break of the resistance level at $31,000 will be a major catalyst for more gains.

John E Deaton: Bitcoin could rise 10x

John E Deaton, a lawyer representing XRP holders, continues his explanations. He states that in the past days, Bitcoin may experience a tenfold increase. Accordingly, he inflamed the discussions by claiming that he could reach an impressive figure of $ 300,000. This remains a speculative claim. However, the tweet sparked controversy among Deaton’s more than 276,000 followers on Twitter.

Bitcoin prediction from optimistic analyst

Bitcoin’s price movements have caught the attention of an optimistic analyst who highlighted the cryptocurrency’s six-year range within an ascending channel. Despite occasional fluctuations, the structure remains intact. Also, recent moves point to a potential bullish scenario.

Bitcoin’s price chart states that BTC has been trading within an ascending channel over the years. It also reveals that it covers its volatility. It is important that it is currently trading near the support trendline. Also, there is rejection of lower lows and bounce back from that level. All this points to a bullish sentiment that is putting the bulls back in contention.

$175,000 estimate

His assessment suggests that a break above the upper resistance level near $32,000 could trigger a new bull run. It also shows that the ascending channel could push Bitcoin to retest its impressive highs of $175,000.

Given the volatility of crypto, such a forecast cannot be ignored. However, past bull runs have shown dramatic price increases. On the other hand, it made this possibility interesting.

Bitcoin prediction from Mark Yusko

Mark Yusko, CEO of Morgan Creek Digital, continues to advocate Bitcoin’s rise. He also confidently predicts that the cryptocurrency could reach a remarkable value of $300,000. In a recent podcast show, Yusko expressed his unwavering optimism about Bitcoin’s potential to reach new heights and potentially rival gold’s market cap.

Bitcoin versus gold: A digital safe haven

Yusko compares Bitcoin and gold. Accordingly, he highlighted gold’s traditional role as a safe-haven asset for investors looking to protect their wealth during economic uncertainties. Yusko believes that Bitcoin can serve a similar purpose in the digital age. If Bitcoin gains widespread trust and adoption, its market cap could rival that of gold.

While the total market value of gold is estimated at around $12 trillion, Yusko points out that only about half of this value is used for monetary purposes. He also points out that the rest is devoted to non-monetary applications such as jewelry. He states that the market cap of Bitcoin will reach around $6 trillion. On the other hand, he predicts that this will lead to a significant price increase and potentially reach the target of $300,000.

New prediction from Willy Woo

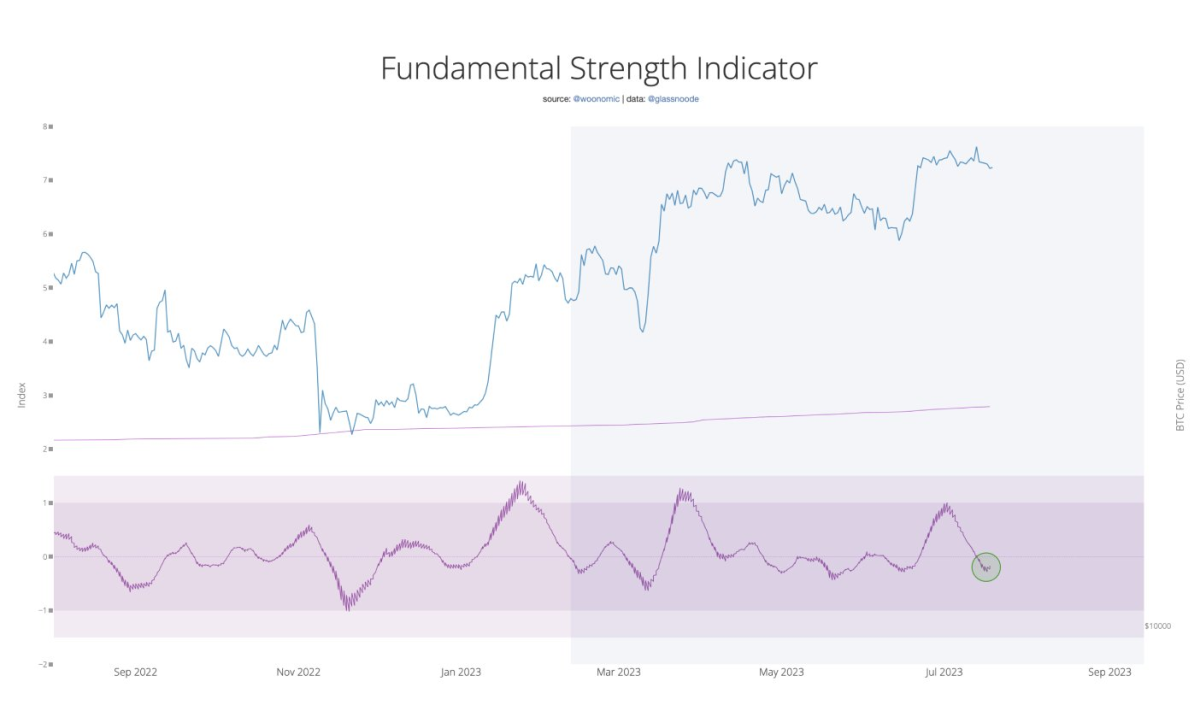

Bitcoin (BTC) enthusiasts have reason to be excited. Because, widely followed chain analyst Willy Woo states that the crypto king is on the verge of a significant bullish boom. Woo, who has more than a million Twitter followers, states that Bitcoin’s fundamental strength indicator (FSI) is sending a bullish signal. Accordingly, he shares that he suggests that the reaccumulation phase is almost complete.

FSI Gives Positive Signal

Woo’s FSI is a unique metric that tracks the strength of 17 fundamental and technical indicators. According to the on-chain analyst, the FSI chart reveals early signs that BTC consolidation is nearing completion. Increasing futures demand amid sideways price movements is considered a bullish signal, signaling the potential for greater action.

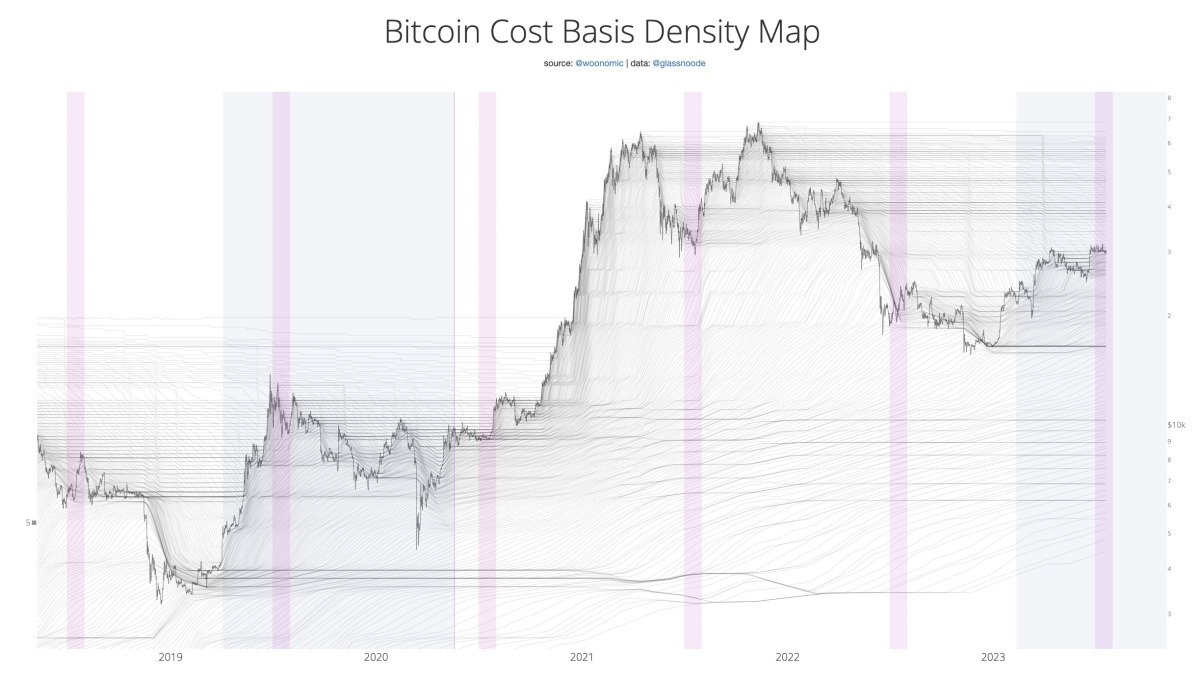

As part of his analysis, Woo examines Bitcoin’s cost basis density map, which tracks price levels at which buyers tend to accumulate BTC. The chart shows multiple support levels for Bitcoin stretching all the way up to $25,000. cryptocoin.com When we look at it from the side, the dense areas on the chart point to strong investor validation through buying and long-term holdings, creating solid price support. Many in the cryptocurrency community are eagerly awaiting a potential upside surge.