Bitcoin (BTC) is holding steady throughout August 12, while price action is stuck in a tight range. Famous traders expect to take positions at critical levels during the weekend volatility.

Bitcoin bottoms out despite ‘surprising’ price action

Data from TradingView followed a sideways Bitcoin environment as the weekend began. BTC price remained at $29,500, a key battleground between bulls and bears, after showing only quiet reactions to US macroeconomic data pressures.

Popular trader Daan Crypto shared in part of his latest analysis that the closing price of the CME Bitcoin futures markets was $29,465. “I expect another classic weekend volatility around the CME closing price,” he wrote in his analysis.

“I will be a buyer at $28.2,000”

Meanwhile, the lack of activity during the week has drawn the attention of a large staff of analysts, including Michaël van de Poppe. Poppe summed up the day as “extremely surprising price action in Bitcoin lately.” According to the analyst:

I still support the upward momentum coming in and I think we’ve hit the bottom + we’re not getting that heavy correction. But if we lose $29,000, I will be a buyer at $28,2,000. Flip $29.7k = party time.

Poppe also believes that Bitcoin’s dominance (BTC.D) will take a hit next month. His predictions are based on technical analysis of the daily Bitcoin chart, which reveals that Bitcoin is currently consolidating.

According to the analyst, a rally in Bitcoin price depends on testing and exceeding resistance areas. As of now, $29,800 has emerged as a key resistance area. BTC will need to break through this level to gain momentum and become bullish. He added that BTC has been climbing higher over the past few days, signaling an impending rally.

Poppe is confident that the Bitcoin price will make at least one major move ahead of the halving.

The next Bitcoin halving will take place in April next year. After analyzing the total crypto market capitalization chart, Van de Poppe predicted that the momentum would not break as long as it remains above $1 trillion. However, if it exceeds $1.26 trillion, the total crypto market cap could reach up to $2.2 trillion in the next bull run. The crypto analyst added that this rally could happen before Bitcoin’s halving in April 2024.

Bitcoin whales take long positions

Maartunn, one of the CryptoQuant analysts who researches exchanges, examined the long positions that emerged from Bitcoin whales. In their analysis, “Another great long position; this time Deribit,” she informed.

Another massive long position; this time on #Deribithttps://t.co/yypUpVraIM https://t.co/rztixskt4a pic.twitter.com/AIlG6kwwey

— Maartunn (@JA_Maartun) August 12, 2023

“Take the bottom, sell at the jump”

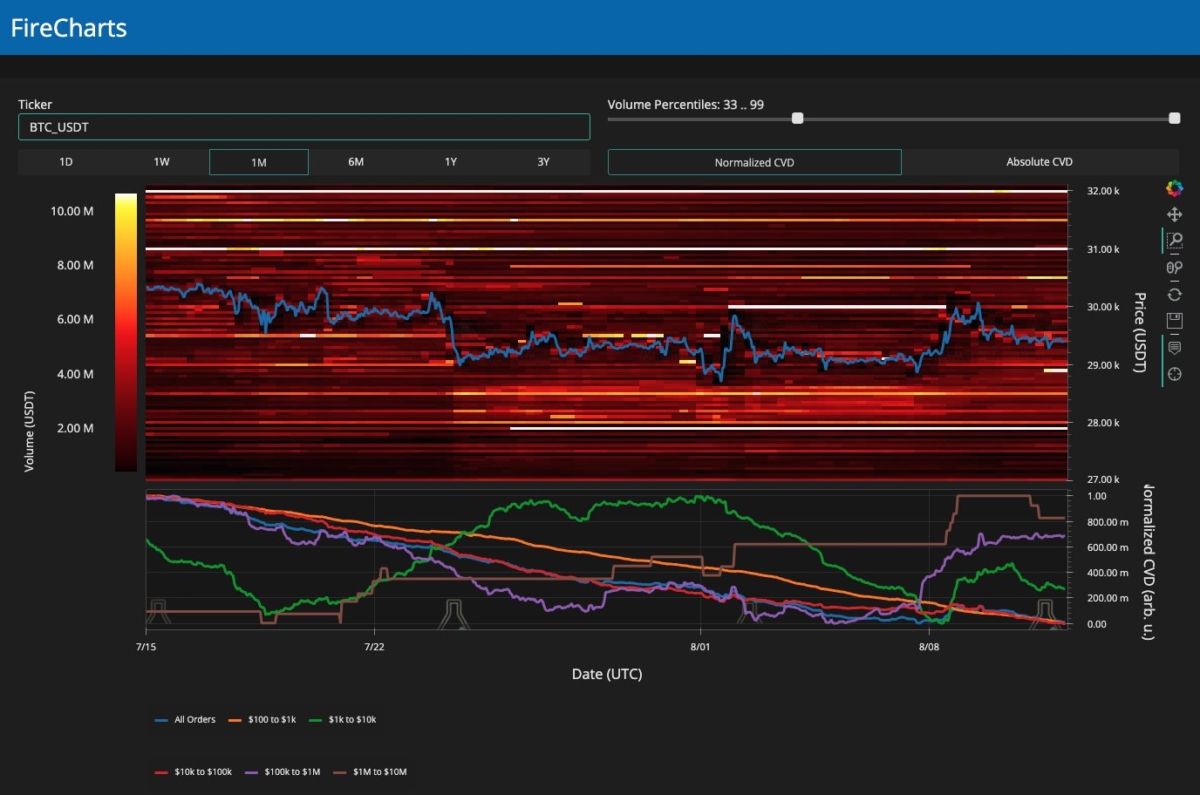

However, Material Indicators reports that the Binance BTC/USD order book signals that the range-bound status quo is likely to continue:

As we get closer to the Weekly Close/Open, the volatility may start to move. It still feels like “buy the bottom, sell at the bounce” conditions apply.

Bitcoin price closes to ‘squeezing history’

By analyzing the lack of volatility in Bitcoin, the trader community decided that an equally strong trend reversal should result. “Bitcoin is approaching historic 3-week compression levels above the 20 MA,” writes TechDev, referring to the 20-period moving average on three-week timeframes.

An accompanying chart shows BTC price behavior after similar episodes in the past. These were only four since the early days of Bitcoin. Analyst Credible Crypto explains, “Historical compression leads to historical expansion… Imagine looking at this graph and thinking, ‘yes, 10k is coming.’ It is a ticking time bomb until the extinction of the bears,” he summarized.

There are hot developments on the US side

Finally, Bitcoin proponent US Senator Cynthia Lummis took a pro-crypto stance in the SEC-Coinbase lawsuit. Lummis submitted his petition to the court today to dismiss the case. The US Senator argues that the Coinbase case is far from an investment case.