Bitcoin is trading about 70 percent below the record level it saw about 9 months ago. Some analysts think that we see the bottom of the largest cryptocurrency around $ 19,000. Some argue that the bottom level has not been seen yet. In this article, we will share the latest BTC comments made by analysts. Here are the details…

Has the bottom level been seen for Bitcoin?

cryptocoin.com As we have also reported, Bitcoin, the best cryptocurrency by market value, managed to reach $ 20,440. Former BitMEX CEO Arthur Hayes suggested that the recent price surge could mark the bottom of the recent correction. Last week, the largest cryptocurrency recorded its worst quarter in more than a decade. It lost more than half of its value this quarter. While many technical signals suggest that the cryptocurrency has reached the end of this correction, there are analysts who are unsure about it.

Ross Mayfield, an investment strategy analyst at US-based multinational independent financial services firm Baird, recently told Bloomberg that the price of Bitcoin could potentially drop even further. He explains that the largest cryptocurrency is currently dealing with a “challenging environment.”

Ark Investment analyst: BTC may continue to suffer

In a recent Twitter post, Ark Invest analyst Yassine Elmandjra pointed to the possibility that the US Federal Reserve will continue to raise interest rates despite mounting recession fears. In such a case, the price of the largest cryptocurrency will likely fall even further. Unrealized net losses (NUPL), which fell 17 percent below the total cost base, also suggest that Bitcoin may be subject to another correction. According to Elmadjra, NUPL has dropped to about 25 percent near the lows of previous market cycles.

However, it fell below its 200-week moving average (WMA) on a short- and long-term cost basis for the first time in Bitcoin history. According to Elmadjra, this indicates that another “bottom” of the crypto king may be seen near. Elmandjra’s view that FED rates are hurting BTC was echoed by Mayfield, who claimed that the central bank’s monetary policy could further dampen investors’ appetite for risky assets.

TechDev: There is a long-term rally taking Bitcoin to high prices

Meanwhile, despite a relentless downtrend, the closely-followed crypto analyst TechDev says Bitcoin could be on track for a long-term rally that takes BTC to exponentially higher prices. According to TechDev, Bitcoin is down massively from its all-time high of $69,000. However, BTC could be retesting support in a multi-year period up to the $400,000 range in the next few years.

Glassnode analysts: High backlog

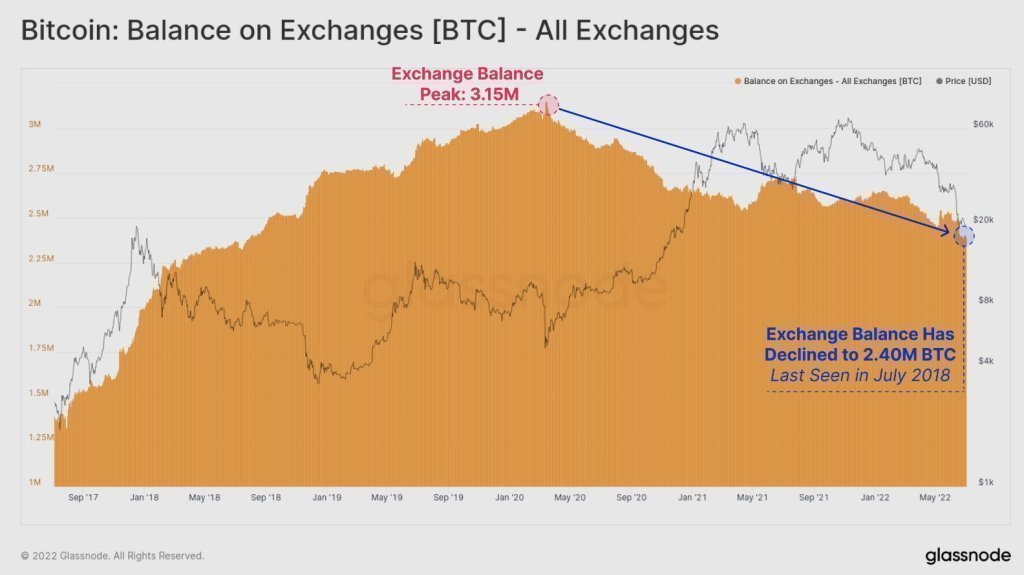

On-chain data provider Glassnode noted that US inflation forecasts remain high with potential recession expectations floating around. He said the market remains largely at risk. It is also reflected in Bitcoin’s on-chain performance and network efficiency. Bitcoin price correction shows striking similarities to previous bear market lows in 2018 and 2020. But as of now, there is not enough catalyst for Bitcoin price reversal.

In its report, Glassnode states that despite the price correction, there is still a high rate of accumulation and retention. Stock market balances are falling at unprecedented rates. On the other hand, “shrimp and whale balances” in Bitcoin are increasing significantly. Meanwhile, former venture capitalist and crypto enthusiast Brett Munster pointed out that Bitcoin adoption remains strong despite the price drop that sets this cycle apart from 2018.