The crypto space has been hit hard after the collapse of crypto-friendly bank Silvergate. For the first time in four months, Bitcoin experienced one of the biggest single-day drops of around $1,200. However, the downtrend seems to be over for now as the price is currently trading sideways near the newly gained $22,300 levels.

“The current decline will continue and then the price will recover!”

According to senior technical analyst Jim Wyckoff, the Friday morning drop in Bitcoin caused Bitcoin futures prices for March to drop to a ‘three-week low’ in early US trading. The analyst says the bulls are losing their short-term overall technical advantage as a price rise is rejected on the daily chart. “Prices are currently in an incipient downtrend and the bears have gained some momentum,” Wyckoff warns.

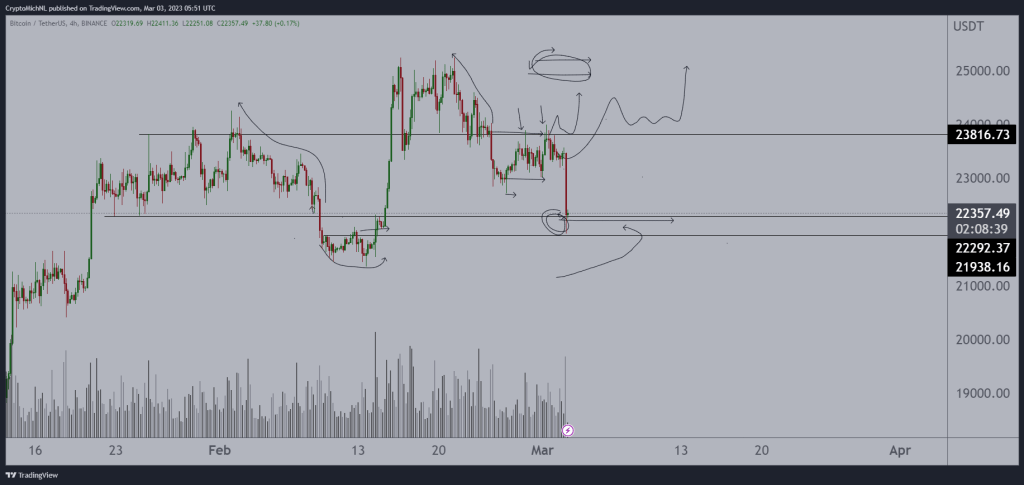

Crypto analyst Crypto Tony shared the following tweet highlighting the support/resistance level at $22,300, his prediction of the BTC price level that the bears are currently watching closely.

$22,300 is the level this weekend for the bears. Flip that into resistance and we are continuing the short fiasco

pic.twitter.com/ooo4RrphTP

— Crypto Tony (@CryptoTony__) March 3, 2023

A more positive take on a similar scenario came from crypto analyst Pentoshi, who posted the chart below outlining the continuation of the current decline and subsequent price recovery.

I'd love to see this

and would be wanting to play it for a bounce pic.twitter.com/oQLzyecJyy

— Pentoshi

(@Pentosh1) March 3, 2023

Popular analyst updates his Bitcoin outlook

Michaël van de Poppe, a widely followed crypto analyst who predicted Bitcoin’s recent decline, says he is now bullish on BTC. The analyst says it’s time to jump into the markets. In this context, the analyst makes the following statement:

All the downsides to Mt. Gox, Ethereum Shanghai, as well as Silvergate, it’s time to start buying. Average dollar cost to markets. Like you do when the markets are bloody as hell.

The analyst reiterates his view with two different approaches to how traders should view the current markets, and explains his views on this issue as follows:

There are tons of fears in the markets. Just take it and wait. It’s that simple… People were so eager to buy crypto two weeks ago. People are now very eager to sell their crypto. Reverse this psychology.

With BTC worth $22,440 at the time of writing, the analyst says he expects the leading crypto to drop to this level before buying it again. It records the following:

That’s why I was waiting for long-term purchases with Bitcoin. We wanted to see a clear break of $23,800 that we weren’t able to get. Then, I wait for the $22,300 field that is currently hit and filled.

Source: Michaël van de Poppe/Twitter

Source: Michaël van de Poppe/TwitterBitcoin (BTC) trading strategy for the next few months

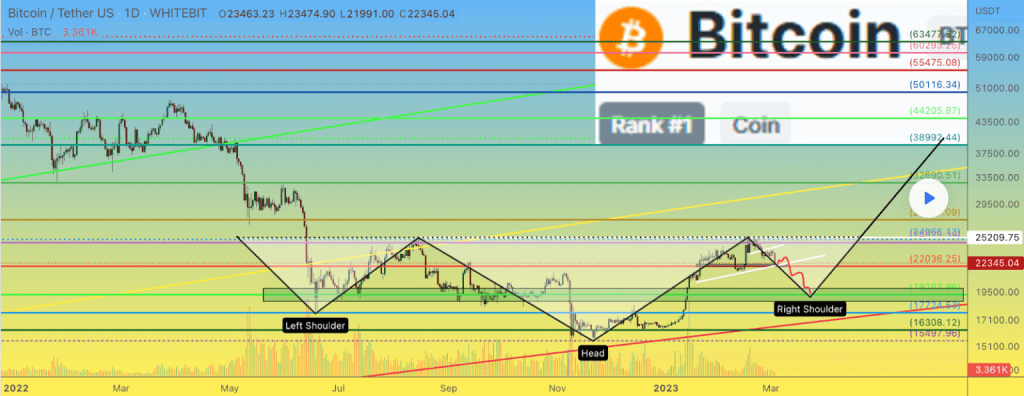

Crypto analyst Sahana Vibhute shares her trading strategy for Bitcoin. BTC price seems to be stuck in tight ranges at the moment, but it could bounce back for a long time to reach higher targets in the coming months. Bitcoin has been trading in fixed wave patterns for a long time and could bottom out if the pattern continues. Once the price tests the lower support, a catapult move could push the price higher near the required target of around $50,000 shortly thereafter.

Source: Tradingview

Source: TradingviewBTC price has hit previous highs again and is facing rejection. Although the price continues to consolidate, it shows the possibility of a rise in the coming days. A global reversal of the BTC price chart can be assumed due to the ‘Reverse head and shoulders’ pattern. CPI, Fed rate etc. March is expected to be extremely volatile due to multiple macroeconomic indicators such as Also, more than 140,000 BTC could enter the markets. Therefore, the middle target for Bitcoin price is around $40,000 to $42,000, which is expected to happen sooner or later.

It is also believed that the BTC price is witnessing extreme pressure that could apply to the entire crypto space if a small group of traders want to take profits. This could intensify the prospect of potential growth that could soon mark new highs in the coming years.

“If Binance fails, BTC could drop to $13,000!”

cryptocoin.com As you follow, Bitcoin has experienced a significant decline recently. This led analysts to sound the alarm bells about what could happen in the near future. According to financial analyst Jared Blikre, Bitcoin’s price could drop to $13,000 if a major event occurs. Blikre warns that the recent collapse of major trading platform Binance could be a ‘black swan’ event that could trigger a significant drop in the cryptocurrency market. This causes the value of Bitcoin to fall sharply, leading to losses for investors who invest their money in this cryptocurrency.

$BTC prices hover above $22,000 as fears surrounding $SI earnings begin to sink into the crypto space.

“When you have leverage built up in a system such as crypto, it can take a long time to deflate that,” @SPYJared says on recent crypto shakeups. pic.twitter.com/9MWlgjsc54

— Yahoo Finance (@YahooFinance) March 3, 2023

Blikre notes that the recent drop in Bitcoin’s value is the biggest red candlestick in more than two weeks, which could signal that the cryptocurrency is about to experience a significant drop. One reason analysts are so worried about the future of Bitcoin is that long positions have been liquidated by futures traders recently. According to reports, more than $203 million of long positions have been liquidated in the last 24 hours and more than 96% of all positions have been closed.