Bitcoin has remained dormant amid suggestions that US interest rates will continue to rise. However, Data showed BTC/USD hovering just above $27,000. So what’s next? While several analysts predicted a drop, Bloomberg analyst Mike McGlone pointed to the possibility of $7,000. Here are the details…

What does the latest analysis show for Bitcoin (BTC)?

Despite the short-term fluctuations in stocks, Bitcoin is firmly stuck in a range it first entered 10 days ago. According to market commentators, there remains a danger of a breakout with a potential retest of key trend lines such as the 200-week moving average (MA), or worse. Monitoring resource Material Indicators said, “This relentless sideways dip is boring and presents some challenges for traders, but I think it’s a healthy consolidation. The longer this situation lasts, the stronger this zone becomes as a current and future resistance/support flip zone,” he said.

Analyzing the bearish scenarios, Material Indicators added that the MAs can create a resistance/support (R/S) flip area on their own, creating problems for the bulls. “If the 100-Day MA continues to hold, this becomes a very strong support. But if the 200-Week MA is broken, it will probably be very difficult to climb back to this level.” At the time of writing, the 100-day and 200-week MA were at $26.530 and $26,280, respectively. An accompanying print of the BTC/USD order book on the largest global exchange Binance showed the bid liquidity underlying the $26,000 mark.

How can the status quo change?

Popular trader Dann Crypto Trades offered an alternative roadmap for how the status quo could change. He argued that “capitulation” could only come because of the longevity of the trading range. Speculators would sell in anticipation of a crash that would never happen. The analyst used the following statements:

The longer we lurk around this lower support range, the more I find myself doubting that this support continues even though the chart still looks excellent. This is mainly because any ‘support’ in 2022 will eventually capitulate after the price has sat above it for too long. I think much of the market is conditioned this way and it can cause a kind of ‘capitulation’ over time rather than price. What I mean by this is that people sell their positions to avoid potential collapse due to boredom or the expectation of a lower breakout.

Scary $7,000 forecast from Bloomberg analyst

On the other hand, Bloomberg Intelligence senior macro strategist Mike McGlone recently pointed to Bitcoin’s downtrend, highlighting the risks associated with the current price level. At the end of 2019, Bitcoin was worth around $7,000, but experienced a significant liquidity pump, which resulted in an increase in value. According to McGlone, this historical event points to the potential for a return to the mean. With Bitcoin hovering around $27,000, there are concerns that the cryptocurrency could face a downside correction.

McGlone says that BTC’s 52-week moving average shows a bearish bias compared to the upside volatility witnessed at the start of 2020. Despite returning from a low point in 2022 when it reached around $15,000, Bitcoin’s value rose to around $30,000 in April 2023, indicating a potentially overbought market.

That the #FederalReserve has kept hiking rates in 1H despite a bank run, plunging commodities and producer prices may portend deflation potential for risk assets. Peaking #Bitcoin and #copper vs. rallying #equitymarkets appears as an unsustainable trajectory. pic.twitter.com/deEhESQ62u

— Mike McGlone (@mikemcglone11) May 22, 2023

The boom and bust patterns influenced by Bitcoin’s massive injection or extraction of liquidity play an important role in shaping market sentiment. McGlone suggests that it is crucial to respect the downward sloping 52-week average when assessing Bitcoin’s future direction. The expert believes that the central bank’s determination could point to potential deflationary pressures on risk assets. McGlone notes that both the falling copper market and cryptocurrencies, of which Bitcoin is a leading example, seem to heed these warnings, contrasting with the resistance exhibited by the stock market.

Michael van de Poppe wants time for Bitcoin

Meanwhile, Michaël van de Poppe, founder and CEO of trading firm Eight, was one of those who asked for time on the lack of BTC price action. He argued that within a week at most, the “major” volatility would return. The macro scene of the day was the scene of a short-lived excitement as some media accounts shared footage of an explosion in the United States. The event, which soon turned out to be an artificial intelligence (AI)-generated fake, still managed to move the stock markets.

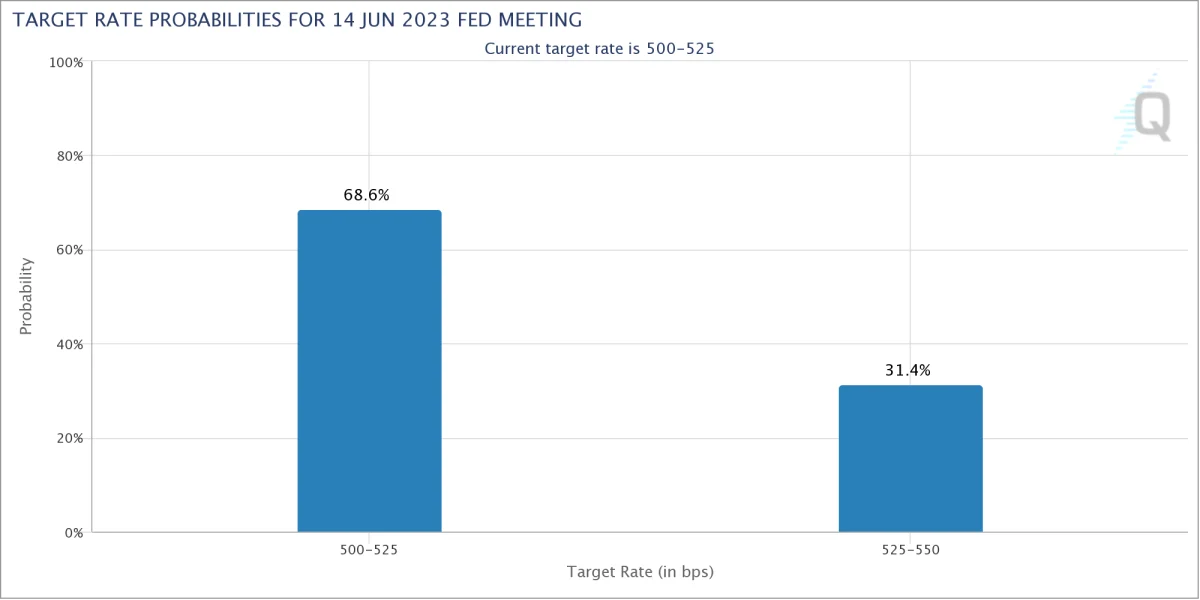

Meanwhile, as a potential blow to risk assets on the horizon, recent comments from the Fed have cast new doubt on a pause in rate hikes in June. Louisiana Fed President James Bullard predicted at least two more rate hikes this year. CME Group’s FedWatch tool lowered market expectations for a rate hike to 68 percent in June.