As gold prices broke the $1,650 level, the overwhelming majority of analysts fell on the precious metal. In this environment, the short-term outlook for gold remains bleak.

“Short-term techniques favor golden bears”

The precious metal is down nearly $90 from its October high of $1,737. December Comex gold futures fell to $1,648.70. For yellow metal, the technical drawing is also pretty bearish. Because sales open the door to $1,600. Senior analyst Jim Wyckoff evaluates the latest developments as follows:

Near-term techniques are bearish. Gold and silver bulls are confusing their metals as they fail to capture the safe-haven offer amid heightened geopolitical and market uncertainties.

“Yellow metal is still struggling!”

The main culprit making things tough for gold is hotter-than-expected inflation. Because it forces the market to reprice aggressive Federal Reserve rate hike expectations. This gives an additional boost to the US dollar. Marc Chandler, managing director of Bannockburn Global Forex, points out the following technical levels for gold:

Gold is still struggling. In the cash market, it has fallen in seven of the last eight sessions. Also, momentum indicators are showing a bearish trend. A break of $1,642 will likely signal a retest of $1,615. The most bullish development would be a move above $1,685. A close above $1,672 is likely to help stabilize the tone.

What do the gold survey results show?

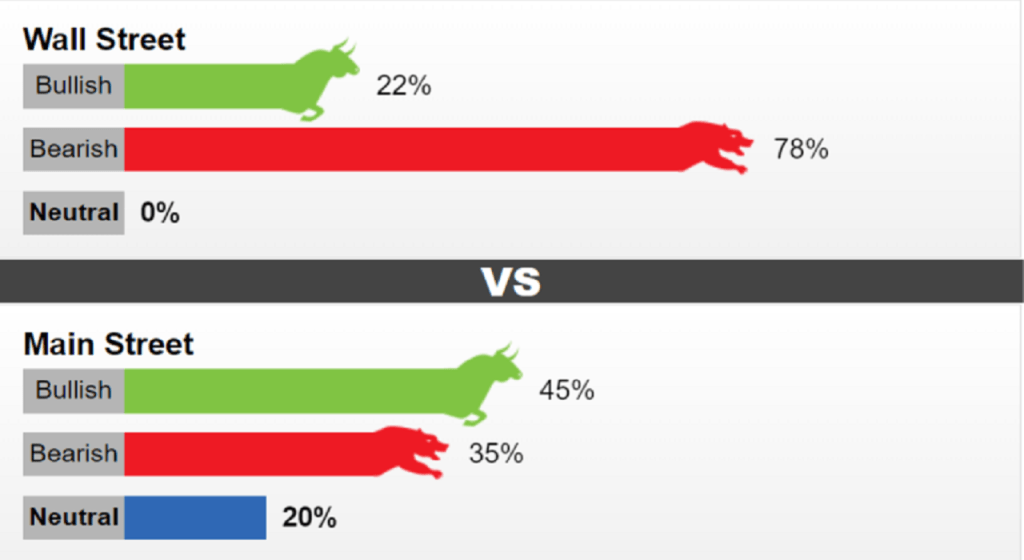

The results of the Kitco Weekly Gold Survey reveal that Wall Street is in a very low price for gold next week. Of the nine analysts surveyed, 78% say they expect lower prices next week. Only 22% report that they are in a bullish trend. There were no votes waiting for horizontal movement next week.

However, the main-street side continues to rise next week. However, there is growth in the bear segment. In the survey, 45% of the 858 individual respondents expect higher prices. 35% of respondents predict a lower move, while 20% prefer to remain neutral.

“The downtrend of gold is not over yet”

cryptocoin.com As you can follow, the US dollar settled near 20-year highs. Thus, the probability of a 75 basis point increase in November increased to 99.7%. Also, a 50 basis point increase in December is priced in with a 74% probability. According to the CME FedWatch Tool, there will likely be a series of smaller rate hikes in February and March as well. As long as this macro environment exists, gold seems to have more disadvantages. Darin Newsom, head of Darin Newsom Analysis, comments:

The short-term downtrend on the daily chart of December gold is not over. Target still stands around $1,645. It came close last week, with the contract dropping to $1,648.30. On the flip side, the technically medium-term trend of the US dollar index (DXY) continues to decline.

Even a few analysts who remain bullish in the short-term precious metal do not rule out a drop before the rally begins. Mark Leibovit, publisher of VR Metals/Resource Letters, has this to say:

I’m a bull in gold and silver. But I feel we will see March 2020 lows (at least in stocks).