The price of gold gained some positive momentum on Tuesday and moved away from a week-and-a-half low of around $1,981 the previous day. While gold has held on to modest intraday gains around the psychological mark of $2,000 during the first half of the European session, intraday bullish faith is lacking, according to market analyst Haresh Menghani. The analyst interprets the data and events that will affect gold and evaluates the technical appearance of gold.

Modest weakness in the US dollar a made for the price of gold

The US Dollar (USD) is under some selling pressure and for now seems to have stopped the recovery from the one-year low it saw last week, two days ago. This gives some support to the gold price in US Dollars. However, a combination of factors prevents any meaningful valuation movement. The US Federal Reserve (Fed) is expected to continue raising interest rates due to the rise in short-term inflation expectations. This, along with the positive mood in the stock markets, may prevent investors from placing aggressive bullish bets around gold.

Falcon Fed’ bets pose a hurdle for gold price

A preliminary report released by the University of Michigan last Friday showed that one-year inflation expectations rose to 4.6% from 3.6% in April. Moreover cryptocoin.com As you follow in , Fed Chairman Christopher Waller called for more rate hikes on Friday and said that the work is still not done as inflation is still very high. In addition, the New York Fed reported Monday that the barometer of manufacturing activity in the state rose for the first time in five months. That, in turn, raised bets on a 25 basis point (bps) increase at the next Federal Open Market Committee (FOMC) meeting in May.

Positive risk tone caps gold’s gains

The expectation that the Fed will further tighten its policies keeps the yield on US Treasuries high, which limits the gains of the non-yielding gold price. Meanwhile, the stronger-than-expected growth of the Chinese economy is easing fears of a global recession and boosting investor confidence. Data released earlier on Tuesday showed that the Chinese economy grew by 4.5% in the January-March quarter, well above forecasts and 2.9% in the previous quarter. This reduces demand for traditional safe-haven assets and prevents gold from gaining further.

Investors now focus on US housing market data

Market participants are now looking forward to the US economic agenda, when Building Permits and Housing Starts will be announced later in the North American session. This, together with the US bond yields, will affect the USD price dynamics and give some momentum to the gold price. Apart from that, traders will take cues from broader risk sensitivity to seize short-term opportunities around gold.

Gold price technical view

From a technical perspective, the $1,980 region appears to have emerged as an immediate and strong support. A convincing breakout of said level will remove the positive outlook and lead to some technical selling. In this case, gold price could accelerate its corrective decline towards the intermediate support of $1,965-1,960 on its way to the $1,950 horizontal zone.

On the other hand, the bulls can wait to break beyond the nightly high of $2,015 to $2,016 before placing new bets. Gold price could then climb to a high of $2,047-2,049 YTD, which it touched last Thursday, before climbing towards retesting its all-time high around $2,070-$2,075 set in August 2020.

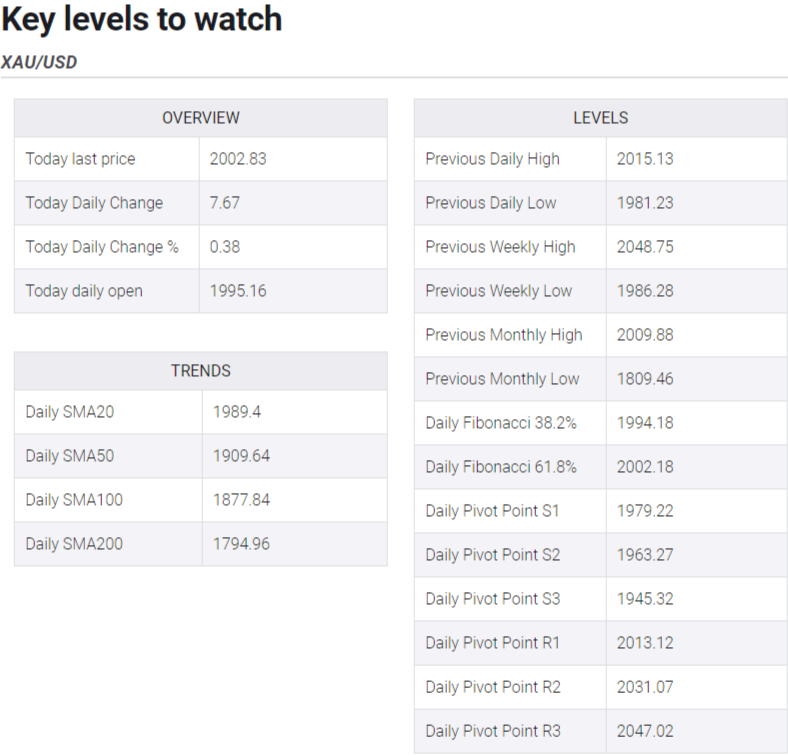

Gold price: Key levels to watch

Gold price: Key levels to watch