cryptocoin.com As we reported, leading crypto analysts pointed to the rally potential for these altcoins on Binance! So, what are these altcoins? Here are the details…

These altcoins may explode soon!

Arbitrum (ARB)

Alongside the rest of the crypto market, Arbitrum, the layer-2 scaling solution for Ethereum, rose 44 percent last week to huge heights. While the increase can be attributed to the ubiquitous uptrend in the market, the massive whale buying of the coin seems to be adding to the uptrend. The buying spree comes weeks after Arbitrum experienced a never-ending fear, uncertainty and doubt (FUD) in the crypto community. Although the FUD resulted in a downturn in the ARB market, the asset has since recovered and caught a rally.

However, whale data excites investors. According to data from Lookonchain, whales are on a buying spree on Arbitrum native coin ARB. Nine whales have purchased 12.4 million ARB coins, equivalent to $21 million, in the past seven days. Meanwhile, eleven other whales still hold large amounts of ARB coins, and only three have sold 22.8 million ARB coins worth $38 million. The massive buying spree by whales shows that they are on the rise for Arbitrum’s potential to revolutionize the Ethereum ecosystem. Arbitrum aims to reduce congestion on the Ethereum network as a scaling solution by providing faster and cheaper transactions.

Its innovative design uses a unique aggregation technology that aggregates multiple transactions into a single batch, allowing for faster payment times and reducing gas fees. This technology has received a lot of attention from Ethereum developers and enthusiasts, who believe that the scale of Ethereum can help meet the growing demand for decentralized applications (dApps) and immutable tokens (NFTs).

The current bullish sentiment surrounding Arbitrum and ARB tokens suggests there could be significant gains for early investors. As the Ethereum network continues to grow and evolve, second-layer solutions such as Arbitrum will likely become increasingly important, providing a scalable and efficient infrastructure for decentralized applications. After surviving a bearish weekend weeks ago, ARB is now in the green, up 44 percent in the last 7 days. The price of the asset started trading from a low of $1.17 on April 10 to almost $2, with a trading price of $1.72 at the time of writing. ARB is currently up 6.3 percent in the last 24 hours.

ARB’s market cap has also risen, rising from 41st place today to 32nd place in terms of market cap among other cryptocurrencies in the global crypto market. Over the past 7 days, over $500 million has been added to the asset’s market cap. Its market value is at $2.2 billion, up 38 percent in the last 7 days. In particular, the massive whale purchase shows that smart money is on the rise over the project’s prospects. The demand for ARB tokens is expected to increase as more developers and users flock to the platform.

Avalanche (AVAX)

Avalanche (AVAX) price is poised to offer bulls a simple yet profitable trade. After breaking above the red descending trendline on Monday, it’s forming for another bullish candle this week, the fourth in a row. Conscious bulls want to trade the projected 10 percent gain and not shoot from the start just yet. Otherwise, the rally could overheat and stall quickly. On the other hand, AVAX price has caused the bulls to prepare for the fifth weekly green candle, as it ignored the continued general decline in many altcoins on Monday. Instead, AVAX bulls broke through the buy level and broke the red descending trendline. The road is now open for more bullishness and it may hold some low hanging critical levels in the run towards $22.

AVAX price sees that the bulls aren’t holding up much, as only R2 per month is around $21.50. Overall, this level doesn’t have much historical significance and there is still room for the Relative Strength Index (RSI) to move higher. We expect the bulls to move towards $22 this week and settle into a wait-and-see pattern before going higher as overall sentiment and other altcoins need to rally to create this perfect tailwind for a higher rise.

The downside risk is based on the element that this winning streak could end as the $22 price cap triggered quite a few rejections and false breakouts. Another false break will send the bulls back below $20. Worst-case scenario, there will be a break below the red descending trendline and the bears need to buy for a full swing at the green ascending trendline towards $14 should the bulls completely lose control and a large windbreak appears on the scene.

Polygon (MATIC)

The price of MATIC trading at $1.17 has been looking for a bullish signal since the beginning of March. A major reason behind the lack of growth is the uncertainty surrounding the long-awaited altcoins as Bitcoin’s dominance continues to signal otherwise. However, BTC dominance dropped to 47.32% last week, which has rekindled hopes for alt season.

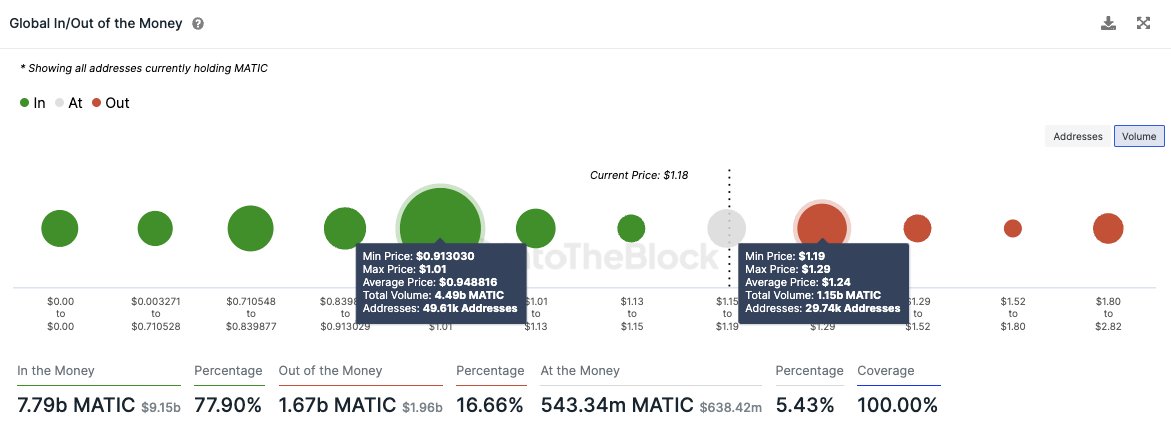

When this season will come is up to speculation, but optimism could be a driving factor in the MATIC price recovery. According to analysts, a boom in the altcoin is only possible if the altcoin can maintain a sustained rise above $1.24. This particular price point is the average cost at which about 30,000 addresses bought about 1.14 billion MATIC coins worth $1.34 billion.

Thus, a break of $1.24 will not only make these tokens profitable a month later, but a close above the daily candlestick could trigger a 53 percent spike to $1.80. With this progress, MATIC will face two more supply walls at $1.42 and $1.64, unlocking 265 million MATICs worth a total of $310 million.

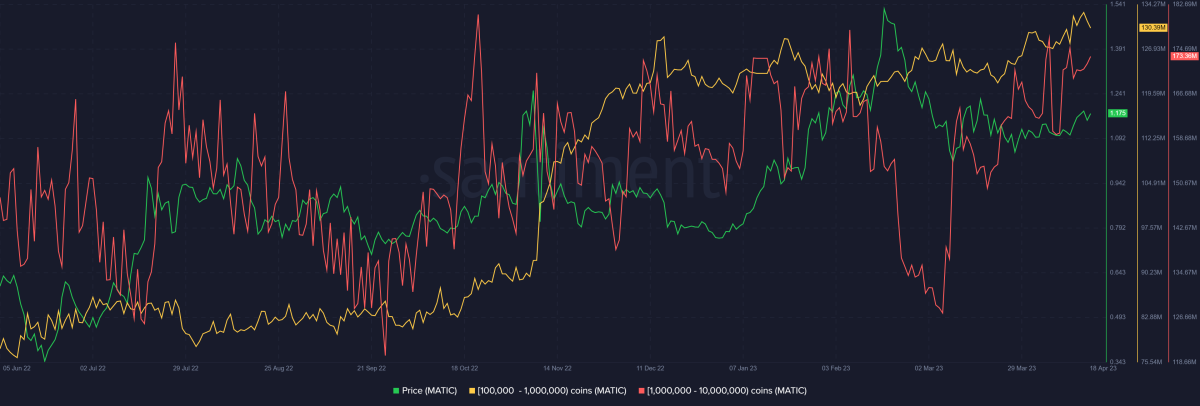

To achieve this, however, the coin will need to have some demand in the hands of investors and whales. The latter is currently showing signs of bullishness as cohorts holding 100,000 to 1 million MATICs are recording a 7.4 percent increase in supply. Similarly, larger wallet addresses with anywhere from 1 million to 10 million MATIC are accumulating. The supply of these addresses increased 35 percent from 128 million to 173 million MATIC.

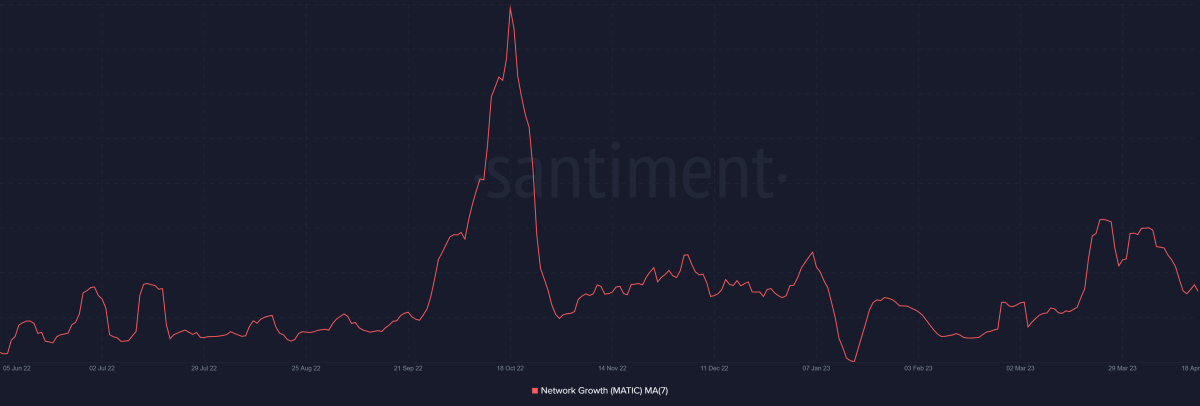

The altcoin may still face some resistance in the hands of investors as the project is currently not seeing much interest in the market. Network Growth, which indicates the adoption rate, i.e. the formation of new addresses on the chain, dropped 37 percent from 130,000 to 81,000.

While this is clearly not a bearish sign, it does highlight some of the doubts investors have.