Bitcoin price drop puts $28,000 support at risk, while BTC ignores US employment data. If the decline continues, eyes are above the $28,000 support, but Binance order book data warns that even this could be “challenging.”

Bitcoin price: “lights out” at $28,000?

After Bitcoin approached $28,000, it turned upwards. Amid an ongoing correction, BTC still failed to retrace even $29,000 as support as US unemployment data hinted that tighter financial conditions are working to cool inflation. Meanwhile, cryptocoin.comAs you follow, spot gold has become the main beneficiary of risky assets, rising above $2,000 during the day.

Gold 1-hour candlestick chart / Source TradingView

Gold 1-hour candlestick chart / Source TradingViewUS stocks opened higher, but later the S&P 500 and the Nasdaq Composite Index reversed their gains, falling 0.6%. While BTC is hovering around $28,300 at the time of writing, popular analyst Adam warns that the current range will not hold. “This seems like a ‘lights out if you lose this level’ kind of scenario,” the analyst says, alongside a chart showing the support range. In addition, the analyst makes the following statement:

In terms of engagement, it’s pretty quiet at low levels as I like to stay here aggressively for a long time. I’d be happy to repurchase above local S/R.

BTC caption chart / Source Man/Twitter

BTC caption chart / Source Man/TwitterOther trader Pierre awaits a retest of the “no-trade zone” stretching up to $27,000.

A few days later, and here we are retesting the "DO NOT TRADE HERE" zone from above, in confluence with D1 trend that has been defended since 20.5-21.8k. https://t.co/q2km1uyfgu pic.twitter.com/VwPKC3FKM4

— Pierre (@pierre_crypt0) April 20, 2023

In an additional post, he explains possible upside and downside targets should BTC fail to maintain a trend in place for several weeks on daily timeframes.

price > D1 trend (defended since low 20s) & 28,000-28,500 (May 2022 support // March 2023 resistance) confluence == good

price < D1 trend (defended since low 20s) & 28,000-28,500 (May 2022 support // March 2023 resistance) confluence == bad

Voilà, that's it. GL HF https://t.co/k50u8cwR6a pic.twitter.com/Bjzhq7DgZ9

— Pierre (@pierre_crypt0) April 20, 2023

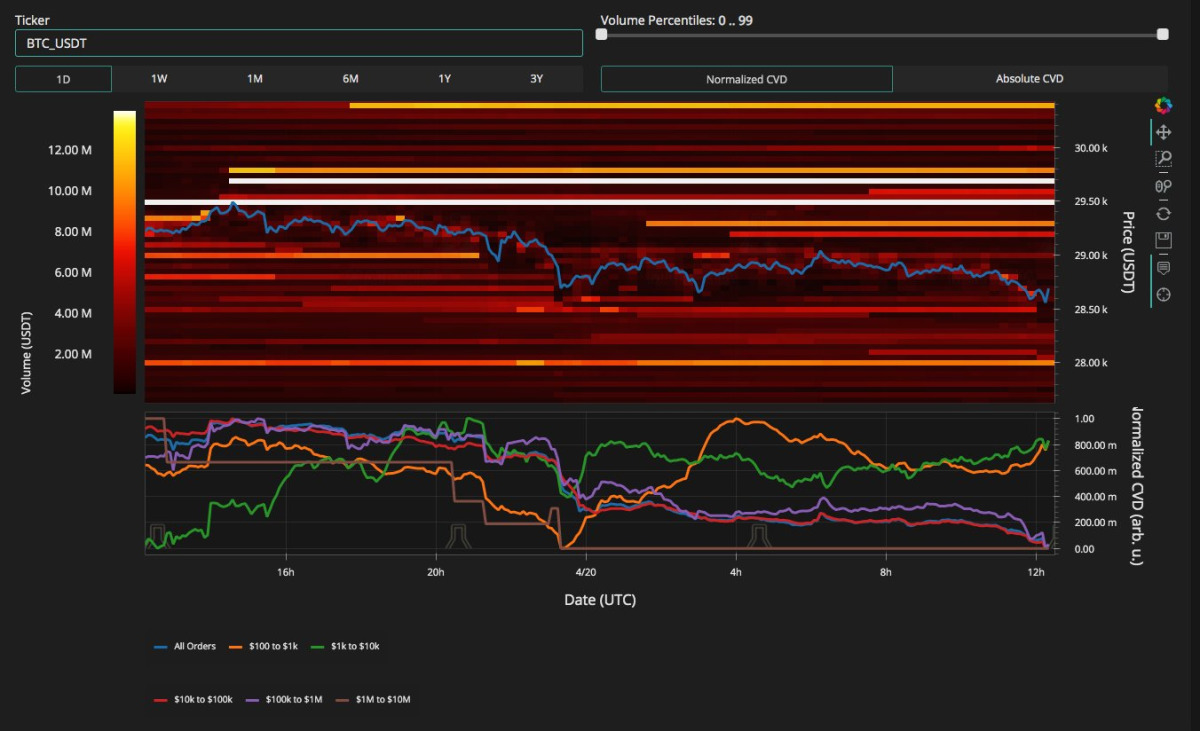

Data from the Binance order book showed that an hour before the employment data, bid liquidity fell below the spot and the nearest significant support is currently at $28,000. “Note: Local support has just solidified,” the tracking resource Material Indicators, which produced the data, wrote in a section of the accompanying comment. He also said, “Some of them were placed to absorb a dump of just over $28,000. “If it gets hit, we expect $28,000 to solidify,” he said.

BTC order book data (Binance) / Source: Material Indicators

BTC order book data (Binance) / Source: Material IndicatorsBTC price plays a key role in the next phase for investors

Crypto analyst Akash Girimath evaluates the technical levels. The long-term outlook for bitcoin price is currently facing resistance and selling pressure as it enters the weekly bearish breaker. This breaker setup ranges from $29,247 to $41,273, with an inefficiency roughly midpoint ranging from $34,277 to $37,406.

While BTC has had an incredible performance since the beginning of 2023, it could continue to rise even higher given the macroeconomic outlook. However, if investors continue to split their profits, a pullback to key support levels is likely. If the downtrend continues, the $25,205 and $24,300 levels are critical to absorb the selling pressure. These levels also act as an accumulation zone.

BTC 1-week chart

BTC 1-week chartIf this move towards $24,000 happens quickly and with a big spike in volatility, it could stall the bottom season. In such a case, altcoins will try to fight the bearish momentum but may eventually slide lower. Only strong altcoins can survive and even fewer tokens can recover.