Changpeng Zhao, CEO of Binance, in his statements during the Hong Kong Web3 discussed issues affecting crypto and criticized the ongoing lack of regulatory clarity. In particular, his statements about the DEX sector, which is the biggest competitor of the stock market, were remarkable.

Binance CEO compares CEX and DEX

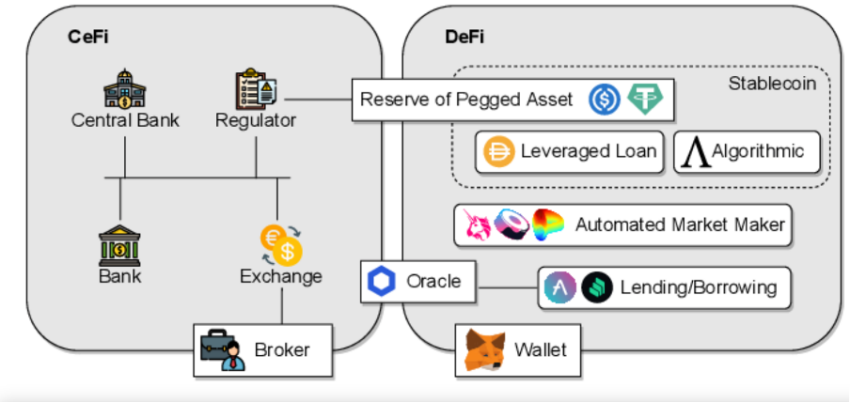

CZ draws complementary roles between centralized finance (CeFI) and decentralized finance (DeFi). Central finance (CeFi) refers to financial institutions or exchanges operating within a centralized framework. On the other hand, decentralized finance (DeFi) refers to a system of financial applications and protocols running on a decentralized Blockchain network.

Both CeFi and DeFi have their strengths and weaknesses. CeFi is more user-friendly and offers more liquidity, while DeFi is more transparent and gives users more control over their assets. However, the global macro economy, including traditional finance and cryptocurrency markets, has had a troubled past. The crypto industry has faced multiple crashes, hacking, fraud and bankruptcy cases.

The complementary roles of CeFi and DeFi

A major bankruptcy disaster that shook the world was the bankruptcy of FTX, the second largest CeFi-based crypto exchange after Binance. Since then, CeFi has come under intense scrutiny and criticism. To strike a balance between the two, the market needs to find a way to mitigate their weaknesses while capitalizing on the strengths of both.

One way to achieve this is to bridge the gap between CeFi and DeFi through decentralized exchanges (DEXs). DEXs allow users to buy and sell cryptocurrencies without intermediaries, making them an essential part of the DeFi ecosystem. However, the challenge with DEXs is that they need more liquidity which is where CeFi comes in.

Integration with CeFi allows DEXs to access more liquidity and provide users with a better trading experience. This integration can occur in two ways. The first is centralized order books, where orders are processed through a central entity that matches buy and sell orders. The second is liquidity pools where users can pool their assets to create a market for trading.

Another way to strike a balance between CeFi and DeFi is to leverage decentralized finance infrastructure. Decentralized infrastructure such as Oracles and authentication can be used by both CeFi and DeFi platforms. For example, CeFi platforms can use oracles to access real-time market data, and DeFi platforms can use authentication to prevent fraudulent activity.

What does Binance CZ think?

Binance CEO Changpeng Zhao shared his views on the matter. He spoke virtually at the Hong Kong Web3 Conference. Key topics of the conversation with CZ included asset security, trust, user experience, regulation, CeFi and DeFi, mass adoption, and the future of the industry.

First, the interviewer brought up the discussion that security is stronger in CeFi or its decentralized counterpart. Zhao’s statements are as follows: “CeFi and DeFi have different features; one is not safer than the other. Security measures need to be considered for both CeFi and DeFi.”

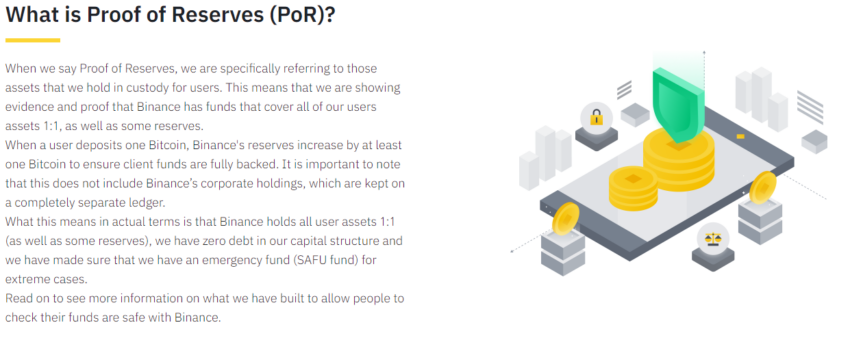

Speaking further, he suggested the need for transparency for a CeFi company. This can be achieved by performing a comprehensive proof of reserve. Proof of reserve helps verify that users’ funds are safe via Blockchain.

On the contrary, in DeFi it is very important to secure private keys to wallets. But some are still vulnerable because of the complexity required. Both CeFi and DeFi have different characteristics in terms of risk and security. CZ adds that ‘we shouldn’t have a one-sided view that one is better than the other’.

Obvious differences

However, there is a difference at this point. One of CeFi’s main criticisms is that it goes against the decentralized values of cryptocurrencies. Last year’s crashes added more support that hampered CeFi’s credibility. However, Zhao thinks otherwise.

CeFi is not against DeFi. DeFi shouldn’t be against anyone, either. In a completely decentralized space, everyone will be for himself. When you create projects and initiatives, that’s centralization. Even in decentralized space there will always be pockets of centralization.

The largest crypto exchange by volume has faced scrutiny over its transparency. Regulators jumped at the opportunity to target the exchange without fail. For example, according to a report in the Valor Econômico newspaper, Binance is under investigation by the Federal Prosecutor’s Office and the Federal Police in Brazil. The cryptocurrency exchange is allegedly helping clients evade a stop order in cryptocurrency derivatives investments.

Building trust

To increase trust between users and relevant stakeholders, CeFi and crypto companies can take several steps:

- Transparency: CeFi companies must provide transparent and accurate information about their services, fees and security measures. They should also disclose potential risks and vulnerabilities associated with their services.

- Security: CeFi companies must prioritize the security of their users’ assets and data. This includes implementing robust security measures such as two-factor authentication, encryption, and cold storage.

- Regulatory Compliance: CeFi companies must comply with relevant regulations and obtain licenses to operate in their jurisdictions. This can help increase trust between users and regulators.

- Customer Support: CeFi companies must provide timely and effective customer support to address any issues or concerns raised by their users.

- Community Engagement: CeFi companies should engage with their user communities through social media, forums and other channels. This can help build trust and build a positive reputation for the company.

By taking these steps, CeFi and crypto companies can increase trust between users and relevant stakeholders, which can help drive adoption and growth in the industry.

looking to the future

In addition to discussing CeFi and DeFi, the interviewee gave insight into the factors affecting crypto adoption and highlighted regulation as a key element. He also pointed to signs that many countries are adopting and clarifying regulations that could help usher in a new golden age for crypto.