The world’s largest cryptocurrency Bitcoin (BTC) continues to face strong selling pressure. It has been fluctuating in the $28,500-31,500 range for a while. Let’s take the technical levels that may be critical in the coming days, from 3 expert cryptocurrency analysts.

Credible talks about a wave pattern that will bring the BTC price to $100k

Twitter analyst nicknamed Credible told his 333,100 Twitter followers that Bitcoin has been in a macro bull market in the last decade. and he says that the 2014 and 2018 bear markets served as corrective periods. Looking at Credible’s chart, the analyst suggests that Bitcoin is in the middle of a major fifth wave that started in early 2019. Coincidentally, Bitcoin is currently in the fifth lower wave that could push BTC above $100,000 all-time high.

Nicholas Merten says that Bitcoin is about to surprise everyone

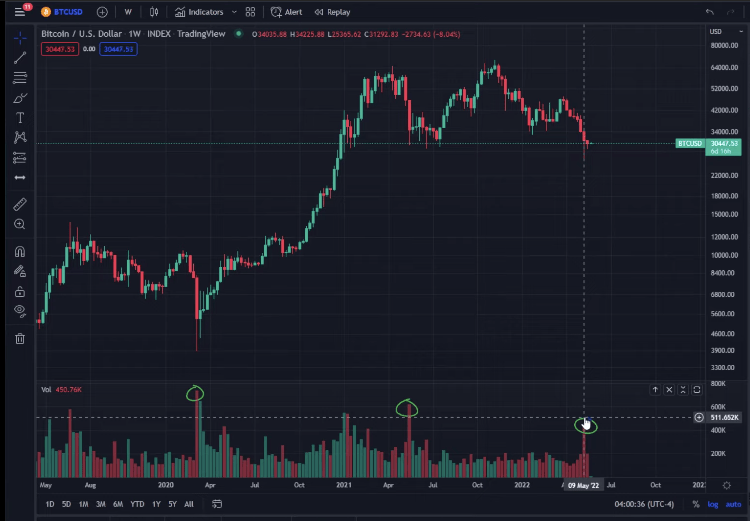

On the other hand, in their recent analysis Nicholas Merten said that Bitcoin is about to surprise everyone. To 516,000 YouTube subscribers, Merten tells that while price action for BTC continues to look brutal, one indicator shows that the downtrend has been left behind. The massive spike in volumes on the Bitcoin chart could be historically reliable indicators to confirm trend reversals.

In the chart below, the analyst points out that volume gains in both March 2020 and May 2021 coincided with the bottom of price corrections.

Meanwhile, Merten says that Bitcoin is poised for an unexpected rally, with a massive surge in volume minted after the collapse of the Terra ecosystem and subsequent market volatility.

Bitcoin options market shows major downside risks over the next 3-6 months

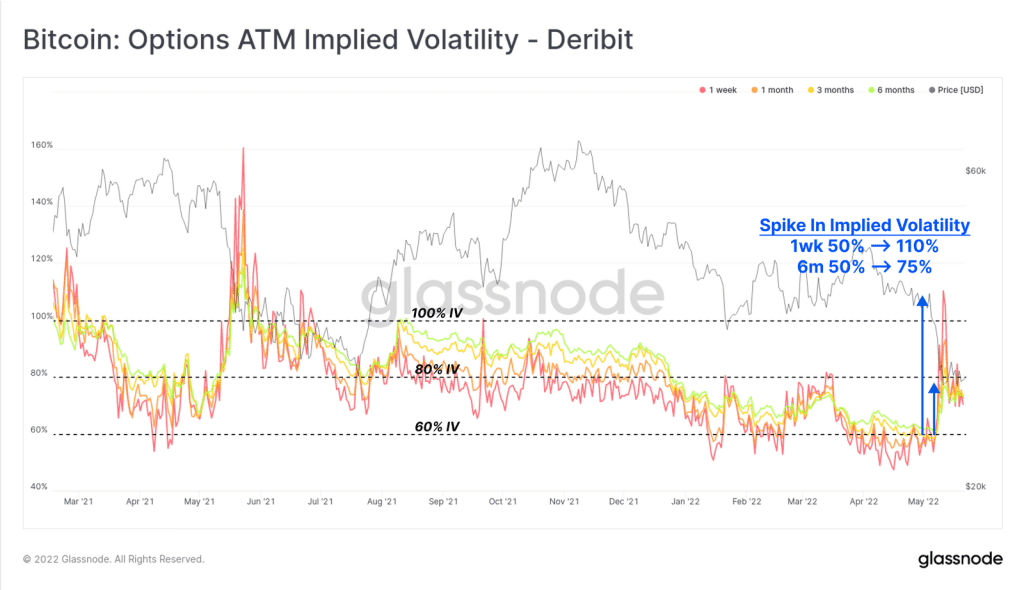

Kriptokoin.com which we also reported As a result, on May 23, BTC tumbled 3% to below $30,000 despite the US stock market picking up. Glassnode data shows that the BTC market has been trading lower for eight consecutive weeks, marking it as “the longest continuous red weekly candlestick sequence in history.” During the market sell-off last week, Glassnode explains the volatility of Bitcoin options:

Short-term cash options IV more than doubled from 50% to 110%, while 6-months IV options jumped to 75%. . This is a break higher than a long period of very low implied IV levels.

Meanwhile, in the last two weeks, the Bitcoin sell/call rate for open interest has increased from 50% to 70%. This means that the market is preparing to hedge more downside risks. As a result, on a long-term basis, i.e. until the end of the year, the option interest setup for Bitcoin is particularly constructive. Glassnode explains:

There is a clear preference for call options centered around $70,000 to $100,000. Also, prevailing put option strike prices are at $25,000 and $30,000, which are higher than mid-year price levels.