New on-chain analysis shows whales are turning to lesser-known altcoins in the latest correction, when Bitcoin slumped to $27,000.

Whales shift their focus to small-volume altcoins

Bitcoin price lost the $30,000 zone again during the week of April 17. The decline this time deepened to $28,000, the starting point of the rally. Ethereum price is keeping the altcoin market strong with relatively few losses over the same time frame. However, the whales may have sensed the incoming trend and therefore largely shifted their focus to other altcoins.

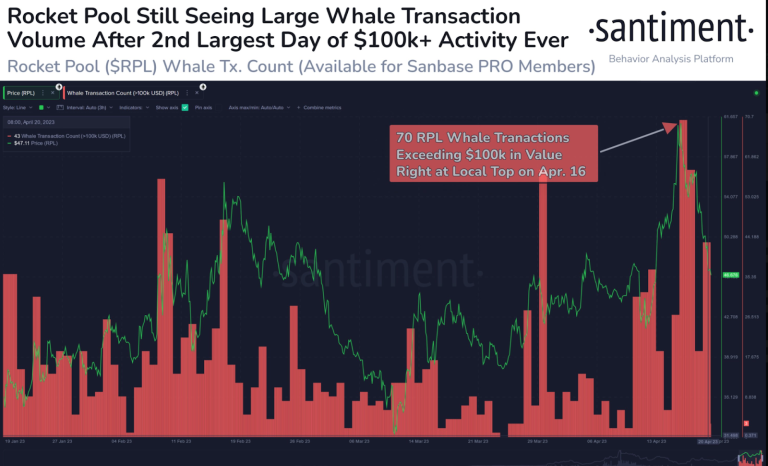

According to Santiment’s analysis, whales are accumulating several small-volume altcoins as the Bitcoin price drops. After the previous surge, whales have shifted their focus to coins like Rocket Pool with a market cap of around $900 million. According to Santiment data, the RPL price traded at its local top of $61.89, with around 70 transactions worth over $100,000.

In addition, a large number of transactions were recorded with the Phala Network (PHA). The data shows that more than 308.2 million PHAs worth approximately $53 million were transferred. It should be noted that this transfer is the 3rd largest whale transaction since the launch of PHA. The whale then transferred these funds to another over-the-counter whale wallet.

Whales turn to little-known altcoins

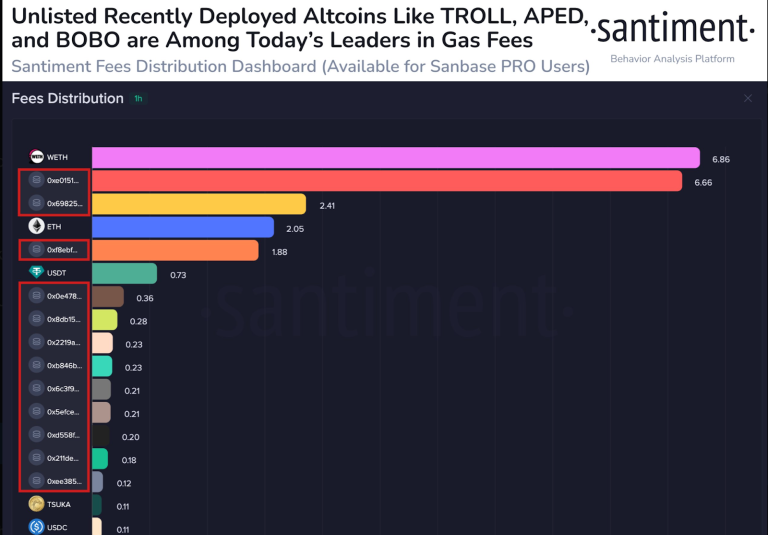

This inference is supported by the fact that coins are leaders in gas fees. Recently, Santiment reported that some platforms are recording higher gas fees than leading Ethereum or Wrapped-ETH or USDT. Instead, whales made abnormal transfers in coins like TROLL, APED, and BOBO.

So, as their data shows, it’s clear that whales are starting to shift their focus from large-volume coins to medium and small-sized ones. Now that Ethereum (ETH) price remains largely stable above $1900 despite the sharp drop in BTC price, a strong lower season can be expected in the coming days.

However, the rally of medium and small-volume tokens will be followed by Ethereum, Solana, XRP, etc. It seems to be higher than popular altcoins such as cryptocoin.comAs you follow, new investment and partnership news continues to be priced.

What’s next for Ethereum?

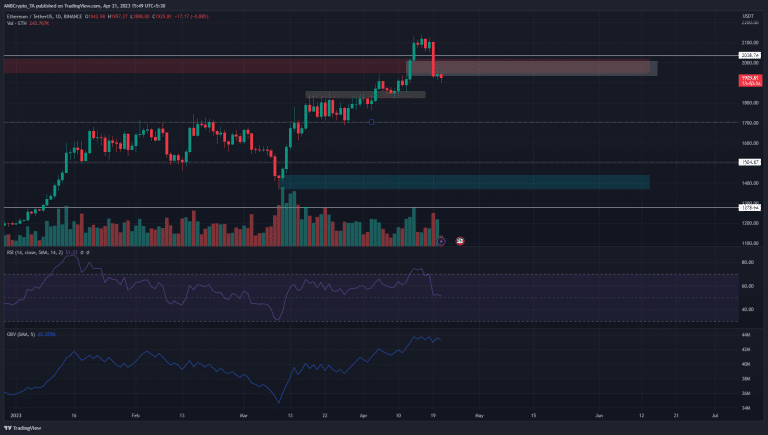

The enthusiasm of Ethereum investors did not last long after it crossed $2000. The recent sell-off forced ETH to retrace towards the $1850 zone. Technical analysis shows that ETH price is following a bearish order block on the daily timeframe from August 13, 2022. That resistance was $2025, which Ethereum surpassed for the first time in eight months. The bulls failed to hold this level and ETH followed the momentum of BTC.

Ethereum bears won the battle above $2000, forcing prices to fall below the bearish block. This invalidated the trend change expectation that has strengthened in recent weeks. A retest of the fair value spread (white) could see a bounce in Ethereum prices. On further declines, another support zone will be present in the $1,840 region. A drop below $1,830 will turn the daily structure bearish.