The gold price plunge below $2,000 ahead of the weekend hurt the short-term bullish sentiment. But with so much uncertainty in the financial markets, few analysts and individual investors expect to see significant selling in gold in the near term.

Drops will continue to be bought

cryptocoin.com As you can follow, better-than-expected US economic data and the threat of inflation to spread throughout the economy caused gold prices to close the week close to the lowest level of the last two weeks. According to many Wall Street analysts, the overall picture has not changed, although prices are likely to drop further in the near term.

The bullish trend is also changing among individual investors, although they expect gold to continue trading around $2,000 next week. Sean Lusk, co-director of commercial hedging at Walsh Trading comments:

Some traders are probably caught on the wrong side and may face some margin calls with a weekly close below $2,000; We may see more selling pressure. Some damage was done as $2000 to $2,050 was a tough level to defend. However, you cannot ignore how much support there is in the precious metals market. The drops will continue to be bought.

Sean Lusk says that gold could drop as low as $1,930 in the near term. But he adds that he expects investors to see low gold prices as a strategic opportunity to protect themselves from the ongoing threat of inflation, a potential recession, and a deeper banking crisis.

What does the gold survey show?

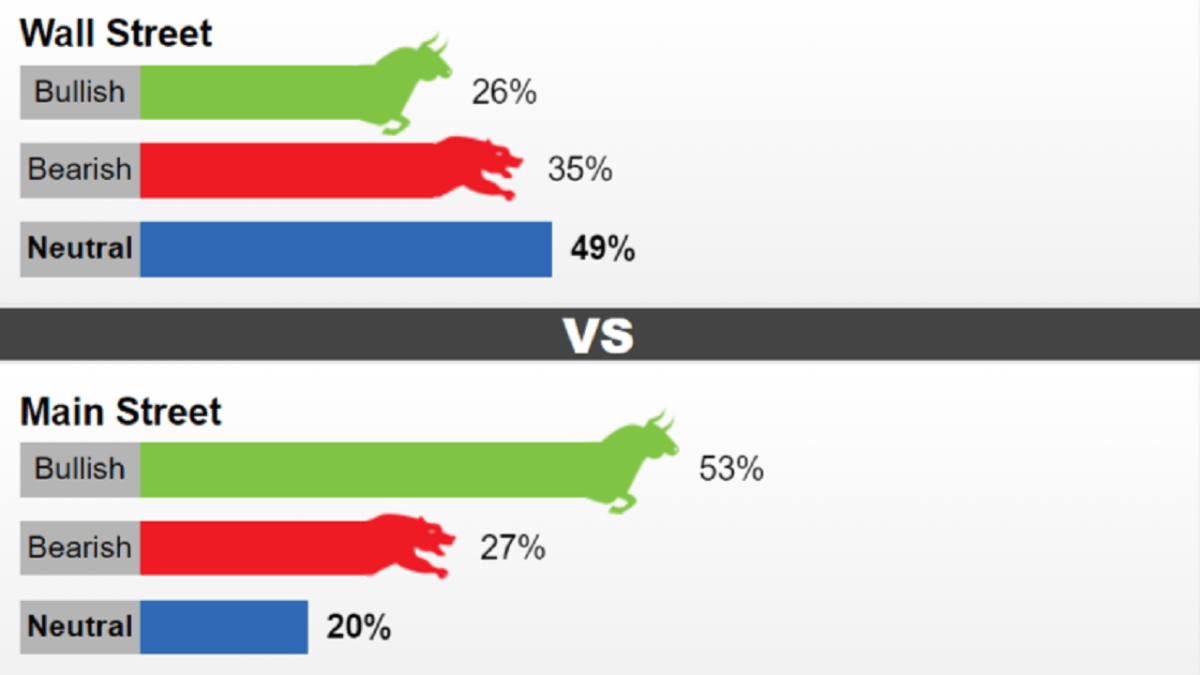

As the bearish pressure builds, many analysts stand aside and wait to see how much momentum this potential correction will gain. 23 Wall Street analysts took part in the Kitco Gold Survey this week. Among respondents, six analysts (26%) were bullish for the yellow metal in the near term. At the same time, eight analysts (35%) show a bearish trend for the next week, while nine (49%) think prices will remain flat.

Meanwhile, 618 votes were cast in online polls. 329 (53%) of the respondents think that gold will rise next week. Another 166 people (27%) say gold will drop, while 123 people (20%) stay neutral in the near term.

While individual investors are still bullish for gold in the short term, sentiment has dropped sharply. Last week, 68% of retail investors were in an uptrend for gold. Looking at prices, Main Street thinks gold prices will rebound to $2,000 next week with an average price target of $2,015 this time. Looking beyond the headline figure, only 18% of online respondents predict gold prices will fall below $1,950 in the near term.

As this perception changes, gold will improve

For many analysts, it’s not surprising that gold is down 1.4% this week as market expectations for the Federal Reserve’s monetary policy have faltered. The CME FedWatch Tool shows that a 25 basis point hike next month is definitively priced in. At the same time, due to renewed inflation fears, markets priced in potential rate hikes further away, closer to year-end.

Adrian Day, head of Asset Management, says there is a bearish trend in gold in the near-term due to changing interest rate expectations. “Gold rose very quickly in March on the false assumption that the Federal Reserve is going to raise interest rates soon,” Day said. Now that perception will improve as it changes,” he says.

There are two big headwinds for gold

Some analysts point out that changing interest rate expectations are driving bond yields and the US dollar, creating two major headwinds for gold. Bannockburn Global Forex General Manager Marc Chandler expects gold prices to decline next week. However, he adds that it must be below $1,950 for a meaningful sale.