Leading analysts of the cryptocurrency market announced 5 critical things to watch this week for BTC, SHIB, DOGE, ETH! So, what are the critical points for BTC, SHIB, DOGE and ETH? Here are the details…

Experts explained: This week, investors should watch 5 critical things for BTC, SHIB, DOGE and ETH!

Bitcoin (BTC) is starting the new week in a dangerous position after suffering its biggest losses since November. After a massive drop from ten-month highs, BTC/USD tumbled nearly 10 percent before the weekly candle finally closed. The culmination of a few dreadful days for long traders around $27,600 means BTC/USD is now battling for last month’s support.

Market participants are split on how the situation will turn out. Some invest deeper and bearish, while others are confident in retesting these multi-month highs. Catalysts may come in the form of the release of US macroeconomic data later in the week, while markets are gearing up for the next Federal Reserve rate decision. With the recent correction removing some of the “greed” in the crypto sentiment, could the shock lead to a more sustained uptrend or is the bull market over, at least for now? Experts conveyed their critical comments on the subject with these 5 events:

Bitcoin price battles for support amid a major correction!

It was a mercifully volatile weekly close for Bitcoin at $27,600, yet still below the starting position at $2,700. According to data from TradingView, this has been the most brutal week since the FTX debacle in November last year.

BTC/USD, currently targeting $27,000, now faces a decision: settle or exit near current support, which was also the focus in March. Popular analyst Daan Crypto on the subject said, “The spot premium has returned to the levels it was before while trading in this price range. Funding rates are generally somewhat negative. Nothing crazy yet,” he said.

Another analyst, Crypto Tony, held the $26,600 level, while Cubic Analytics senior market analyst Caleb Franzen said higher levels must return for the bulls to take the lead. “Bitcoin failed to break and stay above $27,820 (green range), a key level I shared,” Franzen explained, along with a chart. Here are the words of the analyst:

I think we need to see price rise (and stay above) this range for the short-term momentum to shift in favor of the bulls. It continues to act as a resistance…

However, the latest data from the Binance order book showed that the resistance has risen at $28,000. According to monitoring resource Material Indicators, this is described as an attempt to push down spot prices to fill offers at more attractive levels.

#FireCharts shows a new block of ask liquidity suppressing #Bitcoin price, likely trying to push price into their bids in the $27.3k – $26.7k range. #NFA pic.twitter.com/ThOwqUT09R

— Material Indicators (@MI_Algos) April 23, 2023

Analyst Mark Cullen, who is on the more conservative side, predicted that the worst was yet to come, tweeting: “A nice bear flag formed over the weekend, volatility drops as price rises, and H4 bearish divergences occur.”

PCE pressure expected as markets ‘price’ new Fed rate hike

The week’s macro triggers come mainly in the form of corporate earnings and economic data releases in the United States. These will focus on GDP and jobless claims on April 27, as well as the March edition of the Personal Consumption Expenditures (PCE) Index a day later.

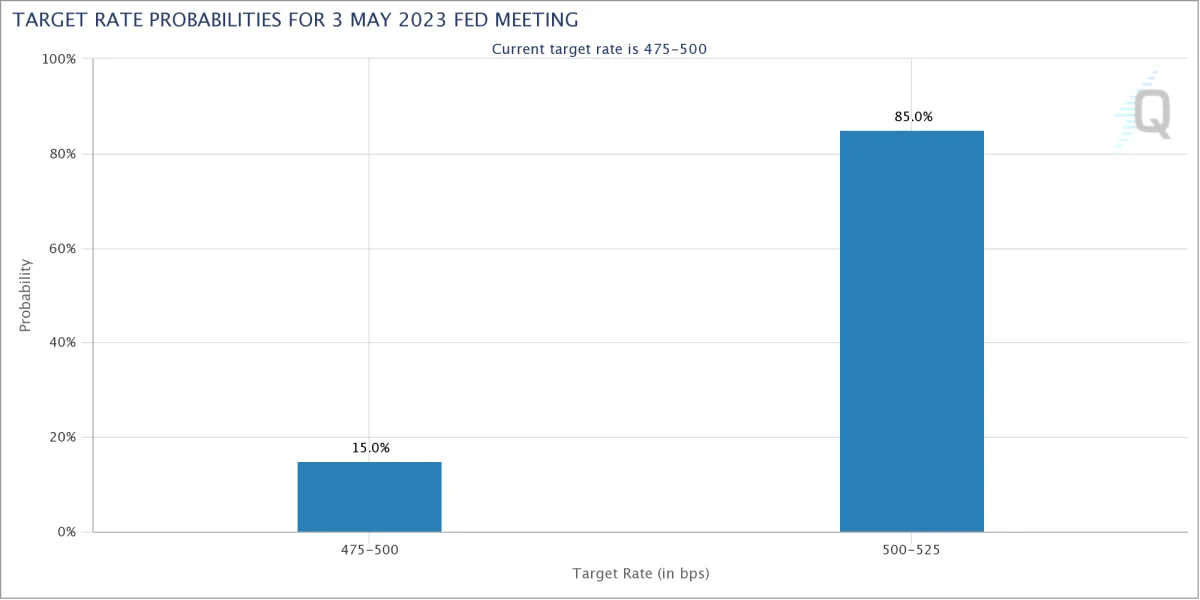

As corporate gains continue as well, the May meeting of the Federal Open Market Committee (FOMC) is on the horizon, at which the Fed will decide the next rate changes. As Chairman Jerome Powell confirms, whether the intrusive macro data pressures are strong will significantly influence this decision and markets will therefore be in a “wait and see” mode until the final figures come in. But according to CME Group’s FedWatch tool, the consensus is now overwhelmingly in favor of a new rate hike, putting further pressure on US banks and the wider financial system. Currently, the probability of a new 0.25% rate hike is 85%.

Bitcoin investors can press the panic button in the face of their losses!

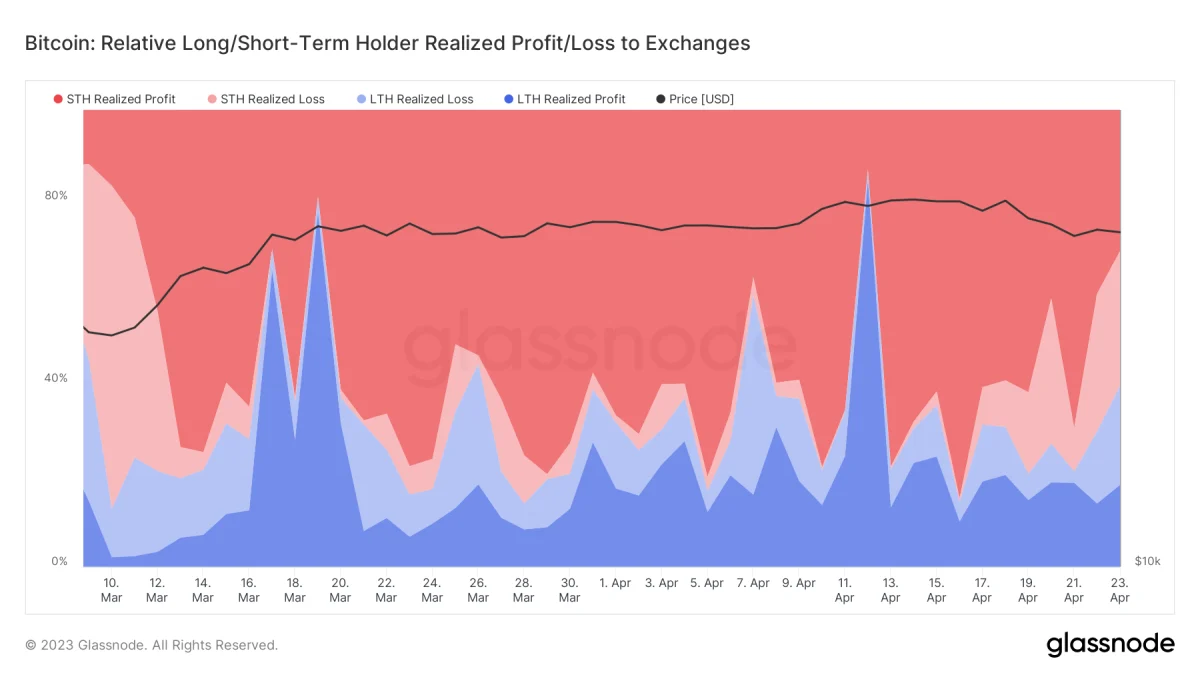

It’s no secret that last week’s BTC price action has spooked many less experienced investors, and the data proves it. Young coins sent to exchanges at a loss have increased sharply over the past week, according to figures from analytics firm Glassnode. Glassnode often divides BTC supply by duration, and “long-term investors” (LTHs) are used to describe wallets that have held coins for 155 days or more. Fewer than that are referred to as “short-term investors” (STHs) and generally correspond to the more speculative end of the Bitcoin investor base.

The data shows that since around April 16, STH investments – those that have moved in the last 155 days – have moved to exchanges at a lower price than they had moved in their previous trades. While these STH realized losses point to increasing panic, LTH realized losses are also increasing among those carrying funds to exchanges.

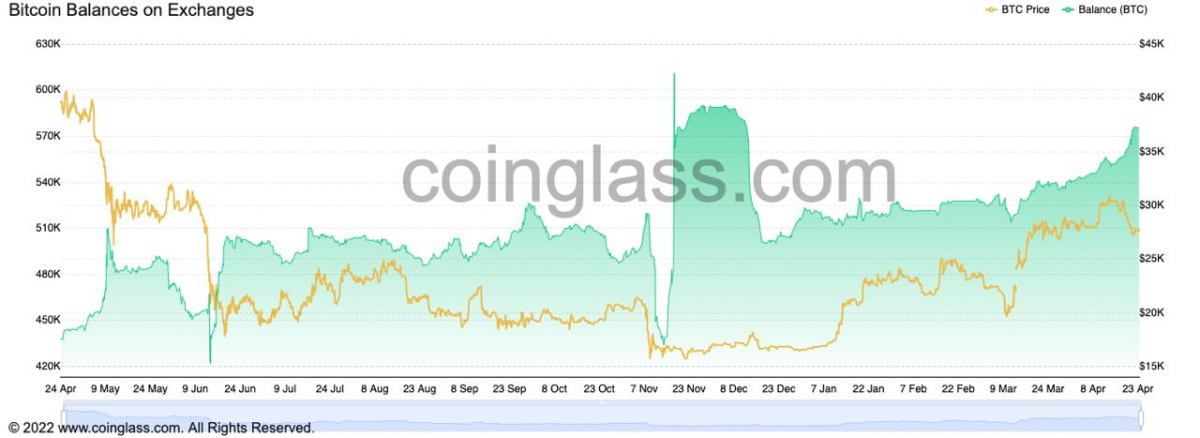

Separate data from Coinglass shows that weekly entries on the largest exchange Binance are 21,000 BTC.

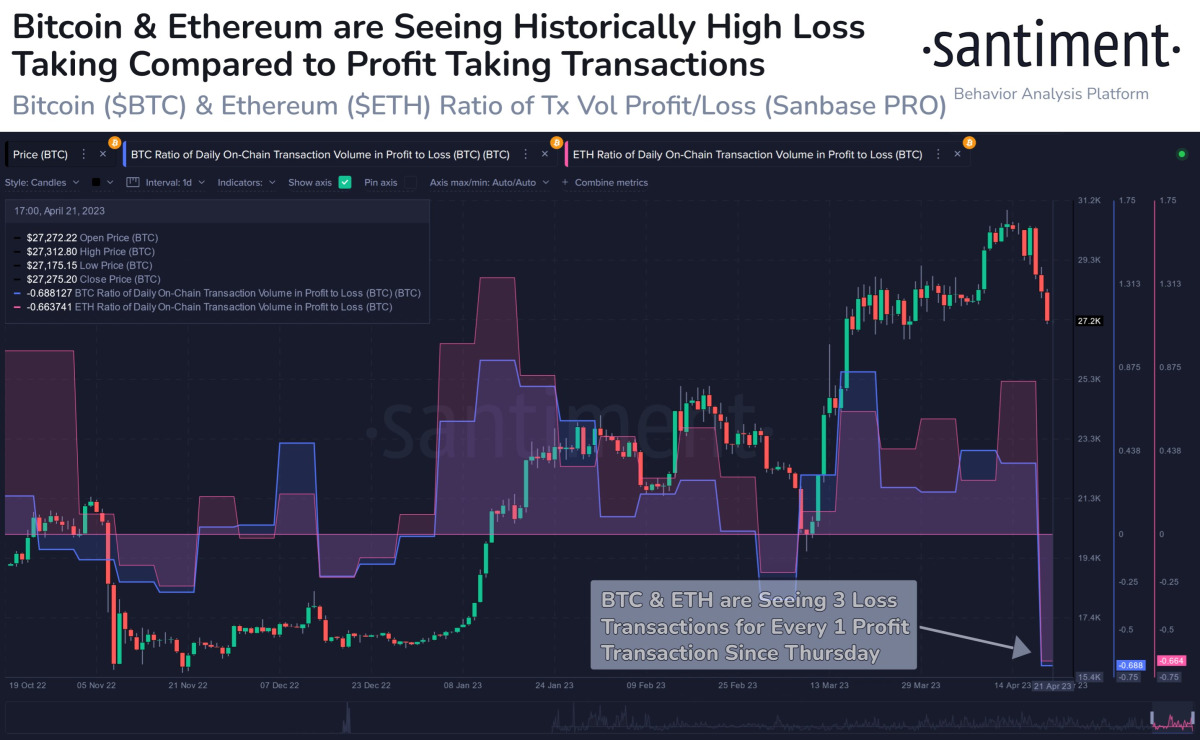

Meanwhile, research firm Santiment points out some interesting behavior by looking at the transaction volume profit and loss ratio in both Bitcoin and Ethereum. Recent days have seen excessive loss-making volume against profit volume despite relatively shallow price pullbacks for both assets. However, Santiment said over the weekend, “Loss transactions increased as markets pulled back, with many investors FOMOing over $30,000 in Bitcoin and $2,000 in Ethereum over the past week.”

According to analysts, ‘smart money’ stopped accumulating BTC!

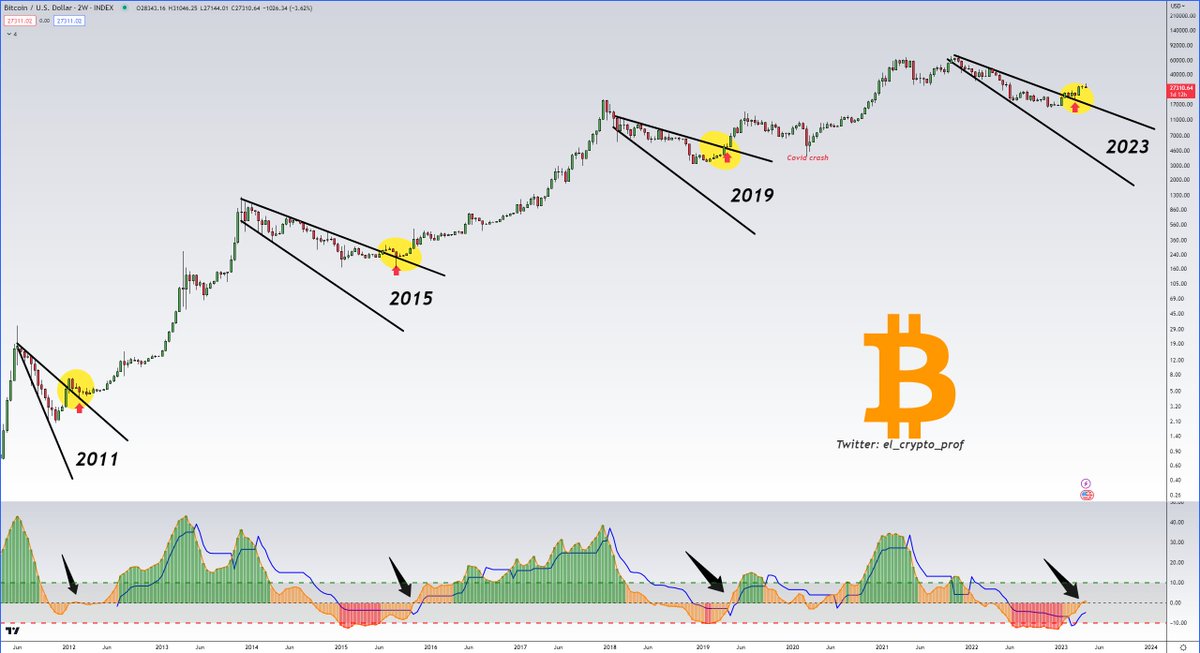

According to experts, if the above phenomenon signals a jolt of BTC, SHIB, DOGE and ETH investors, it may have come just in time, at least by historical standards. In his latest update on market strength, popular Bitcoin analyst Mustache revealed that behind the scenes, the current Bitcoin bull run is playing out just like any other before it. Using qualitative quantitative estimation (QQE), a form of the relative strength index (RSI), Mustache suggested that Bitcoin is at a pivotal point right now. He argued that the “smart money” had already bought the bottom and now waits for the real rise to begin, and said, “The business of accumulating BTC for smart money is over. I told you a few weeks ago that when QQE >0 = Accumulation will end,” he said.

Crypto sentiment drops to “neutral” level

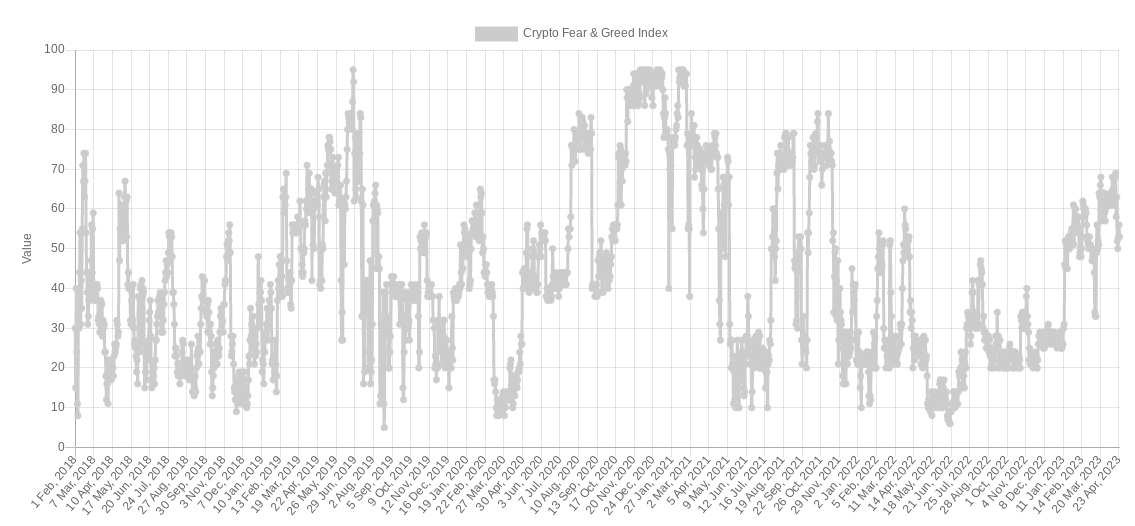

A critical chart for SHIB, DOGE, BTC and ETH is the Fear and greed index. According to the Crypto Fear & Greed Index, the mood among market participants tends to quickly return to more moderate levels. Previously, Fear & Greed was at its highest levels since November 2021 and Bitcoin’s all-time highs. Some had warned at the time that this could be unsustainable and could lead to a rapid market correction as investors were complacent and upside investments continued unchallenged. With the decline in full swing, the Index left the “fear” zone completely and moved to “neutral” and 53/100 points as of April 24.