Bitcoin data shows that tens of thousands of coins have been transferred to exchanges. So, investors may be preparing for a sale. Here are the details…

Binance gets the lion’s share of Bitcoin increase

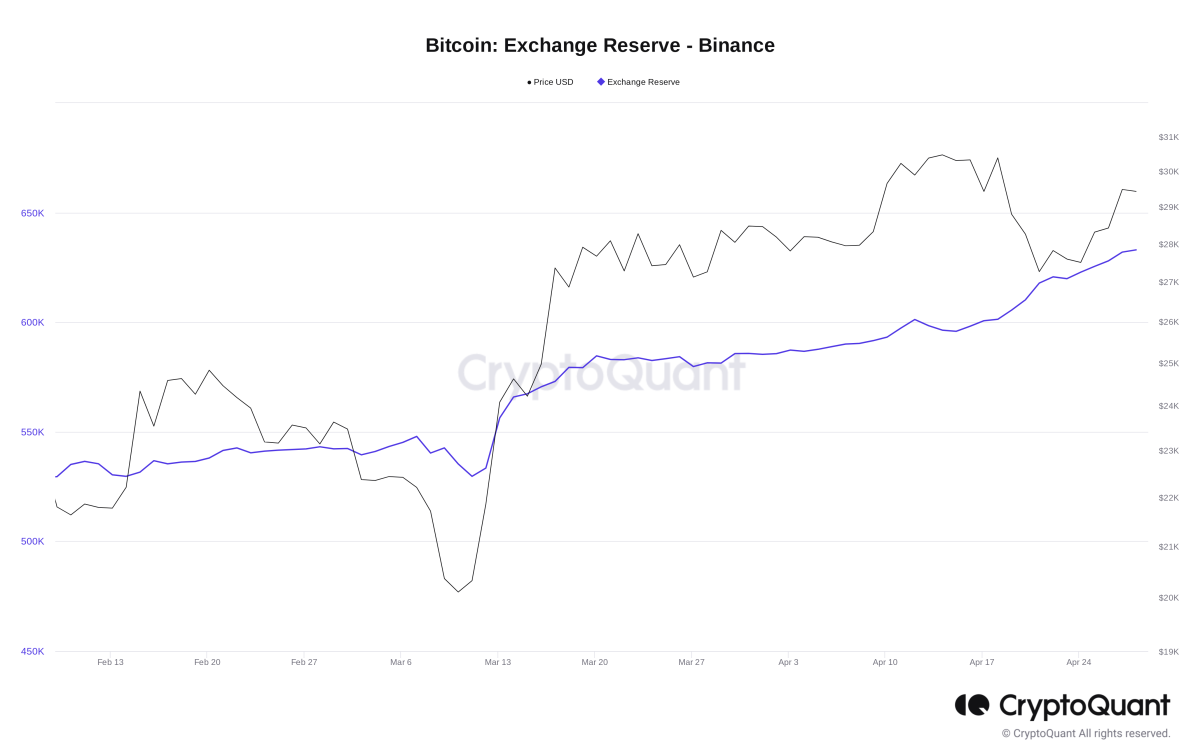

Recent figures from on-chain tracking resource Coinglass confirm that the BTC balance of global trading volume leader Binance has increased by over 50,000 BTC ($1.5 billion) in the past 30 days. With BTC/USD regularly hitting several-month highs since mid-March, the willingness to sell has undoubtedly increased for both long-term and short-term holders. Actual selling pressure has so far been quiet by historical standards, data reports. But on-chain data shows that this could easily change.

According to Coinglass, Binance alone currently holds 51,000 BTC more than 30 days ago. Separate data from analytics platform CryptoQuant confirms that its balance has increased by almost 100,000 BTC compared to March 10, when BTC/USD briefly challenged the $20,000 support. No matter how big these numbers may seem, it dwarfed the rate at which funds entered the exchange’s wallets in the past week, with the balance reaching 22,000 BTC in the past seven days alone.

Binance, which has the largest trading volume among all exchanges, was an exception. Over $10 billion has been traded on Binance in the last 24 hours alone. Other major exchanges have actually lost BTC or seen insignificant balance increases. The total assets of exchanges tracked by Coinglass reached 1.91 million BTC, while the total increase in the 30 days until April 28 reached 14,000 BTC. Investor habits witnessed in recent weeks could increase the pressure on the bulls to support $30,000 and continue to rise.

The analyst drew attention to the rate of short-long positions

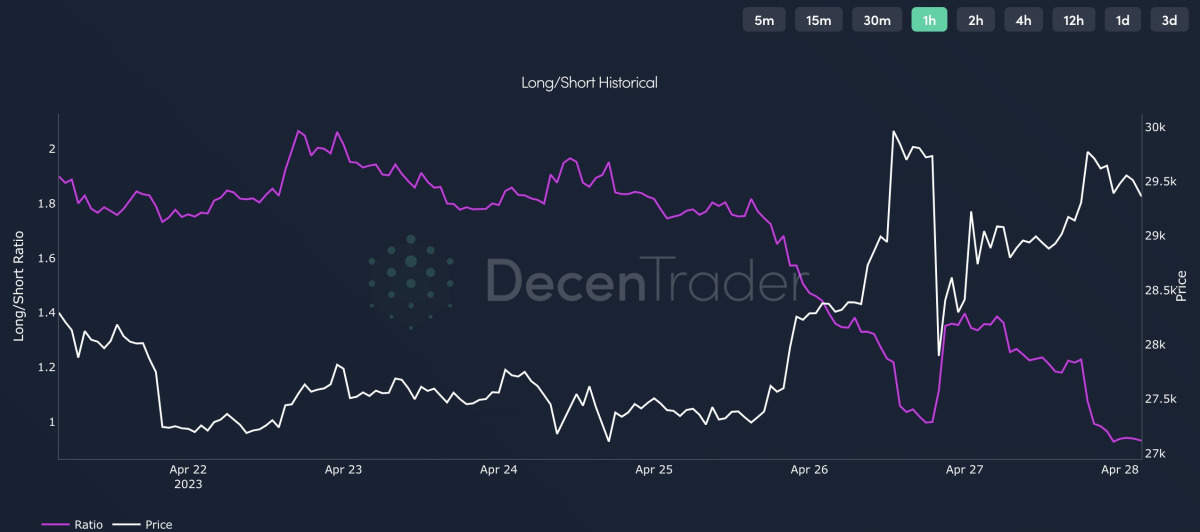

The area around this level is where historical trading volume broke records. It makes the importance of $30,000 more than psychological. The current liquidity situation on exchanges tracked by DecenTrader indicates that $35,000 is a key region to liquidate leveraged BTC shorts. As part of its ongoing market analysis, DecenTrader noted that although BTC/USD has recovered from local lows and traded around $29,500 on the day, bets above $30,000 remain out of reach as support continues to accumulate.

cryptocoin.com As we reported, Decentrader, a famous analyst, tweeted. “The ratio of short to long now shows that you are more short than tall,” he summed up to his Twitter followers. “This also means we’re seeing around $1 billion in open interest returns. This shows that many people have shortened the $30,000 resistance,” he said.