After starting the week with a bullish run, the gold price tried to reclaim $2,000 several times. However, it failed to do so due to the steady recovery seen in US Treasury bond yields. Bitcoin, on the other hand, returned to the $30,000 limit after a dive to $27,000. Gold and Bitcoin investors will focus their attention on the April jobs report and the Federal Reserve’s policy announcements. In addition, investors will follow important macroeconomic data releases from the USA.

Risky week for gold and Bitcoin investors

It is possible that the high-impact macroeconomic data from the USA and the Fed’s policy statements will trigger sharp fluctuations. Therefore, it will be a risky week for gold and Bitcoin investors. Market participants will watch closely the NBS Manufacturing PMI and Non-Manufacturing PMI from China at the beginning of the week. Gold is likely to retain its value if PMI surveys indicate continued expansion in business activities in China, the world’s largest gold consumer. Should one of these PMIs unexpectedly drop below 50, gold could turn bearish in the near term.

The April ISM Manufacturing PMI data, which will be released in the US on Monday, is not expected to have a significant impact on the USD’s valuation. On Wednesday, the ISM Services PMI survey and ADP’s private sector employment report will be ignored by gold and Bitcoin investors ahead of the Fed’s policy decisions.

It is possible for gold to reverse its direction in this scenario!

The market expectation is that the Fed will increase the policy rate by 25 bps to the range of 5%-5.25%. In his policy statement or if FOMC Chairman Jerome Powell says the Fed will pause the rate hike cycle to reassess the economic situation, the initial reaction is likely to put pressure on US yields and open the door to a rally below. However, Powell may reiterate that they have no intention of lowering the policy rate for the remainder of the year. He might also explain that taking a break from tightening doesn’t mean they can’t go back to increments if they feel the need to. In this scenario, it is possible for gold to reverse its direction even if it initially rises.

Markets will also pay attention to Powell’s comments on the financial situation. After the Silicon Valley Bank collapse, Powell said monetary policy needed to be tight enough to keep inflation down. However, he noted that some of this tightness will come from credit conditions. The Fed’s statement that it has not seen a significant tightening in loans is likely to be seen as a hawkish statement. Therefore, this is likely to help the dollar gain strength.

It is possible that this will give the price of gold

On Friday, the U.S. Bureau of Labor Statistics will release its April employment report. Expectations are for Non-Farm Employment (NFP) to increase by 181,000, following March’s 236,000 growth. Wage inflation forecasts, as measured by Average Hourly Earnings, are for an annual increase from 4.2% to 4.4%. Overall, a stronger-than-expected increase in NFP will have a positive impact on the dollar’s valuation, especially if it is accompanied by a strong wage inflation reading. It can also damage the bottom. On the other hand, an NFP of close to 100,000 or less will have the opposite effect on gold.

After all, it is worth noting that navigating the events of the coming week will not be easy. It would be a good idea to watch the movement in US Treasury bond yields to have a clearer view of the big picture. The 10-year US Treasury yield has fluctuated between 3.3% and 3.6% since the Fed’s March policy meeting. It is possible that breaking out of this range would provide a directional clue for the gold price.

Technical view of gold price and forecast survey

Market analyst Eren Şengezer analyzes the technical outlook of gold as follows. Gold price closed below the 20-day Simple Moving Average (SMA) every day this week. Thus, the Relative Strength Index (RSI) indicator on the daily chart declined towards 50, reflecting the hesitation of the buyers.

On the downside, intermediate support was formed at $1,970 ahead of $1,940 and $1,930. A daily close below this last support is likely to trigger a long decline towards $1,900. $2,000 stands as stiff resistance. Once gold breaks above this level and confirms support, the bulls are likely to target $2,020 (static level) and $2,040 (end point of recent uptrend) later on.

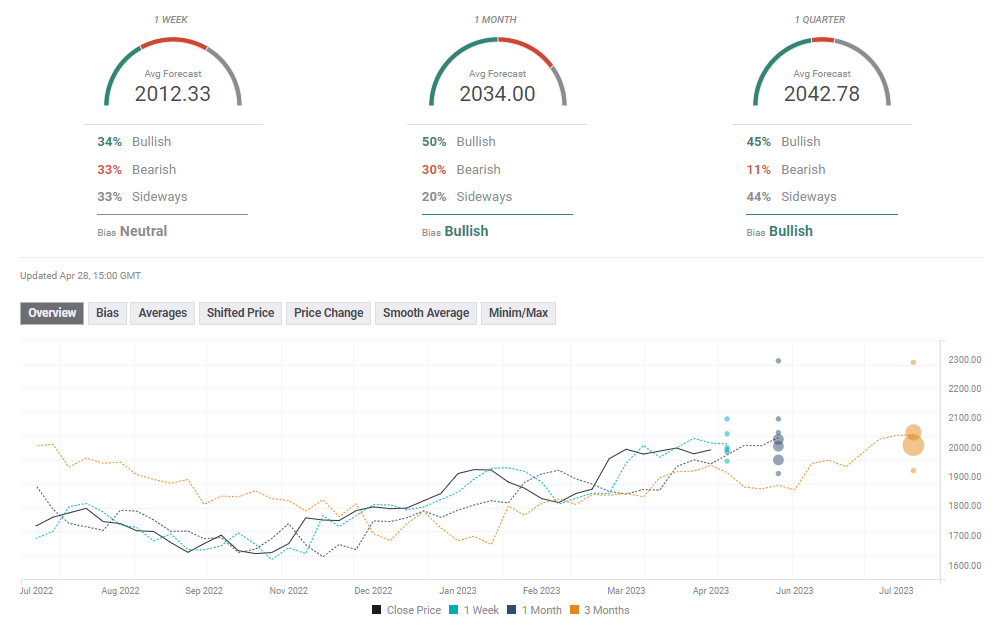

The FXStreet Forecast Survey paints a mixed picture in the short term. The one-month outlook for gold price remains bullish with an average target of $2,035.

It’s important for Bitcoin to break the $30,000 barrier!

cryptocoin.com As you follow, Bitcoin went above $29,000 last week. Popular analyst Michael van de Poppe highlights the importance of Bitcoin breaking the $30,000 barrier for altcoins to regain momentum. The analyst discusses Bitcoin’s dominance in the market, which continues to rise and altcoins struggle to keep up. He says that as altcoins weaken, Bitcoin remains strong, leading to a prolonged correction in the altcoin market. According to the analyst, this trend will continue unless there is an increase in the missing market confidence.

That’s why the analyst emphasizes the importance of Bitcoin breaking the $30,000 mark. He states that this will be the first component for trust in altcoins. If Bitcoin consolidates after breaking this barrier, he expects altcoins to follow suit. The analyst notes that the total market value is still in a bullish pattern, but has not yet overcome important resistance levels.