Good week everyone, dear Coinkolik family! We have entered a very important week in the global financial markets.

Stock markets in many countries, including Turkey, China and European countries, will be closed on Monday due to Labor Day.

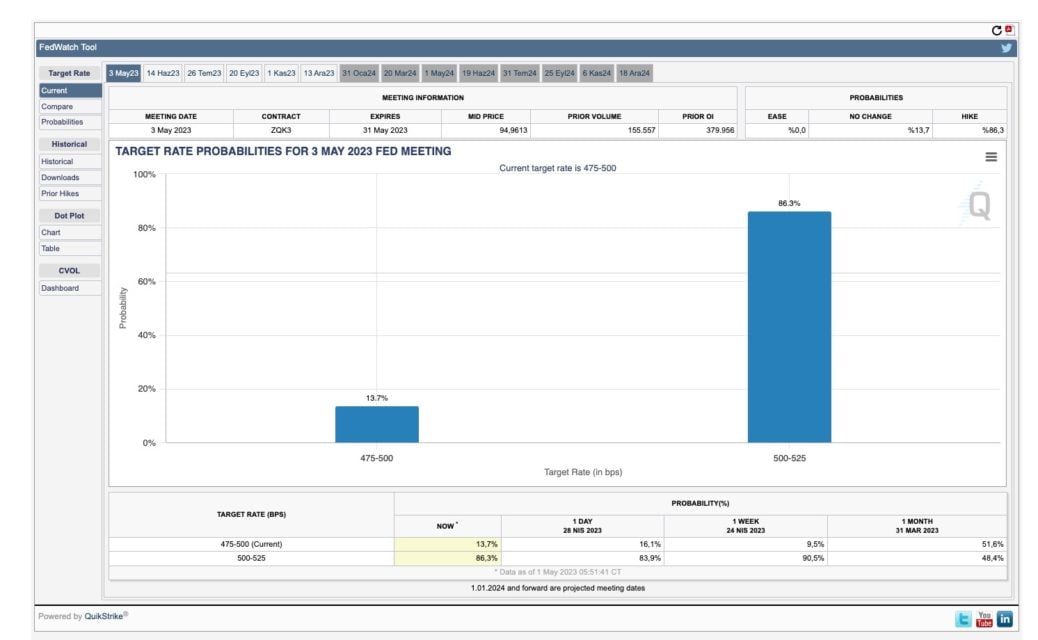

The data flow is intense this week and eyes will be on the decision of the Federal Reserve (Fed) on Wednesday and then on Powell’s speech. The rate decision is expected to increase by 25 basis points with a rate of 87%, thus increasing it to between 5% and 5.25%, the highest interest rate since 2007.

The US CPI data is still well above the Fed’s 2% target, with a rate of 5%, but for the first time, we saw the expression of banking crisis and the expectation of “recession” in the FOMC minutes. The Gross Domestic Product (GDP) data from the USA last week was 1.1%, well below the expectations. Therefore, the rate decision and Powell’s speech will be an important guide on how we should proceed in the coming months.

On Tuesday, the CPI data in the Euro Zone will come. The expectation is for inflation to reach 7%. The upcoming data will be effective in the European Central Bank’s (ECB) interest rate decision on Thursday, but a 25 basis point rate hike is expected for now.

Another important issue in this week’s data will be the US employment data. Powell had pointed to strong employment in every speech. In the data coming Friday, the Unemployment rate is expected to rise to 3.6% and average hourly earnings are expected to hold steady.

Economic Calendar

Monday, May 1, 2023

- Microstrategy – Balance sheet to be announced.

Tuesday, May 2, 2023

- EURO Zone –Consumer Price Index (CPI) (Annual) Expectation: 7% Previous: 6.9% – 12.00%

Wednesday, May 3, 2023

- Turkey – Consumer Price Index (CPI) (Annual) Expectation: 51.33% Previous: 50.51% – 10.00

- US Federal Open Market Committee (FOMC) Statement and Federal Funds Target Rate Expectation: 5.25% Previous: 5%

- USA – Fed Chairman Jerome Powell Speech – 21.30

Thursday, May 4, 2023

- EURO Zone – Interest Rate Decision Expectation: 3.75% Previous: 3.50% – 15.15

- USA – Applications for Unemployment Benefit Expectation: 240k Previous: 230k – 15.30

Friday, May 5, 2023

- USA – Non-Farm Employment Data Expected: 180K Previous 236K 15.30

- USA – Unemployment Rate Expected: 3.6% Previous: 3.5% 15.30

Bitcoin Technical Analysis

Our chart has not changed much from last week to this week. I start by reminding the importance of avoiding risks during the interest rate decision week:

On the daily chart, Bitcoin reacts from the red box area I have determined and moves towards the area I marked with the Key Zone below. A candle closing by breaking this area will perform a “Market Structure Break” on the 4-hour chart and may carry the price to the $24,000-$25,200 levels, which I determined with the black box. It is worth remembering that for a new bullish wave, voluminous candle closings above the $32,000 levels should come.

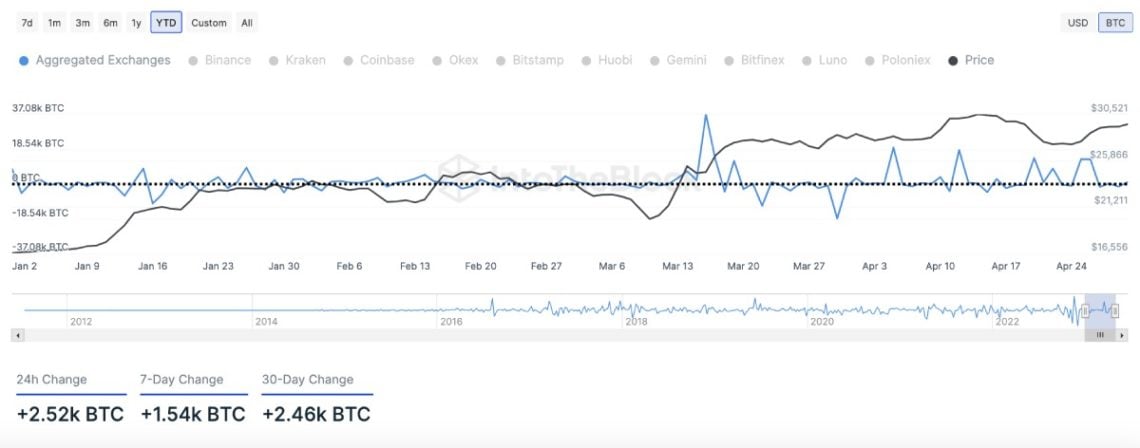

All Stablecoins: Exchange Inflow (Total) – All Exchanges

The Net Flow indicator highlights the tendency of users to send or withdraw funds from exchanges. Your Net Flows will be positive if the inflows to the exchanges are greater than the outflows.

Therefore, we see positive Net Flows coinciding with periods following large increases in price or confirmation of downtrends.

Conversely, Net Flows are negative when withdrawing larger volume from exchanges. This can be seen as a sign of accumulation or denotes buybacks after big dips.

Net Flows also affect large volumes of crypto assets, while smaller volume tokens are more susceptible to large changes in price resulting from currency flows.

Last Week’s Top Rising Cryptocurrencies

- Render (RNDR) 33.3%

- Casper Network (CSPR) 23.6%

- Bitget Token (BGB) 17.9%

- Kaspa (KAS) 17.8%

- Internet Computer (ICP) 15.3%

Last Week’s Featured Crypto News

Google Cloud Will Optimize Polygon zkEVM: Polygon’s core protocols, including Polygon PoS (proof-of-stake), Polygon zkEVM, and Polygon Supernets, will benefit from Google Cloud’s framework and developer tools provisioning. The partnership aims to simplify developer integration to build, launch and grow Web3 products and decentralized applications on Polygon. Transactions will be faster and cheaper

Google Cloud’s partnership with the ecosystem is expected to advance Polygon’s zero-knowledge development.

Mastercard Will Work With Four Popular Altcoins: MasterCard, blockchain developers aptos labs, Ava labs, polygonAnd wither foundation will work with. Raj Dhamodharan, Head of Crypto and Blockchain at Mastercard. MasterCard Crypto CredentialHe stated that they aim to help verify reliable interactions between consumers and businesses using blockchain networks. NFTsalso includes.

First quarter report of crypto exchanges: Is the crypto winter over? Research firm TokenInsight has released its Q1 Crypto Exchange Report, showing centralized platforms getting a vibrant start to 2023. The report stated that during the first quarter, the total crypto market cap rose from $831.8 billion to $1.24 trillion, which means an increase of about 50 percent. Bitcoin (BTC) rose by approximately 100 percent from $ 16,000 to $ 30,000 during this period.

Cryptocurrency exchange Crypto.com and Samsung announced their cooperation: Cryptocurrency exchange Crypto.com announced that it has partnered with technology giant Samsung. The partnership includes updating the stock market app to Version 3.158.1. With the partnership, there are important updates in the application. In the new version of the application, the productivity of the application will increase with the contribution of Samsung, while advanced trading and analysis options will be available.

Binance Re-enters the Japanese Market: Cryptocurrency exchange Binance continues its expansion in the Asian market with its strategy change. In the past, the stock market aimed to operate in many countries by obtaining an independent license. The applications of the exchange, which had problems with compliance with the regulators, were rejected. This time, Binance started to head towards the Asian market by buying local exchanges. The exchange, which acquired Sakura Exchange in November 2022, will re-open in Japan with a name change.